[ad_1]

The stock markets are in turmoil. The Federal Reserve’s recent 75-basis-point interest rate hike further aggravated the market’s fears of an impending recession. Top growth stocks that have long been expensive are available at much more reasonable prices. While no one can predict in which direction the markets may go in the short term, you should do well if you buy fundamentally strong stocks and hold them for the long term.

Here are two such stocks to start buying right now.

1. Tesla

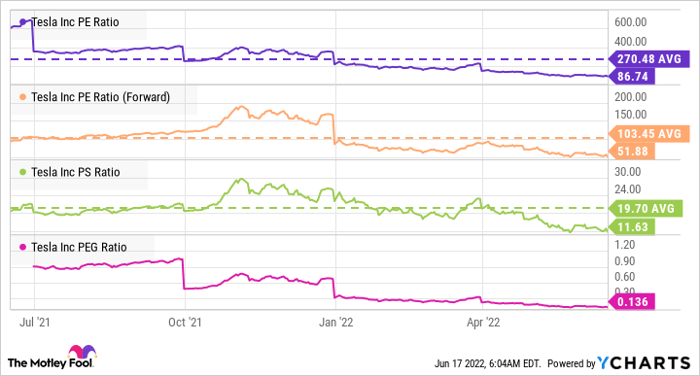

On Thursday, Tesla‘s (NASDAQ: TSLA) stock was trading around $639.30, close to its 52-week low price. The stock’s price-to-earnings (P/E) ratio has fallen to nearly 87, well below an average ratio of 270 in the last year. Based on Tesla’s forward earnings, the ratio stands at nearly 52, well below an average of 103 in the last year.

TSLA PE Ratio data by YCharts

Finally, the price-to-sales ratio has fallen to 11.6, below an average of 19.7 over the last one-year period.

Undeniably, Tesla’s valuation is still massive compared to traditional automakers. However, the company’s industry-leading margins and high earnings growth partly justify its premium valuation. Tesla’s P/E-to-growth (PEG) ratio is just 0.14. The ratio compares a stock’s P/E to the company’s earnings growth. Generally, fast-growing companies are expected to trade at a higher P/E than comparable companies that are growing earnings at a much slower rate.

Finally, Tesla continues to innovate and look for newer avenues to keep fueling its growth. The stock’s price may fall if the company fails to meet its planned growth targets or if it fails to maintain its margins. However, history so far is on Tesla’s side.

2. Enphase Energy

Solar component manufacturer Enphase Energy (NASDAQ: ENPH) has been posting impressive growth over the last several quarters. In the first quarter, Enphase’s revenue grew 46% year over year. In five years, Enphase Energy grew its trailing-12-month revenue every year — from less than $300 million to over $1.5 billion.

ENPH Revenue (TTM) data by YCharts

At the same time, it has been generating steady profits for more than three years.

Enphase Energy’s quality, technologically advanced products are easy to use as well. That’s likely a key factor behind its strong growth. At the same time, the company is laser-focused on keeping its costs low. Keeping costs under control is key for Enphase Energy, which faces stiff competition from low-cost Asian manufacturers.

In terms of future growth, Enphase Energy is working on several fronts simultaneously. First, in addition to microinverters, the company has already expanded its offerings to include batteries. In the first quarter, it shipped 120.4 megawatt hours of batteries. Enphase Energy has acquired ClipperCreek to enter the electric vehicle charger market. Further, it is collaborating with Upstart Power to integrate fuel cells into its batteries and microinverter systems. All these products expand Enphase Energy’s addressable market.

Finally, Enphase Energy is also looking to grow its international operations, with a special focus on Europe in the coming years.

At a forward P/E ratio of nearly 49, Enphase Energy stock isn’t exactly a bargain. But the company’s steady growth makes it a top stock to buy on dips for the long term.

10 stocks we like better than Tesla

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Tesla wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of June 2, 2022

Rekah Khandelwal has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link