[ad_1]

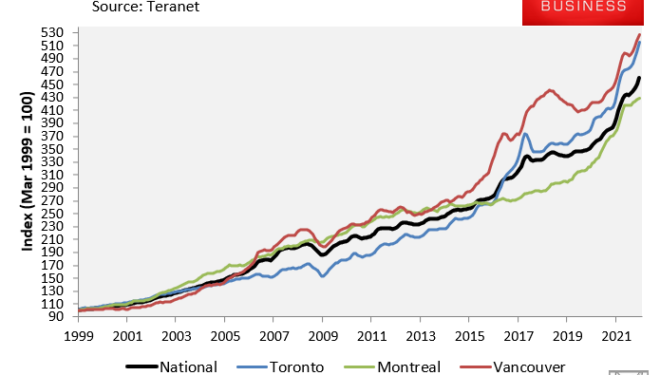

Like most English-speaking nations, Canadian house prices boomed over the pandemic, soaring 32% since February 2020 according to Teranet:

The surge in prices was led by Canada’s largest city Toronto where prices surged 37% over the pandemic.

However, like most nations, Canada’s mortgage rates have begun to rise, jumping by around 0.8% since March, according to the Bank of Canada:

This has prompted concerns that Canada is facing a significant housing correction and a possible recession:

Bank of Canada’s recent rate increases… have triggered a sharp decline in residential sales and a slowdown in home-price gains…

Prices in Canada’s housing market have accelerated at a faster pace relative to most developed-world peers for more than a decade…

The Bank of Canada, like the Federal Reserve and other central banks, is moving quickly to tighten monetary policy in the face of the highest inflation since the early 1990s. Canadian central bank officials acknowledge that annual inflation, as of April nearing 7%, accelerated faster than forecast. This prompted them to lift the benchmark rate in March by a quarter point to 0.50%, followed by a half-percentage point increase in April to 1.0%…

Economists and real-estate agents say early housing data suggest the central bank is underestimating the fallout from higher rates on economic activity…

“I haven’t seen a thrust in fixed rates like this, even during the credit crisis” of 2008 and 2009, said Robert McLister, founder of MortgageLogic.News. “This was a shock in the system”…

Housing accounted for about 20% of Canada’s economic growth last year…

Prolonged weakness in housing could quickly spill over to other parts of the economy, such as consumer spending and construction, economists say…

“The worrying thing is this is only really the first month of weakness in housing,” said [Stephen Brown, economist at forecasting company Capital Economics], who is forecasting a 10% drop in housing prices over the next 12 months. “If house prices fell by much more than we expect, which clearly should not be ruled out given their elevated level, a recession would be almost inevitable.”

It is a theme being played out across the Anglosphere – from Australia and New Zealand to Canada and the United States.

After experiencing the biggest boom in house prices for generations on the back of ultra loose monetary policy and government stimulus, central banks are now tightening in unison, which will likely deliver a synchronised global property correction.

[ad_2]

Source link