[ad_1]

style-photography/iStock via Getty Images

This article was cowritten with Williams Equity Research (“WER”).

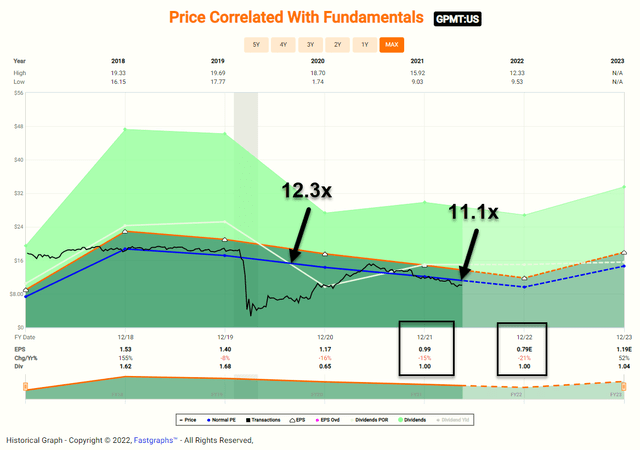

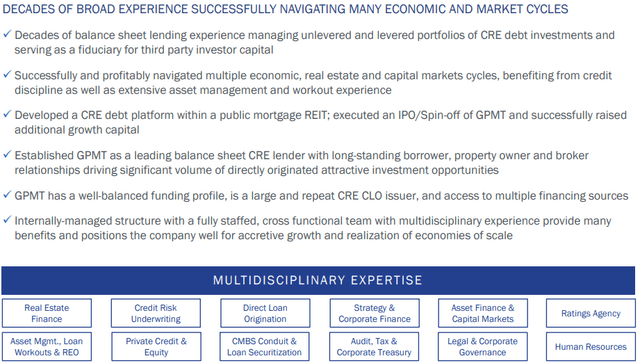

What Makes Granite Point Mortgage Trust Inc. (GPMT) Special?

Granite Point doesn’t have the scale of heavyweight peers like externally managed Blackstone Mortgage Trust (BXMT) and Starwood Property Trust (STWD), but its internal management structure is a rare in this space and Granite Point has impressive capabilities despite its more modest size.

Source: Granite Point Mortgage Trust March 2022 Investor Presentation

Like their equity REIT cousins, there is great diversity in strategy and risk within the mortgage REIT category. Starwood Property Trust, for example, despite being classified as a mortgage REIT is a hybrid and owns a sizeable portfolio of physical properties.

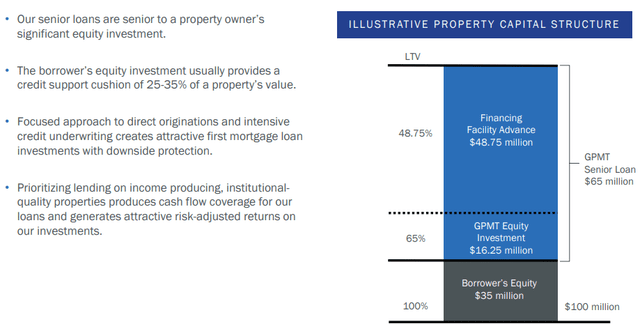

Mortgage REITs also focus in different areas of the capital stack. That’s short of capital structure and includes all layers of debt and equity associated with a company.

Source: Granite Point Mortgage Trust March 2022 Investor Presentation

This illustration shows how Granite Point often includes a 15-18% equity investment within the senior loans it originates. As one would expect, this strategy has plusses and minuses. Granite Point’s approach enables it to win deal flow against larger peers and engage in projects other lenders aren’t suited for.

One example is an $82 million floating-rate senior loan originated in Q1 of 2020 to acquire and renovate an industrial property in Denver. Only a select group of mortgage REITs is willing to invest the equity and take the risk necessary to complete renovations.

Portfolio Construction & Why It Matters – A Lot

Trends in portfolio construction and characteristics are simultaneously among the most important to evaluate for a company and most difficult to ascertain.

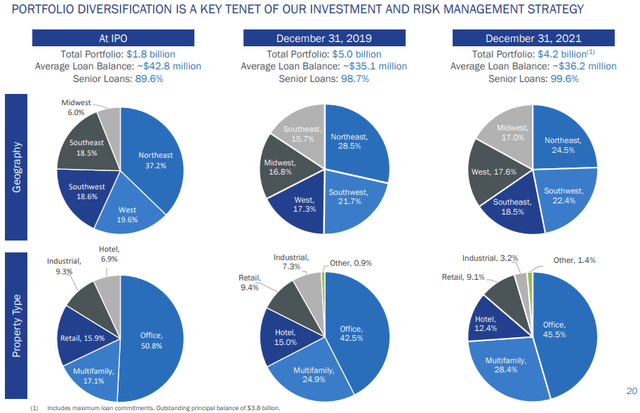

Source: Granite Point Mortgage Trust March 2022 Investor Presentation

This is a great diagram showing portfolio exposures at IPO, just before the pandemic, and as of the end of 2021. Geographic exposures were similar, but exposure to multifamily rose significantly (17.1% to 28.4%) over the years while others went back and forth.

As of the end of Q1, hotel and retail properties make up 21.6% of the portfolio. Performance has mostly stabilized in these more challenging industries, but with recession risk brightening on the horizon, we may be scrutinizing these cyclical areas once again.

The portfolio was 98% floating rate as of the end of Q1 with a weighted average LIBOR/SOFR (think of SOFR as the new LIBOR) floor of 1.14%, which is currently accretive.

When It Comes To mREITs, Risk Is More Important Than Return

That isn’t an exaggeration or cliché talking point. Mortgage REITs are fundamentally credit vehicles, and just like a portfolio of bonds or loans, there isn’t a mechanism to make up for meaningful loss of principal.

Investors can afford to take losses on equity investments because there is an offsetting probability of large wins. That simply isn’t the case with fixed income, and in this case, mortgage REITs.

This brings us to another aspect of investing that might sound obvious, but most people definitively do not appreciate.

Source: Granite Point Mortgage Trust March 2022 Investor Presentation

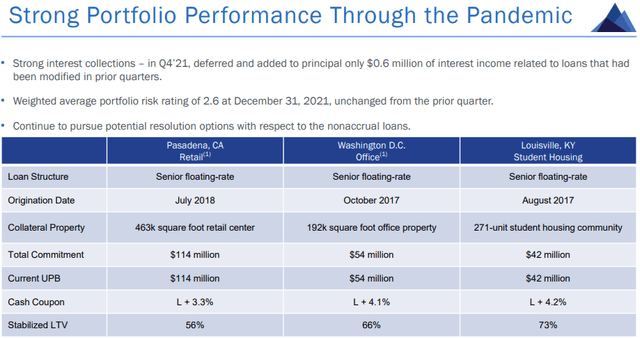

Note the title of this slide from the last Granite Point investor deck: “Strong Portfolio Performance Through the Pandemic.”

Of all the companies you follow, including REITs, Business Development Companies, and all types of C-Corps, have you seen a slide on this subject titled “Weak Portfolio/Operating Performance Through the Pandemic” or “Management Mishandled the Pandemic” or “We Had Too Much Leverage and Underestimated the Risk of a Recession”?

I didn’t see anything like that, and I go through hundreds of filings, supplemental, and earnings presentations every quarter.

Not once.

Investor Materials & Smart Parenting

Earnings presentations are like asking your teenager what they did over the weekend, except it’s asking management about the three months. If a decent kid, they probably won’t lie, but there is a good chance they won’t share the whole truth. Judging a kid’s activities based strictly on their story is naïve at best and could be costly long-term.

SEC filings are the equivalent of having a GPS tracker on their car and one of those apps that records text messages on their phone. Sure, it’s not perfect vision into what’s going on, but these systems aren’t easy to cheat. It also gives you an enforcement mechanism because it’s a heck of a lot easier to catch them in a lie.

That’s the attitude I recommend having when it comes to reviewing investor materials. If the kid is a straight-A student with an excellent history of behaving, that’s akin to a company with a great dividend track record and long reputation of acting appropriately.

That’s no guarantee about the future, and healthy skepticism is warranted, but as investors with many “children” in our portfolio, we need to know who to supervise more closely.

When reviewing diagrams like the pervious one discussing Granite Point’s performance during the pandemic, the key is to figure out what’s not included. We’ll touch on exactly that in the next sections.

Leverage & Problematic Loans

Starting with loans on non-accrual, meaning those that are not living up to their obligations to pay Granite Point interest and or principal payments, Granite Point reduced the previous four problematic loans down to one. This leaves the ratio of loans on non-accrual at 2.7% of the total loan portfolio.

Granite Point raised over $200 million in preferred equity to reduce higher-cost debt. That was among many levers it pulled to survive 2020 and rebuild its balance sheet. In my opinion, the market has not yet appreciated the extent that Granite Point has improved its balance sheet because it’s focused in other areas.

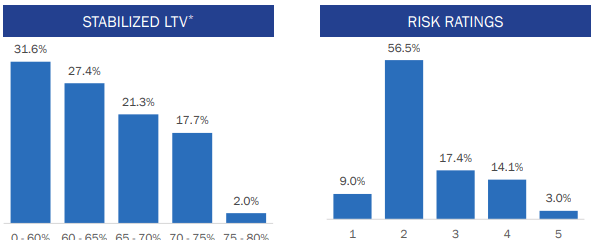

Source: Granite Point Mortgage Trust March 2022 Investor Presentation

Granite Point’s risk ratings have improved significantly since 2020 but warrant a close look. Blackstone Mortgage Trust, for example, has 9.7% of its loan portfolio in categories 4 and 5 compared to 17.1% for Granite Point.

Apollo Commercial Real Estate Finance, Inc. (ARI) finished last quarter at 6.8%. I could go on, but Granite Point maintains among the highest exposure to the highest risk ratings. This matters, because in my experience 90%+ of loans that end up resulting in losses come from this area.

Granite Point conveniently left out risk ratings from its earnings presentations in the quarters following the pandemic.

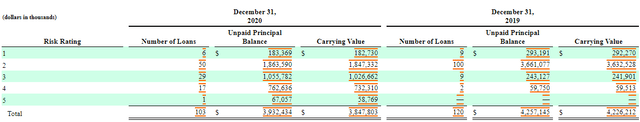

Source: GPMT Q4 2020 10-Q

Fortunately, we can still find them in SEC filings. I’ll do the math for you:

Granite Point’s category 4 and 5 loans were 20.6% of the portfolio at the end of 2020. So, has the portfolio improved?

Yes.

Is it still close to end of 2020 levels of issues, which are much higher than the peer average?

Also, yes.

Valuation & Conclusion

I strategically selected a few data points to set the stage for the last section.

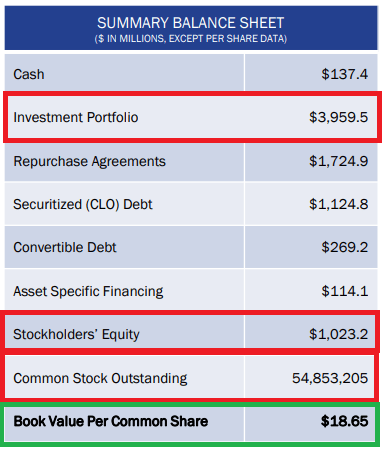

Source: Granite Point Mortgage Trust Q3 2019 Earnings Release

Going into the pandemic, Q3 2019’s investment portfolio was just under $4.0 billion in size with stockholders’ equity of $1.0 billion.

Divide that by 54.9 million shares outstanding and we land on an $18.65 book value per share. This is a rough but useful estimate of the net assets behind each share of Granite Point common stock.

Now the challenges of 2020 arrive.

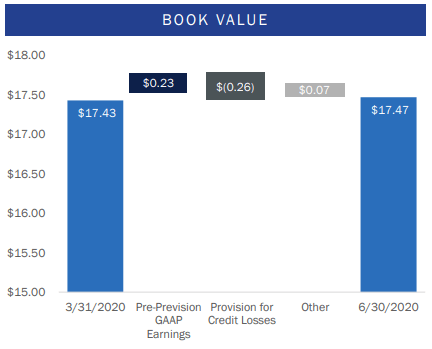

Source: Granite Point Mortgage Trust Q2 2029 Earnings Release

Or do they?

Granite Point’s book value per share increased $0.04 between Q1 and Q2 of 2020 – that’s when the bulk of losses during the pandemic were realized for most companies.

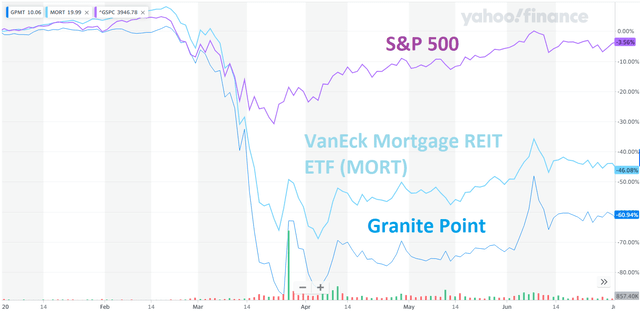

Granite Point lost 90% of its value, and I bought a good number of shares below $4. The mREIT’s common shares are shown below against the S&P 500 index and the VanEck Vectors Mortgage REIT Income ETF (MORT).

Yahoo Finance

Granite Point was still down 60% from previous highs at the end of Q2 2020. The VanEck Vectors Mortgage REIT Income ETF rested at -46% with the S&P 500 sitting less than 4% below January 1st levels.

Granite Point had legitimate liquidity issues, which resulted in suspending the dividend, but our deep financial and operational analysis indicated the stock was still worth a minimum of $8 per share with a fair value of $12-$15 depending on the impact of the pandemic, lockdowns, and how well the economy held up.

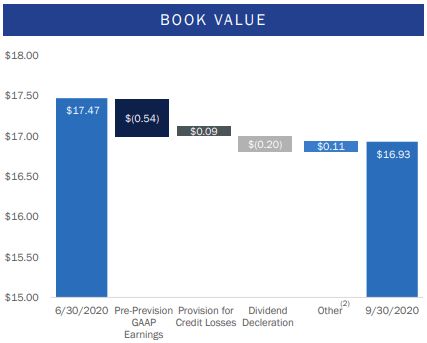

Source: Granite Point Mortgage Trust Q3 2020 Earnings Release

While pleasantly surprised with the stability of Granite Point’s book value per share in Q2, we knew pain was coming for a variety of reasons.

This was illustrated by the decline in book value per share, from $17.47 at the end of Q2 to $16.93 the following quarter. To be fair, those are strong results considering the circumstances.

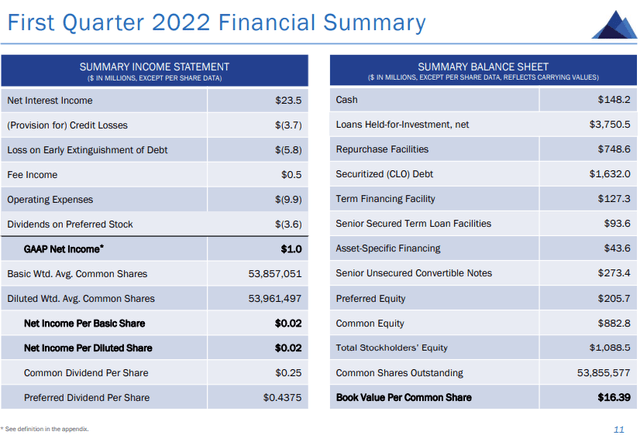

Source: Granite Point Mortgage Trust Q1 2022 Earnings Release

Now we come circle with stats from the recently released Q1 2022 earnings.

Compared to 9/30/2020, the most recent book value per share of $16.39 is 3.2% lower.

That’s not the only decline.

Granite Point’s $0.25 quarterly dividend is 40.5% lower than pre-pandemic’s $0.42. The incredibly rapid rise in the mREIT’s assets from $667 million in 2015 to $4.3 billion at the end of 2019 has also come to an end.

The portfolio hit the brakes going into the pandemic and has been at $3.8 billion for many quarters. A lot of this was due to arguably drastic measures Granite Point took to ensure it would get through the pandemic and resulting liquidity crunch. To that point, it succeeded.

We know Granite Point has higher than average problematic loans compared to peers (per management’s own ratings) and has shown some, but note dramatic improvement in this area since the end of 2020.

Loans on non-accrual have done better, with only one still on the balance sheet, although it’s a not insignificant 2.7% of total assets. Where Granite Point has made more significant progress is sticking to ~100% senior floating rate loans and ending last quarter with 2.7x debt-to-equity (2.5x after reasonable adjustments), of which only 0.9x is resource.

Liquidity, in terms of the $139 million in cash on the balance sheet and $3.0 billion in financing capacity outstanding, is also much more resilient today. Non-market-to-market financing is also 75% of the total, another big improvement compared to two years ago.

It’s a mixed picture, and that’s okay, as what counts is balancing all this against valuation.

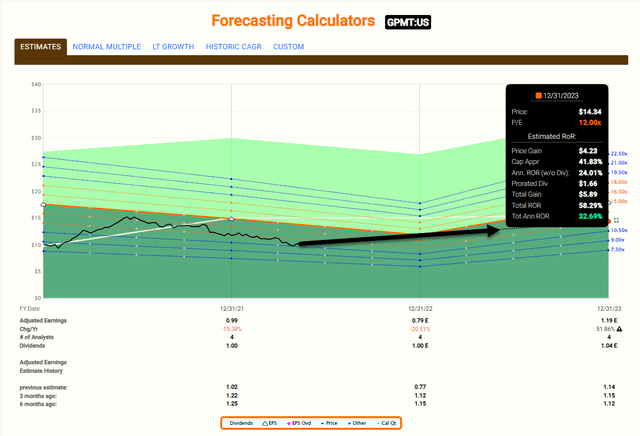

We will determine valuation two ways.

First, Granite Point’s adjusted book value per share was $16.15 as of the end of Q1 2022. The “adjusted” considers $0.21 per share for charges due to the early extinguishment of debt and another $0.03 for related accounting reasons.

We think that’s fair, and the difference isn’t material compared to the standard figure of $16.39, which is inclusive of $0.67 in CECL reserves (anticipated losses for problematic loans).

Granite Point is trading at a massive ~38% discount to book value per share. That’s among the highest in the sector, and that doesn’t account for the fact internally managed companies like Granite Point, all other things equal, should trade at better valuations than their externally managed peers.

What the heck is going on?

Let’s look at the second valuation component to find out.

Second is cash flow per share. Given the immense discount to book value we discussed a second ago, we’d expect Granite Point to score well in this department. GAAP earnings won’t be helpful for multiple reasons, so we need to use non-GAAP metrics like distributable earnings (“DE”). Before the write-off of $12.7 million, DE were $0.24 per share.

That barely covers the $0.25 dividend and excludes the write-off; without that adjustment, the mREIT’s DE was only $0.05. The $0.24 is no anomaly and in the same ballpark as previous reporting periods.

This results in a cash flow yield of approximately 10% with the stock price around $10. This is 10-15% higher than the likes of BXMT and STWD, which is something, but not nearly enough to justify Granite Point trading near book value.

Ladies and gentlemen, we’ve found our culprit: the reason Granite Point’s common stock has slid back to $10 a share and a ~38% discount to book value while many of its peers trade at a premium is because of cash flow.

It simply doesn’t currently generate enough cash flow per share to trade near book value when there are plenty of other quality mortgage REITs generating almost as much cash flow per share and current dividends.

As we at Wide Moat say all the time, cash flow is king.

In terms of tailwinds and headwinds, Granite Point’s lower cost of capital in multiple areas will mathematically improve earnings in the coming quarters. It won’t be extraordinary, but it will help.

Effective leverage around 2.5x is also well below the target of 3.0x to 3.5x. Coupled with its much more intelligently designed leverage/borrowing profile, Granite Point is well positioned to deploy capital into the tough market that many anticipate.

If you’ve followed our work on other mREITs, you’ll recognize this language, as the other players are a couple quarters ahead of Granite Point and already started increasing leverage.

In aggregate, we do believe Granite Point trades at a discount and is attractive at $10 per share, but it’s unwise to expect the stock to return to $15 a share anytime soon.

That’s exactly why WER sold the vast majority of his exposure around that level – it didn’t make any sense.

As portfolio performance improves, which we are confident it will (a severe recession notwithstanding), a $14 price tag seems extremely reasonable. That’s still a meaningful double-digit discount to book value, and cash flow per share should increase 10-20% by that time.

To obtain a high probability of at least a 50% total return in the next couple years, we recommend paying no more than $10.50 per share. The 33.3% target capital gain plus $2.0 a share in dividends along the way (assuming two-year hold time) is a much higher expected return profile than any other mREIT we cover and beats out a large percentage of equity REITs as well.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

[ad_2]

Source link