[ad_1]

btgbtg/iStock via Getty Images

Introduction and Investment Thesis

Eagle Bancorp Montana, Inc. (NASDAQ:EBMT) might have a tough go of things in the near future. In general, its securities have accumulated losses and will likely continue to do so as interest rates rise. In addition, its mortgage banking business (which has represented a large portion of its revenue in the recent past) has begun to slow down, materially cut in half. In addition, rising interest rates will likely cause its deposit yields to increase four-fold, while its non-interest expenses remain a burden.

In the analysis below, we attempt to estimate a “normal” net income figure by considering EBMT’s revenue relative to its expenses, combined with its recently acquired First Community Bancorp; then determine how these normalized earnings compare to the stock’s current market price.

Acquisition of First Community Bancorp, Inc.

Per a recent 8-K, as of April 30, 2022, EBMT completed its previously announced acquisition of First Community Bancorp, Inc., at which time First Community Bancorp was merged into EBMT, with EBMT continuing as the surviving corporation. In exchange for each of First Community Bancorp’s outstanding shares (i.e., 37,000 shares as of 12/31/2021), EBMT paid $276.32 in cash and 37.7492 shares of EBMT common stock. This means that EBMT will have to pay $10,223,840 in cash, and issue 1,396,720 new shares (i.e., 37,000 x 37.7492).

All in, this purchase price totals about $38,577,256 (i.e., 1,396,720 EBMT shares at the 4/29/2022 closing price of $20.30, or $28,353,416; plus $10,223,840 cash). Per the 2021 financial statements of First Community Bancorp included with a recent 8-K, the book value of First Community Bancorp on 12/31/2021 was $41,046,964; therefore, EBMT was able to buy the net assets of First Community Bancorp at a presumed 6% discount to its book value (i.e., $38,577,256 / $41,046,964 – 1). I would guess that the idea was to complete the purchase at 1X book value (i.e., at $22/share on the date of original announcement of September 30, 2021), but EBMT’s stock has slid to $20/share since that time), resulting in less share value being exchanged. Anyway, it appears so far that perhaps EBMT shareholders got a good deal.

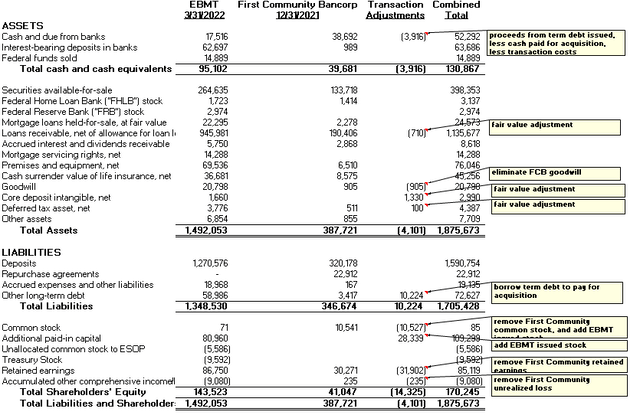

To understand what the company looks like going forward, we will need to combine their balance sheets. Let’s explore that now.

Combining the Two Banks

Fortunately for us, EBMT has provided us a pro-forma combined balance sheet in a recent 8-K. This balance sheet is as of 12/31/2021, however; so I’m going to update it with EBMT’s recent balance sheet per its recent 10-Q, and use the their same transaction adjustments to combine EBMT’s 3/31/2022 balance sheet with First Community Bancorp’s 12/31/2021 balance sheet. Although things will have changed for First Community Bancorp over the past 4 months (e.g., loan originations or increase in deposits, etc.), this should be sufficient as a means for approximating the combined bank’s prospects going forward. At the filing of EBMT’s next 10-Q (i.e., as of 06/30/2022), we will have a better idea of how the combined bank looks; but in the meantime, we can put together a close estimate and analyze the prospects of the combined company using this method. This is how the combined balance sheet would look:

Revenues

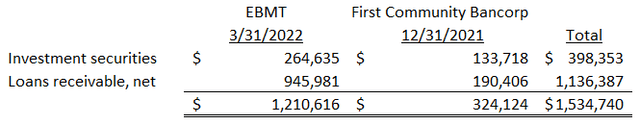

To determine anticipated revenues, we need to look to the balance sheet and multiply its interest-earning assets by their various yields. The most significant interest-earning assets of the combined bank are its available-for-sale securities and its loans:

Let’s look at each of these in turn:

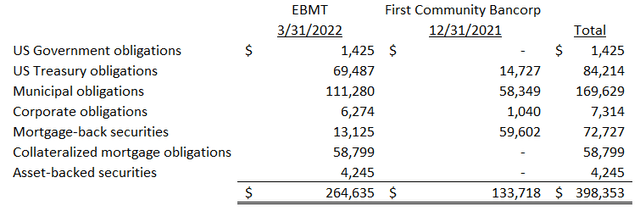

Available-for-Sale Securities

If we were to combine the available-for-sale securities as of the dates specified above, we would result in the following disaggregation:

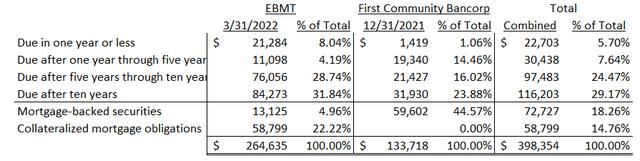

The nature of these securities presents a lower risk of default; however, due to the current environment, our primary risk is interest rate changes. Every category on both companies is currently sitting on unrealized losses due to the recent increase in interest rates; however, to determine our going-forward risk, we need to consider the duration of the securities (i.e., securities with a longer time to maturity exhibit more volatile swings with changes in interest rates). To do so, we can pull the respective companies’ footnotes related to maturities and combine them together:

The majority of the securities for both banks seem to mature more than 5 years from now, which presents a higher risk when interest rates increase. During Q1 2022, EBMT had an unrealized loss of $17mln on its investment securities; this represents a 6.2% loss on the 12/31/2021 fair value of $271mln. Due to the similar make-up of First Community Bancorp’s securities, I would anticipate a similar loss of 6.2% for Q1 2022, which would result in an $8.3mln loss (i.e., $133.7mln * 0.062), bringing their securities value down to $125.4mln. With that in mind, if we take into account that the Fed plans many quarters similar to Q1 2022 going out into the future, we have a significant risk of losses piling up in these securities.

Due to EBMT being publicly traded, we have some good information about their current yields on securities; First Community Bancorp, though, not so much. So we will have to make some assumptions. Given the similar make-up of the securities (i.e., even the maturities are similar), we can assume that the yields on First Community Bancorp’s securities are similar to those of EBMT’s; then as a check, we can divide their 2021 interest income by their average securities balance to see if they jive.

Per EBMT’s recent 10-Q, the annual yield on its average balance of securities for the first quarter was 1.93%; if we were to multiply that yield by the current balance of $265mln, we would get $5.1mln in interest, which is less than a third of its unrealized loss in that quarter. To put that another way, it would take three years of interest to break even on that loss! A similar result for First Community Bancorp would result in $2.6mln interest per year against an $8.3mln unrealized loss. Looking at the pro-forma combining income statement, the interest for securities of First Community Bancorp was actually $1.8mln, so perhaps their yield is even lower than EBMT’s.

For accounting purposes, these unrealized losses do not hit the income statement until realized, so everything could appear fine in earnings, until all of a sudden we are hit with a sizable realized loss when/if sold. It’s safe to say that we are in the hole here with the available-for-sale securities. Either we hold these securities at a very low yield, or we sell them at a loss to originate loans or buy higher yielding securities. Perhaps our best guess for earnings on the securities (i.e., interest income, net of losses on the securities) is $0.

Loans

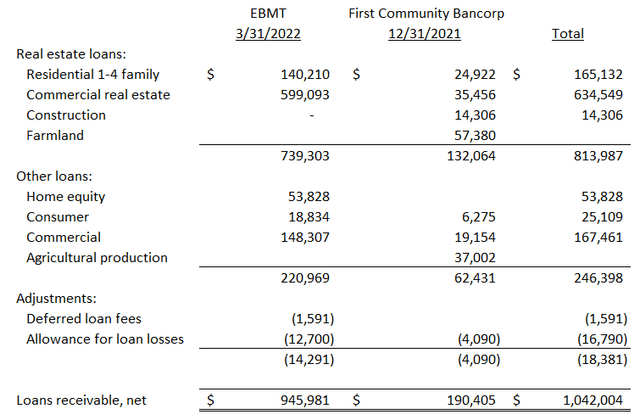

The loans represent the largest source of revenue for the banks, due to their higher balance and higher yields. If we were to disaggregate the loans and combine the two banks together, this is how it would look:

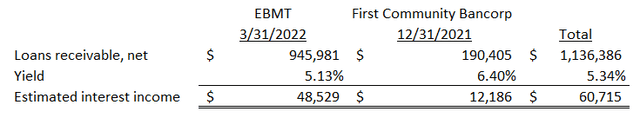

Unfortunately, neither of the financial statements (i.e., EBMT’s or First Community Bancorp’s) disaggregate the yields by loan type, and First Community Bancorp does not disclose yields at all; so we will have to take a bird’s eye view of this and make some assumptions. Per EBMT’s MD&A within its recent 10-Q, it is yielding 4.73% across its loan portfolio. Based on the loan balance above, that would yield $44.7mln of interest income per year; this is actually pretty close to the run-rate of Q1 2022 interest income of $45.5mln. Using a similar methodology for First Community Bancorp’s interest income, by dividing the 2021 interest income by its average loan balance (i.e., beginning balance + ending balance / 2), we come to a yield of 6.4%; that’s an unusually great yield!

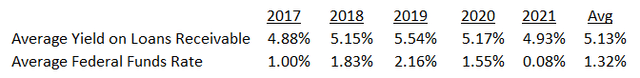

We need to consider, though, the impending increase to interest rates this year, and whether the loan types for the banks would allow for adjustable rates. In reading the recent 10-K, we note that the majority of EBMT’s loans are fixed or are adjustable after a certain number of years. The only “true” adjustable rate loans appear to be the commercial loans which only represent 15% of the portfolio. That means the bank is likely unable to materially participate in the rising rates until they originate new loans or the current loans’ rates reset. To get a picture of how this might look, we can take a look back over the past 5 years to see EBMT’s changes in yields as the rates increased through 2021:

Based on the current discussions and plans of the Federal Reserve, I expect the next five years to be very similar to the last five years, as far as the increase to interest rates (i.e., we are very similar to 2017 right now). So, assuming the average of the last five years for the yield at EBMT, we would come to the following annual interest income:

Author Calculations based on SEC filings

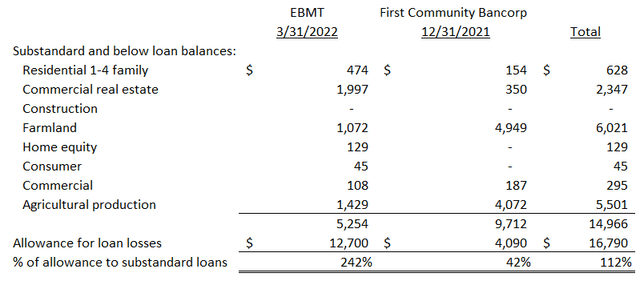

First Community Bancorp yields seem a bit high compared to other banks, but perhaps it is because First Community Bancorp leans toward the more risky loan types. To determine whether we are likely to be paid back the principal plus interest and whether the loan allowance is reasonable, we need to take a look at the credit quality of the loans. In the table below, we compare the amount of substandard loans to the allowance for loan losses per the balance sheet:

Author Calculations based on SEC filings

We note above that the allowance for loan losses of EBMT is significantly more conservative than that of First Community Bancorp. We also see significantly more substandard loans in the First Community Bancorp portfolio than that of EBMT. My inclination would be that EBMT’s methodology is the more appropriate of the banks, and will likely be the methodology going forward. As such, I would think that the allowance for First Community Bancorp should fall more in line with the percentage used in EBMT’s financials. If we were to bump up First Community Bancorp’s loan allowance to 242% of substandard loans, that would increase their allowance to $23.5mln (i.e., 2.42 * $9.712mln, an increase of $19.4mln). We have to keep in mind, though, that per the accounting standards of business combinations, this adjustment will never make it through the income statement, but rather, the fair value of the loans will be brought onto EBMT’s balance sheet on the acquisition date; if this scenario occurs, we will likely see a reduced loan balance for First Community Bancorp as of the acquisition date. EBMT’s pro-forma balance sheet in the recent 8-K estimates a reduction of $4.8mln in loan value upon consolidation, but I expect the reduction to likely end up more in line with the $19.4mln determined above.

So how does this affect the income statement then? Noted above, the yield on First Community Bancorp’s loans are higher than average, and perhaps this higher yield will be substantially offset by future allowances that brings it back into a normal range. As such, when determining our interest income for First Community Bancorp, perhaps we should base it on the net adjusted loan balance after reducing it by the $19.4mln allowance as discussed above. This would make me a bit more comfortable about anticipated interest income from the entity. Such a reduction would bring anticipated interest income on First Community Bancorp to $10.9mln (i.e., ($190.4mln – $19.4mln) * 6.40%), and the combined bank’s interest income to $59.4mln (i.e., $48.5mln + $10.9mln). Given that this $59.4mln is remarkably close to the pro-forma consolidated amount of $58.9mln, let’s just use their amount for ease of comparison.

Other Income Sources

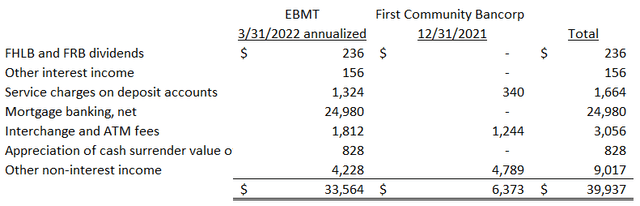

In addition to the interest on securities and loans, as discussed above, the banks also have additional income sources that I want to mention; but for brevity, we won’t dive too deep. I’ve taken the EBMT Q1 2022 income statement and annualized the other income items below, and combined it with the First Community Bancorp 2021 full year other income amounts:

Most of these income sources are generally negligible, but altogether they really add up. In particular, the mortgage banking profits at EBMT represent a large percentage of the bank’s entire revenue. In the 2021 full year income statement, the mortgage banking fees were $41mln; but in the first quarter it appears the amount has decreased (on a quarter by quarter basis, from $11.8mln to $6.2mln, a 47% decrease). Management stated in the recent 10-Q that this is a result of slowing in mortgages due to change in the interest rate and housing environment; a recent article by the Wall Street Journal also points to a significant reduction in profits across the industry for mortgage originating/selling organizations. Because of this, I think the annualized Q1 2022 mortgage banking profits presented above might be more appropriate going forward (or perhaps even still a bit high). As such, I think we can estimate the combined banks’ non-interest income to be $40mln per year.

Expenses

Interest Expense

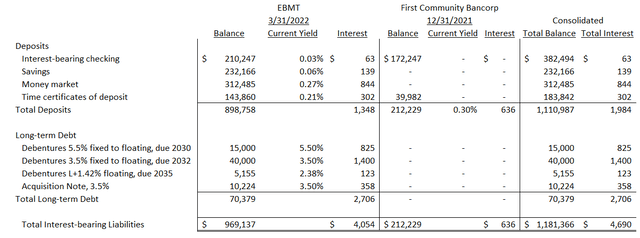

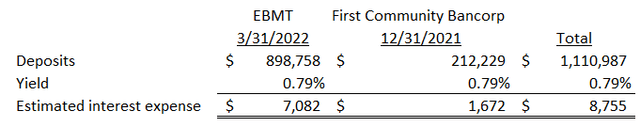

To determine anticipated expenses, we need to look to the balance sheet and multiply its interest-bearing liabilities by their various yields. The most significant interest-bearing liabilities of the combined bank are its deposits and its term debt:

From the table above, we see that EBMT has the majority of the deposits and other long-term debt, and therefore incurs the majority of the interest expense. The interest expense in the table for First Community Bancorp is the 2021 amount per its audited financial statements. We note that EBMT’s yield on interest-bearing deposits will likely have to increase as interest rates increase across the market. Also important to note is that the fixed long-term debt becomes floating later in the 2020’s; but the company has been given the option to redeem the debt once that occurs, so the bank will probably redeem it if the recalibrated rate is too high at that time. As such, we can have some comfort that the rates on that debt will not likely increase significantly any time soon. The table also includes the $10.224mln note that will be incurred to pay the cash portion of the acquisition.

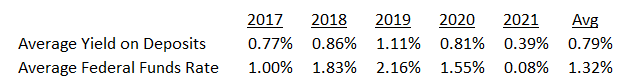

Given the high risk of interest rates increasing substantially by the end of the year, let’s take a look at what might happen if rates increased to the 2% level that occurred in 2019 (which seems to be the Fed’s plan based on various discussions). Similar to what we did in the loans section above, we could look back at the yield on deposits over the past 5 years, to see EBMT’s changes in yields as the rates increased through 2021:

SEC filings on Edgar and FRED

Assuming EBMT’s average yield on deposits over the past five years is a good expectation for how the yields at both banks might look over the next five years, we would come to $8.8mln annual interest expense on deposits:

Author Calculations based on SEC filings

Combining this with the term debt interest expense noted in the table above, we have $11.5mln ($8.755mln + $2.706mln) in expected total interest expense.

Non-Interest Expense

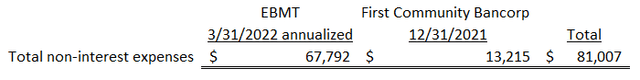

Due to the consistent nature of the banks, I would anticipate the non-interest expenses to remain relatively consistent in future years. We do have the issue, however, of various transaction expenses related to the acquisition of First Community Bancorp. But we might could also consider that synergies between the banks or elimination of redundancies could make those additional expenses a wash. Before we jump into it, let’s take a look at what the non-interest expenses were for EBMT in Q1 2022 and First Community Bancorp for the year ended December 31, 2021:

Total non-interest expenses come to around $81mln per year for the combined bank. The pro-forma consolidated financials disclosed with a recent 8-K anticipate $85.7mln in non-interest expense, which is based on EBMT’s 2021 amounts plus $242k in additional amortization on a core deposit intangible to be recorded and net transaction costs of approximately $1.5mln (i.e., $3.92mln in transaction costs, less $2.5mln in savings on compensation agreements). Based on this, I think it best to go with management’s expectation of $85.7mln as our basis for non-interest expense. Although perhaps in the future we could see some cost savings with the elimination of redundant items.

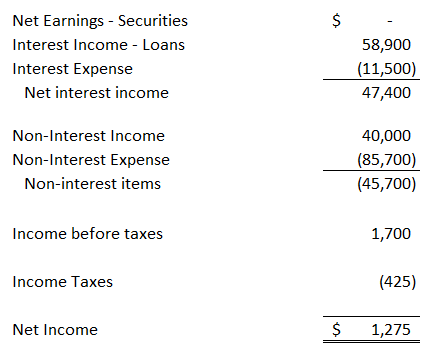

Profitability

Based on the analysis above, we can attempt to normalize the profitability of the combined bank, and determine what the combined income might look like for the bank. To do so, we will take into account our discussions above to come to appropriate amounts of revenues and expenses:

- Interest Income – Securities: As noted above, we are earning interest on these securities, but we are also incurring significant unrealized losses in them as interest rates are rising. I think a conservative approach here would be to anticipate $0 earnings on these securities (i.e., that the losses on them will wash the interest income); even though the interest income and losses are characterized differently in the income statement, we can assume $0 net income for our purposes.

- Interest Income – Loans: Per the discussion above, we estimate the interest income on loans to be $58.9mln per year.

- Non-Interest Income: Per the discussion above, we estimate the non-interest income to be $40mln per year.

- Interest Expense: Per the discussion above, we estimate the interest expense to be $11.5mln per year.

- Non-interest Expense: Per the discussion above, we estimate the non-interest expense to be $85.7mln per year.

- Income Taxes: The pro-forma consolidated financial statements disclosed with the recent 8-K estimate a 25% tax rate; we will use that here.

To summarize, this is how the combined profitability of the bank might look based on our discussions above:

Author Calculations, per discussions above

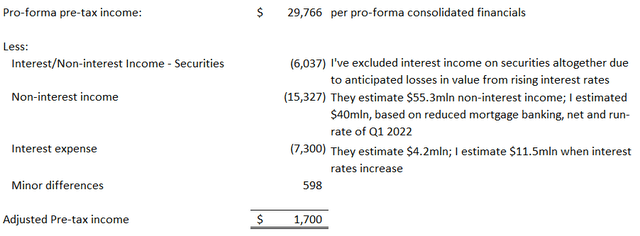

Based on the table above, we might expect nominal income of $1.3mln, based on the discussions previously. This is not a very palatable earnings amount; so what is happening here, why am I so far off from the company’s consolidated pro-forma financials? The consolidated pro-forma financials present an annual income of $29.8mln pre-tax income, and this is a reconciliation of how I differ:

Author Calculations, based on discussions above

Per the above, the primary driver of my reduced income going forward is the increase in anticipated interest rates (which were not present in the pro-forma consolidated financials), driving down the values of securities and reducing activity in the mortgage banking non-interest income. In addition, the non-interest expenses of running the bank represents a very large percentage of the revenue and really cuts into the bottom line. Perhaps the combined bank can eliminate some redundancies, but they did not mention or account for this in their pro-forma consolidated financial statements (other than $2.5mln in savings on compensation); so we have to assume they do not expect reductions in the non-interest expense.

Valuation

As of 05/17/2022, EBMT’s stock was trading at $19.15 per share; and across 7,952,456 shares outstanding (per the pro-forma consolidated financials disclosed in the recent 8-K, which include the additional shares issued for the acquisition; less 100,000 shares purchased in February 2022), the net income would be $0.16/share (i.e., $1.275mln / 7.952mln shares), which would be an earnings yield of 0.84% (i.e., a 119 P/E).

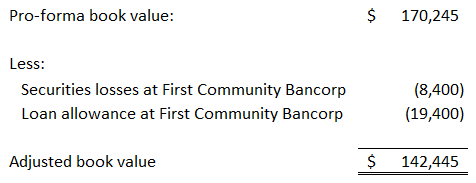

Currently, as presented above, the book value of the combined bank is $170mln; at the 05/17/2022 share price of $19.15 across 7,952,456 shares, we get a market value of $152.3mln. Therefore, the market price is sitting at a 10.4% discount (i.e., ($170-$152.3)/$170) to book value per the pro-forma consolidation financials constructed above, which might be reason enough for someone to buy shares. However, as discussed above, the securities at First Community Bancorp might see significant losses in Q1 2022 and an increased allowance might need to be recorded at First Community Bancorp, which would bring down the book value of the combined bank; and additional losses could accumulate throughout the year as interest rates continue to rise. Based on decreased values in securities at First Community Bancorp and the additional allowance to First Community Bancorp’s loan portfolio (as discussed above), we might determine a more accurate book value as follows:

Author Calculations

Based on this assessment, we might determine the market value to be 7% above the combined banks’ book value (i.e., $152.3/$142.4).

Conclusion

In general, I think the combined bank will have a tough go of it soon, as the losses on its securities start to accumulate, its mortgage banking non-interest income begins to slow down, and it begins to be squeezed by higher interest rates on its deposits as well as its high non-interest expenses. Given the current interest rate environment, I think an investor would be better off avoiding EBMT in favor of other companies that have a better risk/reward profile; at least until after the Q2 2022 financial statements are released and we are able to have a better idea of how the combined bank looks.

[ad_2]

Source link