[ad_1]

AlexLMX/iStock via Getty Images

Canada’s top five banks are set to report their Q2 earnings this week.

Bank of Nova Scotia (NYSE:BNS) and Bank of Montreal (NYSE:BMO) are set to report on May 25th before market open, while Toronto-Dominion Bank (NYSE:TD), Royal Bank of Canada (NYSE:RY) and Canadian Imperial Bank of Commerce (NYSE:CM) will report their numbers on May 26th before market open.

Earnings at the top five are expected to drop on average as the banks were likely weighed by increased expenses and loan-loss reserves and lower investment banking revenues, despite strong loan growth and margin expansion as interest rates rose. A surge in inflation and stock market sell-off will also weigh on earnings, Reuters said.

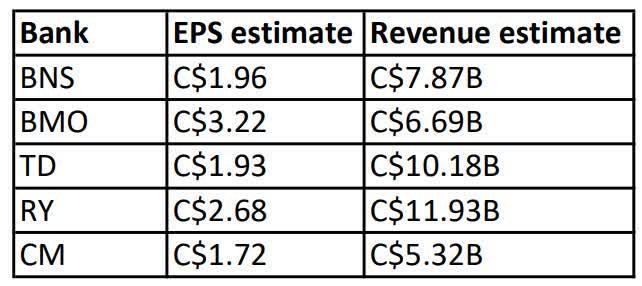

The consensus estimates for the banks are given below:

While record-low interest rates during the coronavirus pandemic weighed on net interest margins, they boosted demand for mortgages. Strong equity markets and deals activity, meanwhile, powered capital markets and wealth management divisions.

Government stimulus programs kept loan losses low.

Falling equity markets would have weighed on assets under management and investment banking activity has also slowed down dramatically, Manulife Investment Management portfolio manager Steve Belisle told Reuters.

Labor market shortages will also be a challenge according to National Bank Financial analysts, with recent announcements by banks of wage hikes and bonuses. They also noted factors such as slower asset growth potential outweighing a boost from margin expansion.

Investors suggested that banks may see lower credit-loss reserve releases or higher provisions in the second quarter in response to higher risks.

However, SA contributors have been largely bullish about the top five banks, with one noting that BNS’ credit quality is gaining strength with fewer write-offs and lower provision for credit loss. Wolf Report expressed confidence that banks will benefit from a rising interest rate environment.

Jonathan Weber suggested TD has the edge over RY due to even more favorable dividend metrics and fundamentals, but both banks look good on paper. Meanwhile, Mark Dockray suggested holding onto CM, with a dividend yield at the top-end of its peer group.

[ad_2]

Source link