[ad_1]

ThitareeSarmkasat/iStock via Getty Images

Thesis

The mREIT sector faces tremendous challenges and uncertainties ahead, and I won’t recommend mREIT stocks in general. However, I can recommend a holding rating for New Residential Investment (NYSE:NRZ). Not because it is immune to what’s coming ahead, but because I see it better positioned for the difficulties ahead.

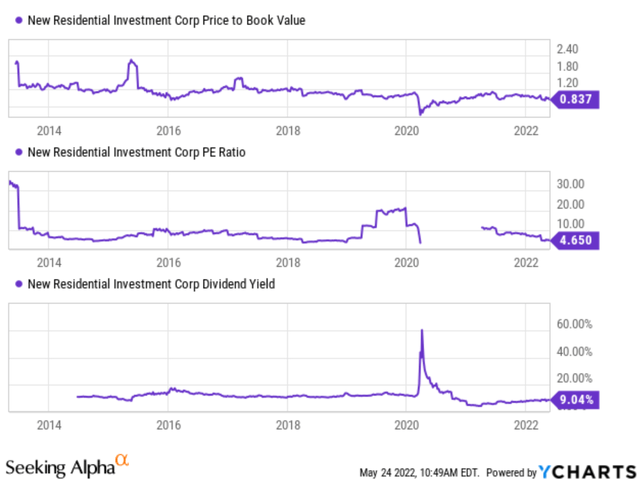

First, it should be more resilient to rate changes than the average mREIT sector because of its diversified revenue sources. Its loan origination and MSR sectors respond in opposite ways to interest rate movements. Secondly, a combination of the book value recovery and price corrections have brought its valuation below book value (0.84 times book value as of this writing). It is almost a 25% discount compared to its historical average of 1.1 times book value, providing a sizable margin of safety here.

The current macro environment

Its Chief Executive Officer Michael Nierenberg summed up the current macroeconomic uncertainties very nicely in the earnings report on May 3:

The macro environment, there is no secrets here. Inflation at multiyear highs. The Fed is going to raise rates, we believe, 50 basis points this week. The geopolitical uncertainties continue to add to market volatility and macroeconomic concerns. I pointed out about where 2-year and 10-year treasury yields, what they have done in the quarter. Credit spreads, once again, have widened significantly, double where they were in the fourth quarter of ‘21.

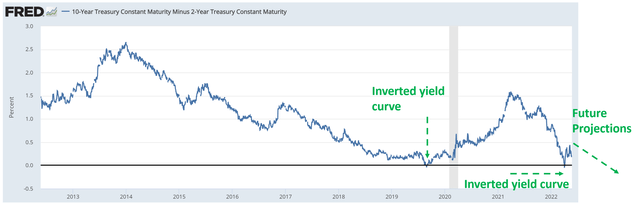

Notably, the 2-year and 10-year treasury yields Nierenberg mentioned are shown in the chart below.

As you can see, the spread between 10-year and 2-year treasury rates jittered below 0% in April. And the dreaded yield curve inversion has briefly occurred. The spread has rebounded a bit to the current level of 0.21%, still a nervously thin level to me. To put things under historical background, the last time the yield curve inverted was toward the end of 2019. And we all know what followed afterward: the recession in early 2020. The inverted yield has been a reliable leading signal for recession historically, and it is a possible scenario this time too.

Even without a recession, a narrowing yield curve can also put tremendous pressure on the profitability of the mREIT sector, and NRZ is no exception. Furthermore, I see the good chances that the yield curve will further narrow from here as argued in my earlier article here,

Now with Fed’s hawkish tapering and anticipated interest rate raises, there are a couple of possible outcomes. Again remember that the Fed only controls the short-term rates. The long-term rates can change in any fashion (stay put, rise more slowly, or rise more quickly than the short-term rates) and lead to either expanding or contracting yield spread.

Unfortunately, the spread is taking the direction of contracting so far. And according to Fed’s dot-plot, the short-term interest rates will gradually rise to 2.5% to 3% level in a few years. I expect the long-term rate to rise no more than that, i.e., to stabilize in the 2.5% to 3% in the long term also (long-term rates eventually cannot rise above inflation or GDP growth – otherwise, our government would have solvency issues). This means the narrowing is expected to continue and further pressure NRZ’s profitability.

Then the next question is how well is NRZ prepared for a narrowing yield spread, as discussed immediately below.

Is NRZ prepared for a high-rate environment?

In short, NRZ is better prepared for a higher rate environment than the average company in the mREIT sector. Thanks to its Caliber acquisition recently, it now has two major diversified revenue streams responding in opposite directions to interest rate changes. The first stream consists of the mortgage origination business typical to the mREIT sector. This sector’s earnings are typically pressured by narrowing yield as it profits from the short-term and long-term credit spread. The second stream consists of the MSRs. NRZ now holds the largest portfolio of MSRs among non-banks. And the rising rate environment will drive higher earnings from this segment. As Chief Executive Officer Michael Nierenberg commented (the emphases were added by me)

I will tell you today we are positioned for much higher rates. MSRs, as I pointed out before, $626 billion, an industry leading MSR portfolio, will go up in value as rates rise. We saw the results of that in the first quarter. Our origination franchise continues – will continue to be focused on purchase and recapture, Baron will talk to that in a little bit. Assets that we have on our balance sheet that have positive duration are all hedged against rising rates.

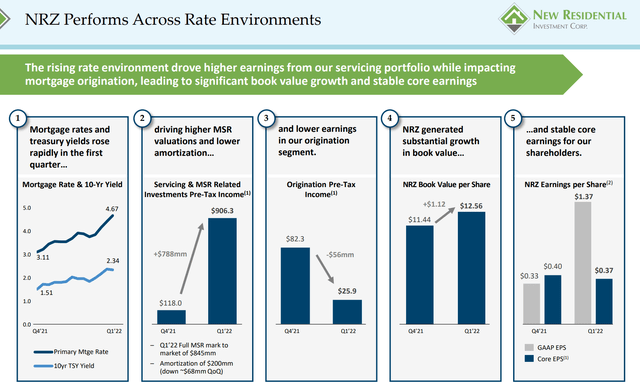

The financials certainly corroborate the above CEO comments. As you can see from the following chart, last quarter, it reported a sharp increase in Servicing & MSR Related income. The increase was $788M, from $118M in Q4 of 2021 to the current level of $906M. While at the same time, earnings from the mortgage origination segment decreased by $56M.

Valuation and projected returns

Thanks to its diversified earnings streams and hedges against higher interest rates, it reported healthy book value growth and stable core earnings. Book value has recovered to $12.56 per Common Share as of March 31, 2022, representing a 9.8 percent recovery from December 31, 2021. Core earnings have come in at $177.4 Million or $0.37 per Diluted Share, comfortably covering the $0.25 per share dividend.

Due to a combination of the book value recovery, earnings stability, and also recent price corrections, its valuation now stands at an attractive level as you can see from the chart below. In terms of price to book value ratio, the most important metric in my view for mREIT, stands at 0.84x only. To put things under a broader historical perspective, the stock has been trading at an average of 1.1 times book value in the past decade. Therefore, the current valuation is at almost a 25% discount compared to its historical average. The valuation also looks attractive in terms of PE ratio (about 4.6x) and also dividend yield too (9%+ notably).

Summary and other risks

I won’t recommend mREIT stocks in general given the uncertainties ahead but can recommend a holding rating for NRZ. I expect it to weather the difficulties ahead better than the average mREIT sector. Its loan origination and MSR segments enable a hedging mechanism. Its substantial discount from book value (by about 16%) and from the historical average (by almost 25%) provides a margin of safety here. Finally, 9%+ of the current dividend yield also provides support.

Finally, there are other risks besides the interest rates mentioned above. The likelihood of a recession has grown significantly in recent quarters as rising inflation and globalization uncertainties worsen. Stocks with bellwether status such as Walmart (WMT) and Target (TGT) all reported headwinds due to inflation and higher costs last week. On the housing front, there are tremendous uncertainties too. Inventory is extremely low, housing prices may have passed the peaks already, and affordability is under pressure. As an mREIT player, NRZ will be sensitive to these broader economic conditions and also the housing market parameters.

[ad_2]

Source link