[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

The worsening economic outlook has had investors back away from the banking sector, amid concerns that inflationary risks and rising credit costs will drag on earnings growth. But while these concerns are indeed very real, investors should not underestimate the impact of the rising Fed funds rate on the interest income banks earn from the loans they make.

Earnings growth across the sector is expected to be uneven though, as not every financial institution is going to benefit to the same extent from the rising interest rate environment. At the same time, there are other factors to consider too, such as differences in the composition of their balance sheets, business exposures and credit risk characteristics.

Considering the above, one bank which appears to be particularly attractively positioned is Fifth Third Bancorp (NASDAQ:FITB).

Interest Rate Tailwinds

The regional bank’s asset sensitive balance sheet is one reason why the interest rate tailwinds could have a bigger impact on its earnings compared to its rivals.

Fifth Third, like many regional banks, generates the bulk of its revenues from money lent out at higher rates than paid on deposits – the difference known as net interest income. NII accounted for more than 60% of the bank’s revenues, even as lending margins fell to new lows in 2021. And while variable-interest loans account for slightly under half of its loan book, the lender has a loan-to-deposit ratio of just 69%, indicating a position of excess deposits.

Its low reliance on wholesale funding, together with room to sacrifice market share for deposits, should mean Fifth Third would face less pressure to pass through higher rates to its depositors as the Fed policy rate climbs. As such, its interest expense should remain relatively low compared to sector peers in the current tightening cycle.

Meanwhile, on the asset side, interest income would not merely grow from higher rates on loans, but also from scope for increased lending to customers and intentionally adding duration to its securities portfolio, which should further boost NIMs.

“We expect deposit betas of around 15% on the first 125 basis points of Fed rate hikes…[and] approximately 25% over the first 200 basis points this cycle compared to the mid-30s last cycle. The ultimate impact to NII of incremental rate hikes will be dependent on the timing and magnitude of interest rate movements, balance sheet management strategies including securities growth and hedging transactions, and realized deposit betas.”

“For the second quarter, we expect NII to be up 11% to 13% sequentially.”

CFO James Leonard, Q1 2022 Earnings Call

Fee Revenue Headwinds

Higher net interest income will, however, be partially offset by headwinds on the non-interest side of the business. Fee-based income, which was a major boost for banking revenues in the wake of the pandemic, is expected to come under pressure in the near term.

Firstly, the outlook for mortgage revenue is expected to decline by around 10% in 2022 compared to 2021, as higher rates curb refinancing activity and slow the housing market. And to compound its woes, commercial banking fees and private equity income may also come under pressure from the Fed tightening cycle, slowing activity in capital markets and a more challenging investment environment.

Management has downgraded its expectations for fee revenues – its latest guidance puts adjusted non-interest income at stable to 1% lower in 2022 compared to the prior year baseline of $3.15 billion, down from growth of between 3% to 5% as stated in its January guidance.

By contrast, net interest income is expected to be 13-14% higher for the full year, a big increase from 4-5% growth in its January guidance. The current April guidance assumes the Fed funds rate will rise to 2.50% by the end of this year, up from 1.00% previously. But with market expectations pointing to an even higher year-end rate of between 2.75%-3.00%, net interest income could still handsomely exceed management’s upgraded guidance.

Conservative Provisioning

Looking ahead, the big uncertainty is the impact of the deteriorating economic outlook on the bank’s credit quality. In particular, aggressive monetary tightening risks pushing the US economy into a recession.

The reversal of loan loss provisions in 2021 was the single biggest contributor to the banking sector’s earnings recovery, and so a potential sharp rise in credit costs could quickly eat into the projected earnings growth coming from higher net interest income.

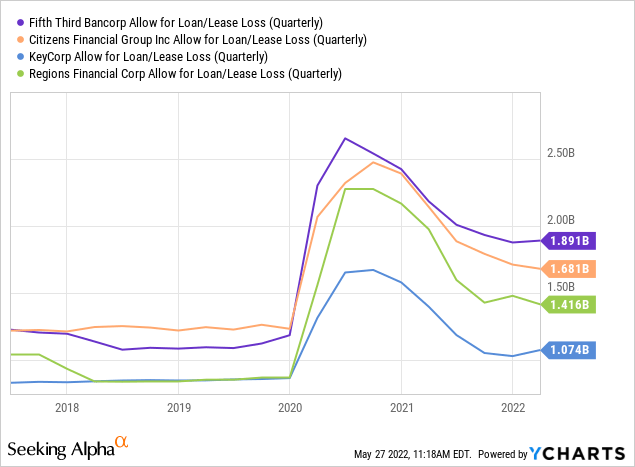

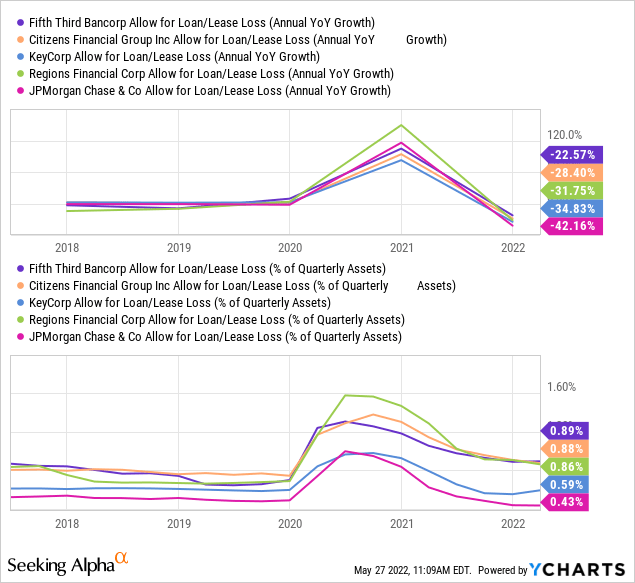

Against this, it’s important to realize that Fifth Third has not been as aggressive in releasing provisions booked during the pandemic as some of its rivals had been.

As such, its loan loss reserves remain significantly elevated against pre-pandemic levels and in comparison to sector peers. Its total allowance for credit losses covered 411% of its non-performing loans at the end of the first quarter of 2022, a much higher ratio than many of its peers. This would suggest the loan book’s credit risks are conservatively managed, which should take the edge off provision increases in the medium term.

Earnings Revisions

Seeking Alpha Earnings for Fifth Third Bancorp

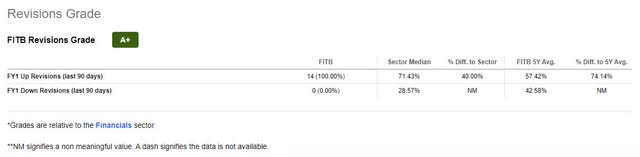

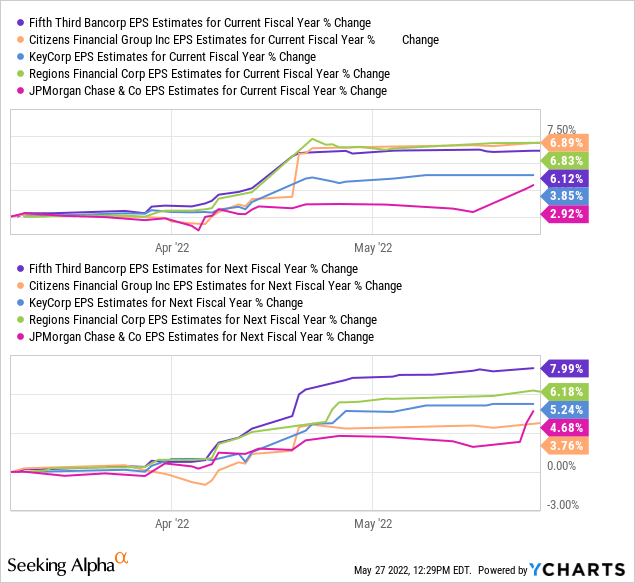

Wall Street analysts have been warming up to Fifth Third’s earnings outlook. The stock has an A+ Revisions Grade from Seeking Alpha’s Quant Ratings, reflecting 14 upwards earnings revisions over the last 90 days and no downward revisions.

Over the past three months, the consensus EPS estimate for the current year has increased by 6.12%, while the forecast for the same in 2023 is 7.99% higher.

Valuations do not seem too demanding either, with the stock trading at 10.2 times its expected 2022 earnings – that’s a 3.8% discount to its sector and an 11.6% discount to its 5-year average.

[ad_2]

Source link