[ad_1]

The stock market has taken a liking toward value stocks at the moment. The reason for the rotation into value is purely due to the economic cycle, which is currently in a contractionary phase. Higher implied interest rates usually send investors into a “flight for safety” mode, which gives rise to value stocks due to their more fundamentally secure standing. In addition, a rising yield curve could give way to some previously overlooked cyclical value plays.

I identified three value stocks that I’m bullish on.

Micron

Micron’s (MU) more than 25% year-to-date drawdown sees the stock trading near oversold territory. Yet, matters could change in the near future as investors become aware of the stock’s value prospects.

The company holds down a strong market position in the semiconductor industry, which is conveyed by its 19.48% return on invested capital and its 45.97% gross profit margin, with the latter revealing economies of scale while the prior illustrates Micron’s competitive pricing power.

Furthermore, Micron exhibits earnings-momentum as it recently beat its second-quarter earnings target by 16 cents per share. The firm produced robust cross-segment revenue growth on a year-over-year basis, with Compute and Networking (CNBU) increasing by 31%, Mobile (MBU) increased by 4%, Storage (SBU) increased by 38%, and Embedded (EBU) also increased by 37%.

Micron is undervalued on a normalized basis as the stock’s current price-earnings ratio underscores its 5-year average by 30.93%. Moreover, TipRanks’ value stock screener rates the stock as a top value pick in the current market climate.

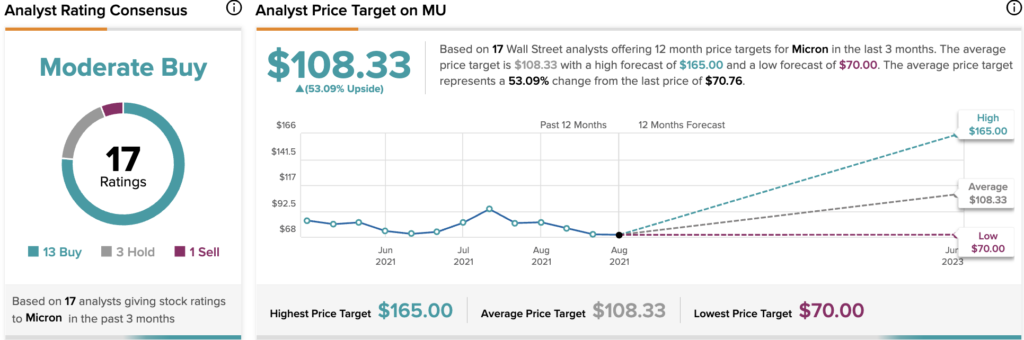

Turning to Wall Street, Micron Stock earns a Moderate Buy consensus rating based on 13 Buys, 3 Holds and 1 Sell rating assigned in the past three months. The average MU stock price target of $108.33 implies 53.09% upside potential.

AT&T

Morgan Stanley’s (MS) Mike Wilson recently cited AT&T (T) as a stock that could weather a bear market. According to Wilson, AT&T illustrates quality and defensive attributes that could see it outperform the broader market during a possible economic downturn.

AT&T stock has been a hot topic since the firm announced its restructuring a while back. In addition, the firm’s Warner Media spin-off garnered much traction as speculation mounted on the use of the $40.4 billion cash injection. However, most investors have turned bearish on the stock in the past year, which drove it into a lucrative price zone.

From a valuation vantage point, AT&T is in top shape. On a normalized basis, the stock’s price-book ratio is at a 33.38% discount, its price-earnings at a 33.94% discount, and its price-sales at a 26.96% discount. Moreover, the stock sports robust style factors, with its returns on equity and free cash flow margins reading at 10.24% and 26.44%, respectively.

Turning to Wall Street, AT&T Stock earns a Moderate Buy consensus rating based on 11 Buys, 6 Holds and 1 Sell rating assigned in the past three months. The average T stock price target of $23 implies 8.8% upside potential.

Citigroup

Citigroup (C) is a new Warren Buffett favorite. Buffett accumulated $3 billion worth of Citi stock during the first-quarter to align with his deep value investing strategy.

The big bank’s a prime example of a cyclical value play as it could benefit from rising interest rates. Firstly, rising rates could strengthen Citi’s debt operations, in-turn proliferating the bank’s bottom-line earnings. Additionally, a series of interest rate hikes could trim Citi’s wage bill as a tight labor market would wane, subsequently improving the bank’s operating efficiency.

Furthermore, Citigroup plans to evolve as a business. The firm recently stated that it plans to employ more than 4000 technology experts to digitalize its institutional client offerings. According to Citi’s head of enterprise and markets risk technology, Jonathan Lofthouse: “We’re trying to digitalize as much of our client experience as possible, front and back, and modernize our technology.”

If Citi’s existing intrinsic value can coalesce with growth initiatives, it could see the stock live up to its intrinsic potential.

From a quantitative vantage point, Citi is significantly undervalued. The stock’s trading at a 1.79x discount to its book value, suggesting that its asset base isn’t fully priced by the market. Banking stocks are usually strong candidates whenever they trade below their book value.

Turning to Wall Street, Citigroup Stock earns a Moderate Buy consensus rating based on 7 Buys, 7 Holds and 1 Sell rating assigned in the past three months. The average C stock price target of $64.67 implies 24.13% upside potential.

Concluding Thoughts

Investing in value stocks is an excellent way to ride the higher interest rate wave. The three stocks mentioned in the article provide a combination of defensive and cyclical value options. There’s no guarantee that value investing will prevail during this trying economic period. However, they certainly possess a better probability than growth assets.

Read full Disclosure

[ad_2]

Source link