[ad_1]

Repo rate is the interest rate at which the RBI lends short-term funds to banks. The cost of funds for banks rises when repo rate is increased and the immediate impact of a repo rate hike is on retail loans such as home, car and personal loans.

With the recent policy rate hike, the central bank has hiked this benchmark rate by 90 basis points in the current rate-hike cycle and lenders such as banks and housing finance companies may raise their lending rates in response, which would result in an uptick in your EMIs.

The math:

“If you have a home loan with Rs 30 lakh outstanding with a balance tenure of 20 years at 7% pa interest, your EMI will go up by Rs 1,648 from Rs 23,259 to Rs 24,907. For each lakh rupee of loan, you may have to dole out Rs 55 extra for EMI. Similarly for an auto loan of Rs 8 lakh for a tenure of 7 years if the interest rate rises from 10% to 10.9% the corresponding increase in EMI will be Rs 375 from Rs 13,281 to Rs 13,656. Personal loan of Rs 5 lakh with a tenure of 5 years, if the interest rate rises from 14% to 14.9% your EMI will increase by Rs 235 from Rs 11,634 to Rs 11.869,” said ” Anil Rego, Founder and fund manager -Right Horizons PMS.

The existing loans which are at fixed interest rate does not have any impact with the repo rate hike.

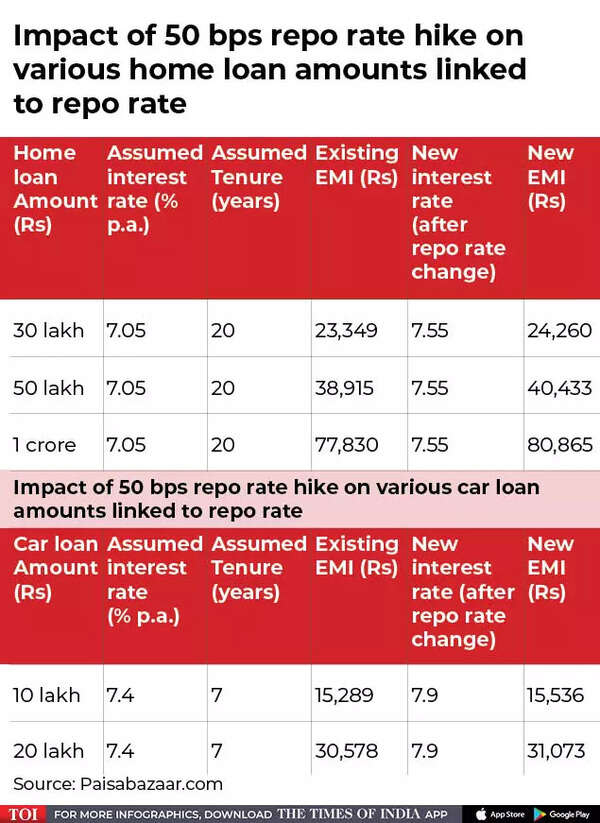

How your monthly outgo will increase:

“Home loan interest rates which had bottomed out around 6.50 per cent in April will now be inching towards 7.60 per cent in June. The back-to-back repo rate hikes will make floating-rate loans longer. For example, if a person had borrowed at 7 per cent for 20 years and if their rate increased to 7.50 per cent, they would need to pay 24 more EMIs,” said Adhil Shetty, CEO, BankBazaar.com.

But if the borrower had opted for an EMI adjustment, his per lakh EMI would increase by Rs 30 in the above example. In essence, monthly outgo would increase by about 4%.

“The math is different for each borrower. The key is to pay off the loan in the intended timeframe. Borrowers may use pre-payment methods such as EMI step-ups or lump-sum payments to control their interest burden,” said Shetty.

Retail borrowings are expected to be impacted with only the end user opting for home loans and postponing other purchases. “Borrowings for discretionary spendings may see a nosedive,” said Chaitali Dutta, personal finance and wellness expert.

Floating rate retail loans linked to repo rates would have faster transmission of rate hikes

“The transmission would be quicker for fresh floating rate loans. However, the exact date of the lending rate hikes by the banks for new borrowers would depend on their rate reset dates set as per their guidelines. In case of existing floating rate loans linked to external benchmarks, the borrowers would be charged higher rates based on their interest reset dates. Till then, they would continue to pay their existing interest rates till their next reset date,” said

Naveen Kukreja – CEO & Co-founder, Paisabazaar.com

What should borrowers do?

Borrowers of floating rate loans, including home loans, should expect their EMIs and overall interest cost to steadily increase in the near term. Those who have not opted for the EMI increase option would instead have their loan tenure increased. The increase in interest cost would be higher for the tenure increase option than the EMI increase option.

” Existing floating rate borrowers having adequate surpluses should try to prepay their loan and preferably opt for the tenure reduction option to generate higher savings in interest cost,” said Kukreja.

Who should opt for the home saver option?

Home loan borrowers, both fresh and existing ones, with restricted liquidity can opt for the home saver option. Under this facility, an overdraft account is opened in the form of savings or current account where the borrower can park his surpluses and withdraw from it as per his financial requirements. “The interest component of the loan is calculated after deducting the surpluses parked in the savings/current account from the outstanding home loan amount. Thus, home loan borrowers would be able to derive the benefit of making prepayments without sacrificing their liquidity,” said Kukreja.

For instance, if your outstanding is Rs 40 lakh and you have parked Rs 8 lakh in the overdraft account for three months, then the bank will charge interest on Rs 32 lakh for those three months, which will lower the total interest outgo.

Home loan balance transfer

Many existing home loan borrowers may have witnessed substantial improvement in their credit profile due to the improvements in their credit score, occupation or income profile after availing home loan. Such borrowers should explore the possibility of interest cost savings through home loan balance transfer. The improved credit profile may make them eligible for home loans at much lower rates from other lenders, said Kukreja.

This service lets customers transfer the total outstanding loan balance to another bank that gives them lower interest rates on the outstanding loan amount. When the outstanding loan amount is higher, this is the best alternative, but processing fees and other related charges must be considered.

You other option is full or partial prepayment to reduce loan burden

“Managing the monthly cash flows is critical now. Avoid skipping loan EMI’s as it will adversely affect your credit rating. In case, cash flow is tight, then opting for a longer tenure is better. However, if your cash flow can absorb an increase in EMI, then opt for the same tenure, this will reducing your overall interest pay-out,” said Dutta.

If you have surplus funds, you should compare the interest rate on your loan versus the growth rate of your investment. Only if you see that you can earn at least 1.5% or 2% more than the loan rate, then invest the surplus.

What about fixed deposits?

If any of your fixed deposits are maturing now, wait for the fixed deposit rates to increase then opt for a deposit with a better rate. When the repo rate stood at 4.4 percent, State Bank of India (SBI) — India’s largest lender by assets — had interest rates in the range of 2.9-5.8 percent for fixed or term deposits of up to five years. An 8% interest is considered to be a decent return and experts expect FD rates to increase by 100 to 150 bps in the coming two to three quarters so there is a chance ates may hit 8% in the next two years for certain categories of deposits.

However, investors remember that interest earned on fixed deposits are taxable at the respective income tax slab. So, if you fall under the higher tax bracket of 30%, you should ideally pick debt funds to reap the indexation benefit on long-term capital gains.

[ad_2]

Source link