[ad_1]

Nikita Malyutin/iStock via Getty Images

Creating superior customer experiences in the age of abundance

The Internet has helped usher in the age of abundance. As a result, today’s consumers, particularly Millennials and Zoomers, are seeking differentiated experiences and acquiring goods and services which they can identify or have established emotional connections with.

Companies with the best loved brands and differentiated offerings – even those in fiercely competitive industries – such as Apple (AAPL), BMW (OTCPK:BMWYY), Coca-Cola (KO), Louis Vuitton (OTCPK:LVMHF), Nike (NKE), Starbucks (SBUX) – have not only survived but thrived through the COVID-pandemic. Apple competes against Google’s ((GOOG)(GOOGL)) Android but extracts a majority of the smartphone industry’s profits; BMW competes against numerous car manufacturers and ride-sharing companies but remains consistently profitable; Coca Cola succeeds even though it competes against Pepsi (PEP), Royal Crown, Dr Pepper (KDP), coffee, tea, and even tap water. These companies offer a superior product experience by successfully communicating their differentiating attributes to customers (BMW – the Ultimate Driving Machine), develop positive associations in their customers’ minds (Nike’s Air Jordan), and establish emotional connections with their customers (Luis Vuitton handbags).

We have entered an age in which communicating the availability and attributes of a product is available is no longer sufficient. Companies need to create a high concept/high touch message that resonates with customers’ right-brain by appealing to the six senses that was described by author Daniel Pink in his book, A Whole New Mind (figure 1).

Figure 1: The Six Right-Brained Senses

|

The left-brain… |

will need to be supplemented by the right-brain… |

|

Functional objects |

DESIGN: the beautiful, whimsical, or emotionally engaging attributes of the product or service |

|

Rational arguments |

STORY: a compelling narrative that conveys the history or future |

|

Intense focus |

SYMPHONY: combining disparate pieces into a new whole for the customer |

|

Cold logic |

EMPATHY: forging relationships, care for others |

|

Seriousness |

PLAY: less sobriety and more laughter, lightheartedness, happiness, and fun |

|

Accumulation of material goods |

MEANING: purpose and fulfillment for the customer |

(Source: Daniel Pink, A Whole New Mind)

Traditional advertising media such as newspapers, billboards, radio, television have been limited to a one-to-many format, which requires a “one size fits all” message. Today’s technology has digitally transformed marketing tools and social media, enabling companies to initiate and maintain increasingly personalized one-to-one conversations with customers over multiple channels and measure the effectiveness of the messages conveyed through the customers’ journey. With the exponential increase in bandwidth, computing power, and AI, many forms of media previously too expensive to utilize – video, interactive tools, and virtual/augmented reality – have become affordable and within reach of more companies, which necessitates new cutting-edge design tools to create and maintain a competitive advantage.

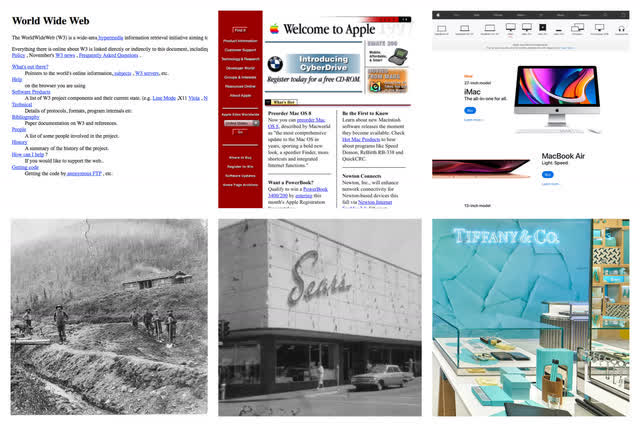

A brief history of online media communication

The internet has matured at an astonishing pace over the last three decades. Since the first webpage was published by Tim Berners-Lee on August 6, 1991 (figure 2, left column), internet commerce has turned from a land grab (akin to the gold rush in the 19th century) into online storefronts (middle column, www.apple.com, circa 1997), and now into valuable cyber real estate that companies use to showcase their products, sell to, as well as create online experiences for and emotional connections with customers (right column, www.apple.com today).

Figure 2: From land grab to digital experiences

Various consumer websites

In April 2020, hop-hop star Travis Scott created Astronomical, a live online concert in a three dimensional “Fortnite” video game world that was attended by more than 12 million people, which also comes with a 360-degree virtual reality view option. The October 1, 2020 Economist article, computer-generated realities are becoming ubiquitous, describes it as “in every sense, a truly immersive experience … that took place in a world, of sorts – not merely on a screen”. I believe this provides an early glimpse into the future of digitally transformed marketing and consumer experiences in the metaverse.

Adobe’s products and segments

Throughout its history, Adobe (NASDAQ:ADBE) has helped democratize digital communications by enabling online marketers and web developers to build and strengthen connections with customers through more visually appealing, interactive, and effective and meaningful communication. Its tools enable online content creators to incorporate each of the elements described in figure 1 above into their communications.

1. Digital Media Segment

Adobe’s Digital Media Segment is targeted at creative professionals (photographers, film, video editors), communicators (content creators, marketers, and digital designers), and consumers. It consists of several sub-segments:

- Text: Adobe pioneered Postscript fonts which spared the world form the tedium of courier fonts. It also brought us the PDF file standard (which it provides royalty-free, though it sells the Acrobat Suite), InDesign high-end desktop publishing, and Adobe Sign that electronically automates the signature collection process;

- Imaging: Photoshop and Illustrator have spearheaded increasingly high-quality graphic art, and become the industry standards for raster and vector graphics editing;

- Audio and video: Audition, Premiere Pro, and After Effects have made professional quality editing tools available to the “average” video and graphics producer;

- 3D, virtual/augmented Reality: Adobe Dimension, Substance, Aero (released in 2019), and other tools are enabling users to author and publish three dimensional, virtual, and augmented reality projects, potentially on the metaverse;

- Web platforms: Behance, Spark, and Stock enable customers to share and sell their creative works; and

- eLearning software: including Captivate, Presenter Video and Connect are increasingly relevant in today’s remote-learning environments.

Adobe is the dominant industry leader in this segment. It offers these products via Adobe Creative Cloud through a SaaS (software as a service) model and charges its customers monthly subscription fees instead of a one-time purchase cost. Adobe’s products are powered by its Sensei artificial intelligence engine to help customers work faster and smarter. Adobe makes some of its digital media products available a la carte but is also offering a line of more affordable hobbyist-grade tools, Creative Cloud Express, that are targeted at users who do not need the power of professional designers and communicators.

Adobe’s many competitors include Corel PaintShop, Affinity Photo, Pixelmator Pro, AVID Media Composer, as well as free programs like Blender. A whole generation of graphic designers have been trained on Adobe’s products and saved large collections of working graphic files in its file formats, which creates a barrier to switching to competitors’ apps. As a result, Adobe’s revenue streams in this segment are recurring and stable and the company likely garners the lion’s share of profits in this segment.

2. Digital Experience Segment

Adobe also offers a set of online customer experience delivery tools, including social, advertising, targeting, web experience, content management, customer personalization, and analytic tools. To bolster its offerings, Adobe has acquired Omniture, Magento, and Marketo, to incorporate customer data insights, content and commerce, marketing effectiveness, and customer leads and journey management. These products are good complements to the Digital Media segment as they allow Adobe to offer a full suite of solutions to web designers, developers, and marketers.

In the first quarter of 2022, Adobe was named a leader in three industry analyst reports focused on core customer experience management segments, including Gartner’s Magic Quadrant for Digital Experience Platforms, IDC MarketScape’s for CDPs for Front Office, and the Forrester Wave for Digital Asset Management.

The digital experience market is much larger and faster growing than the Digital Media market. However, competition is also far more intense-Adobe competes against Oracle, Salesforce, SAP, IBM, and many others. According to Forrester, Adobe has the strongest presence along with Salesforce and Oracle, but with a market share of less than 5%, it does not dominate the segment.

(Note: Adobe includes legacy software into what it calls the publishing segment. This segment accounts for a de minimus portion of its revenues, so I will not spend much time writing about it.)

Long-term financials

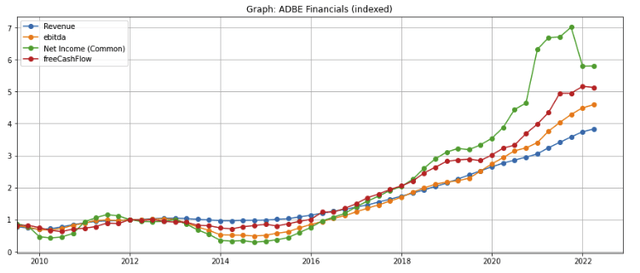

Growing and recurring revenues

Investors have benefited from the Adobe’s contribution to the democratization of tools that enhance digital communications and experiences. Since 2012, revenues have quadrupled, free cash flow quintupled, and net income sextupled (figure 3).

Between 2013 and 2016, the company transitioned its revenue model from an upfront sale to a subscription model, i.e., instead of paying a large upfront fee for a perpetual license to use the software, customers now pay a monthly fee for the right to use its software for the month. Revenues flattened and earnings declined over the transition period, but going forward, the company receives recurring subscription revenues as long as the customer continues using the software.

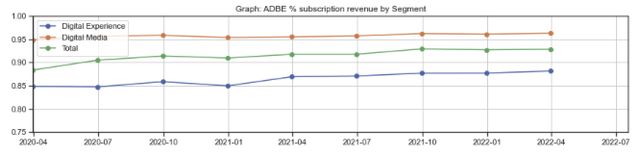

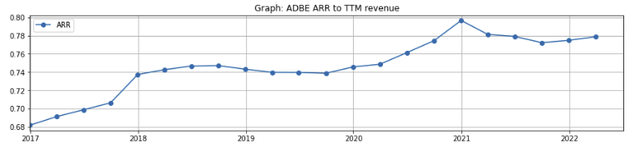

As such, the quality of revenues and earnings is far higher today than it was prior to 2016. Over 90% of Adobe’s revenues are recurring subscription revenues (figure 4) and its ARR (annual recurring revenues) is approaching 80% of trailing twelve-month revenues (figure 5).

Figure 3: Adobe long-term financials

Created by authoring using publicly available financials

Figure 4: Adobe’s percentage of revenues from subscription

Created by authoring using publicly available financials

Figure 5: Adobe’s annual recurring revenues to trailing twelve-month revenues

Created by authoring using publicly available financials

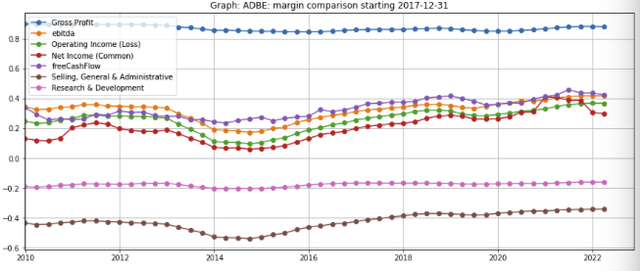

Steadily expanding margins

Over the last five years, the company’s gross margin has been stable (figure 6, blue line). However, its EBITDA, operating and net income, and free cash flow margins have expanded due to operating leverage, as the SGA (selling, general & administrative) expenses as a percent of revenue declined.

Figure 6: Adobe margin comparison

Created by authoring using publicly available financials

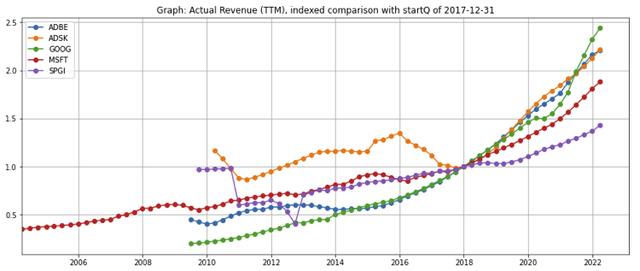

Growth compared to peers

Since 2018, Adobe’s revenue growth (figure 7, blue line) has been comparable to Autodesk (ADSK) (orange line), higher than S&P Global (SPGI), Microsoft (MSFT), and Alphabet (purple, red, and green lines).

Figure 7: Adobe’s revenue growth compared to peers

Created by authoring using publicly available financials

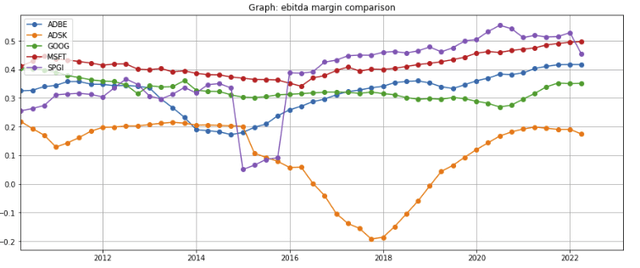

EBITDA margins compared to peers

Adobe’s margin has been expanding since it completed the transition to a subscription software model (figure 8, blue line), and it now joins a small select group of companies with EBITDA margins of over 40%.

Figure 8: Adobe’s EBITDA margin compared to peers

Created by authoring using publicly available financials

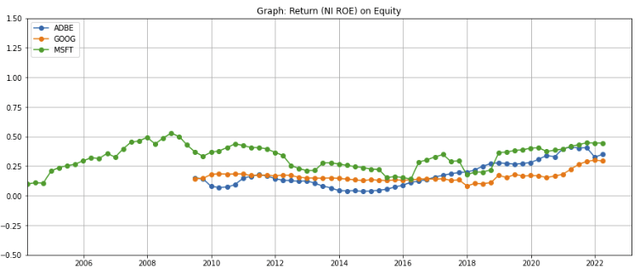

Return on equity

Adobe’s strong (~30%) and growing return on equity is a (very rough) proxy for its ability to compound capital for investors over the longer term (figure 9, blue line).

Figure 9: Adobe’s return on equity

Created by authoring using publicly available financials

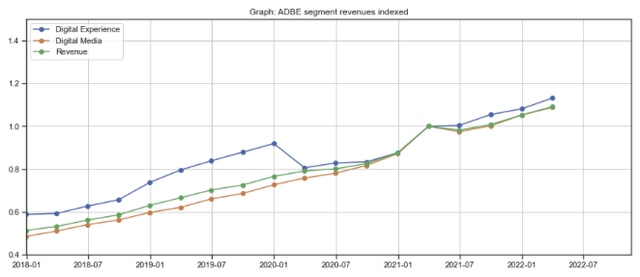

Segment analysis

Delving into the individual segments:

- revenues jumped in 1Q 2021 compared to 1Q 2020 due to a 31% increase in Creative revenue and 24% increase in digital experience, which management attributes to the increase in new user adoption, subscription revenue, and the acquisition of Workfront(figure 10, orange line)

- the growth of the digital experience segment has kept up with digital media since Anil Chakravarthy, who was previously CEO of Informatica, took over as general manager of the segment in January 2020 (blue line).

- the large dip in the digital experience segment revenues in 2020 were due to the company’s decision to exit its advertising cloud – a high revenue but low margin offering it started in 2016 via the acquisition of TubeMogul (blue line).

Figure 10: Adobe’s segment revenues, indexed to 4Q2020

Created by authoring using publicly available financials

Note: I have left out revenues from the publishing segment as it is de minimus compared to the digital media and digital experience segments

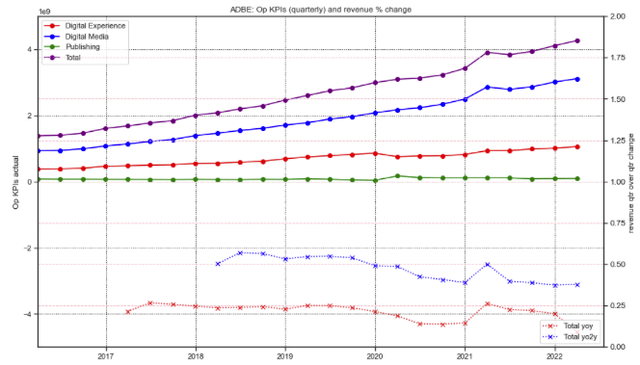

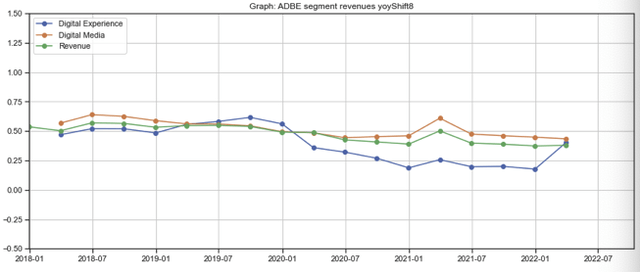

Slowdown in revenue growth

Adobe’s revenues have continued to grow, but the year-over-year growth rate has decelerated. 1Q 2022 year-over-year revenue growth dropped sharply to 9% compared to 1Q 2021 – the lowest in the last five years (figure 11, red dotted line, right y-axis). This slowdown likely alarmed investors which, combined with the market swoon due to concerns over the Fed’s interest rate hikes and Russia’s invasion of Ukraine, contributed to the sharp stock price decline in the first half of 2022.

The low 1Q 2022 year-over-year growth rate was exacerbated by the tough comparison against the strong growth of 1Q 2021, which had one extra week in the quarter compared to 1Q 2022. After adjusting for the extra week in 1Q 2021 and foreign currency fluctuations, the year-over-year revenue growth is 17%. However, the company’s year-over-two-year growth rate also decelerated (blue dotted line).

Figure 11: Adobe segment quarterly revenues and growth rate

Created by authoring using publicly available financials

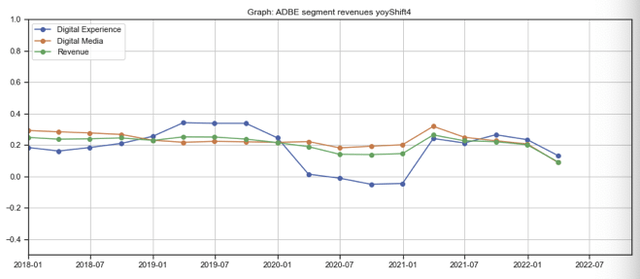

The revenue slowdown was evident in both the digital media and digital experience segments (figure 12, orange and blue lines), and less pronounced on a year-over-two-year comparison basis (figure 13).

Figure 12: Adobe segment quarterly year-over-year revenue growth rate

Created by authoring using publicly available financials

Figure 13: Adobe segment quarterly year-over-two-year revenue growth rate

Created by authoring using publicly available financials

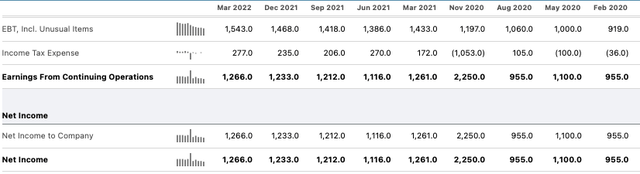

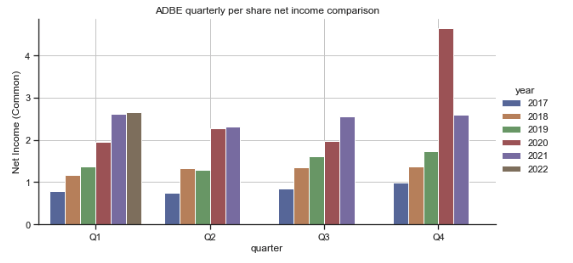

Sharp drop in 1Q2022 per share net income growth

Adobe’s flat 1Q2022 earnings per share growth compared to 1Q2021 was concerning (figure 14, Q1, purple and brown bars). In additional to the additional week in 1Q 2021 compared to 1Q2022, it is also driven by the volatility in income tax expense, as the company paid $100 million less in taxes in 1Q2021 and had a tax credit of $36 million in 1Q2020 (figure 15, second row).

If the tax rate in 1Q2021 were closer to that of 1Q2022, the year-over-year earnings per share growth would have been ~9% instead of 0.4% – roughly in line with revenue and EBITDA growth (figure 16) for the period – and still a decent result considering the fact that 1Q2021 revenue was unusually strong due to the extra week in the quarter.

Figure 14: Adobe quarterly earnings per share

Created by authoring using publicly available financials

Figure 15: Adobe’s income tax expense 2020-2022

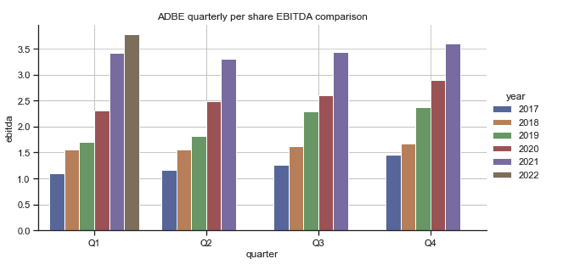

Figure 16: Adobe quarterly EBITDA per share

Created by authoring using publicly available financials

Despite the limitations and criticisms of EBITDA, I believe EBITDA growth is still a good measure of a company’s earnings power as it captures the effects of revenue and operating leverage but leaves out the accounting and exogenous factors such as depreciation, goodwill amortization, interest, and taxes.

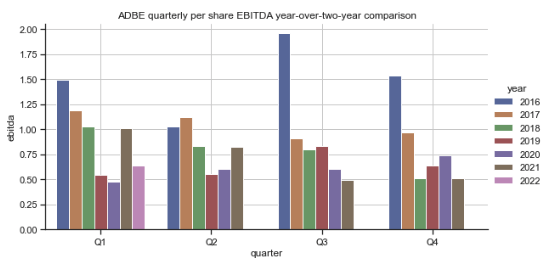

Adobe’s 1Q2022 year-over-year growth appears to have slowed down against tough year-ago comparisons, but its year-over-two-year per share EBITDA growth remains over 50% (figure 17). However, the stock price has pulled back by over 45% from the high set in 4Q2021 (figure 18).

Figure 17: Adobe quarterly per share EBITDA year-over-two-year comparison

Created by authoring using publicly available financials

Valuation

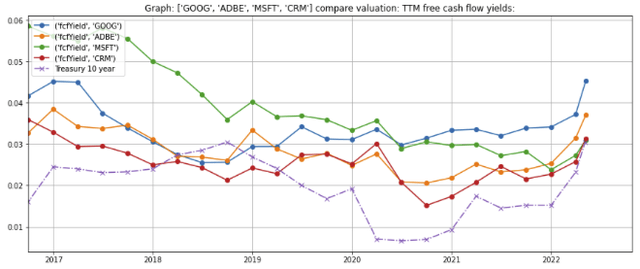

Following the stock’s 45% pullback from the highs set in the fourth quarter of 2021 (figure 18), Adobe’s free cash flow yield is approaching 3.8% – near a 5-year high (figure 19).

Figure 18: Adobe’s stock price over the last year

Figure 19: Adobe free cash flow yield vs peers

Created by authoring using publicly available financials and stock prices

Management outlook and planned price hikes

In the 1Q 2022 earnings call, management stated that “digital is a tailwind and will continue to be a tailwind” despite the COVID pandemic and the war in Ukraine, and it planned to have a “major comprehensive price overhaul” for the first time since 2017: [Bold text inserted by author into quote]

“We expect quarterly sequential revenue and EPS growth in Q3 and Q4… strong second half ARR performance across Document Cloud and Creative Cloud… ARR contributions to increase sequentially in Q3 and Q4 from a new offering and pricing structure [aka pricing increases] that starts late in Q2.”

I will be watching the next three quarters closely. Unless the numbers over the next two quarters show continued deceleration and weakness against the less demanding 2021 comparisons, this may be an attractive opportunity to initiate or add to a position.

Concerns

- The market for digital media may not continue to grow at historical rates: however, Adobe’s addressable market has expanded from to its entry into the consumer market (through its Creative Cloud Express suite of products) and the metaverse (with Substance 3D and Aero), both of which should help drive revenue growth.

- Adobe’s Substance 3D and Aero products face tough competition to dominate the augmented/virtual reality markets. Formidable competitors include EPIC, Roblox (RBLX), Meta, Apple, and others.

- Valuation: down from two years ago but not at bargain levels, which provides a limited margin of safety.

In summary

Over the last decade, it has become imperative for businesses to build stronger emotional connections with their customers over digital media.

Adobe has grown into one of the largest companies by democratizing tools enabling online content creators to provide superior high quality digital experiences for and effective communication with customers.

The company enjoys attractive software economics with powerful operating leverage and has been a consistent grower and compounder of capital.

Growth in Adobe’s Experience Cloud segment, line of affordable Creative Cloud Express hobbyist tools, Aero and Substance 3-D products, along with planned price hikes beginning in 2Q 2022 should drive continued revenue increases.

The stock price decline due to the deceleration in Adobe’s revenue growth and Fed interest rate hikes and may be overdone, presenting investors with a potentially attractive buy opportunity.

[ad_2]

Source link