[ad_1]

Picture this: You move into your newly purchased home and within the first year the garbage disposal quit working, one of the toilet tanks sprung a leak, the water heater stopped heating and the air conditioner conked out. Encountering unexpected repairs after closing is never an exciting proposition unless, of course, you don’t have to pay for the repairs.

I know what you’re thinking. If you’re not the person who’ll be ponying up the bucks for the after-closing repairs, who will be? To be sure, there are many good candidates for the job. We’ll explore who they are later in this piece. Let’s first explore the topic at hand; home warranties.

In the case of a new-home purchase, builders typically provide a one-year “bumper-to-bumper” warranty. Beyond that, some builders offer an extended “aftermarket” warranty that adds another year to major component coverage and provides 10 years of coverage on the structure. Homeowners who purchase existing homes can purchase after-market warranties offered by dozens of private home warranty companies.

More from Gary:Landlords love to return security deposits

Coverage for existing homes typically includes repair or replacement of basic systems such as heating and air conditioning, plumbing, major appliances, garage door openers, ceiling fans, pools, spas, wells and sometimes roofs. If a covered component or system breaks down within the coverage period, which typically spans one year from the date of closing on the purchase of the home, the warranty company will dispatch a local tradesperson to repair or replace any items covered by the contract. The homeowner pays only a small deductible that typically ranges between $85 and $100 per service call.

Defining the term “service call” can be a bit challenging. For example, seven electrical problems occurring at the same time can be addressed in one service call made by one electrician. Calling in a plumber and an electrician at the same time will require two service calls, however.

OK, so the homeowner pays the deductible and the home warranty company pays for the repairs. Who, then, pays the $400 to $800 fee for issuing the coverage in the first place? Here’s where those other candidates come in. The warranty company doesn’t care who pays for its product. As a result, it will accept payment from the buyer, the real estate agent, the seller and even the mortgage company. Exactly who or what combination of people will pay for the warranty is normally worked out when the purchase agreement is negotiated.

Not all home warranties are created equal, so it’s a good idea for buyers to make sure a clause is inserted into the purchase agreement giving them the opportunity to shop for the warranty company. Sellers also have an interest in knowing what types of warranty coverages are available to them, both while their home is for sale and after closing. So, how do buyers learn about the types of home warranties that are available to them? They usually obtain the lowdown from their Realtor or builder.

Where do Realtors and builders get their information? In some cases, real estate and construction companies are affiliated with a particular warranty company that may give agents and builders incentives to “push” the company product — whether or not it fits the circumstance at hand. In instances where Realtors and builders don’t have formal relationships with warranty providers, warranty company representatives hawk the benefits offered by their respective companies directly to the real estate and building companies.

So, what sort of due diligence should be exercised when choosing a warranty plan? One good idea is to ask what’s included in the basic warranty coverage and what additional options are available. This is where you’ll need to don the drugstore glasses and read the fine print. The cost or deductible for an individual service call is also a good number to know.

More in real estate:MFA continues to promote HomeNow down payment assistance program

In addition, it’s a good idea to make sure you know exactly what type of coverage is offered for each type of system or appliance that exists in the home you’re buying. For example, plumbing coverage may only apply to blockages that are no farther than four inches into the wall. Also, explore exclusions and limitations that are contained in the contract. Basically, home warranties only cover items that fail due to normal wear and tear. Pre-existing conditions and items that were suspect when you purchased the property, or items that fail due to abuse or lack of adequate maintenance, are not usually covered.

Finally, get an independent home inspection. Not only will it provide an excellent physical snapshot of the property you’re buying — before you buy it — it will also provide irrefutable proof of the condition of the home and its components should a warranty company attempt to deny a valid claim.

Keep in mind that, as with any other insurance purchase, it may take some time before you’ll know whether buying a policy was the right thing to do.

See you at closing!

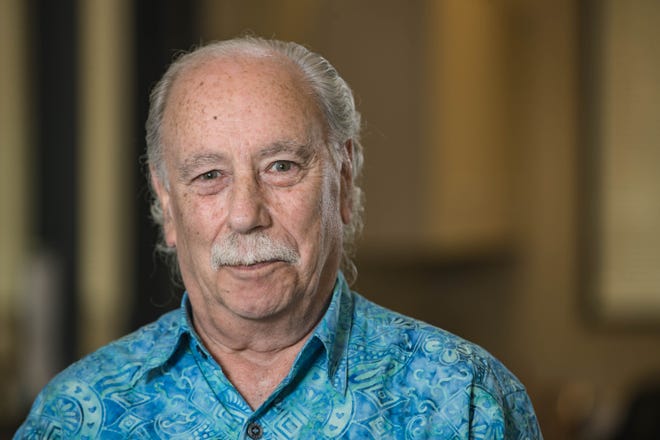

Gary Sandler is a full-time Realtor and president of Gary Sandler Inc., Realtors in Las Cruces. He loves to answer questions and can be reached at 575-642-2292 or Gary@GarySandler.com.

Keep reading:

[ad_2]

Source link