[ad_1]

Bank of England’s Pill: Inflation is our biggest challenge in 25 years

The Bank of England’s chief economist has admitted that the central bank faces its toughest challenge since independence in 1997, and signalled that interest rates need to rise further.

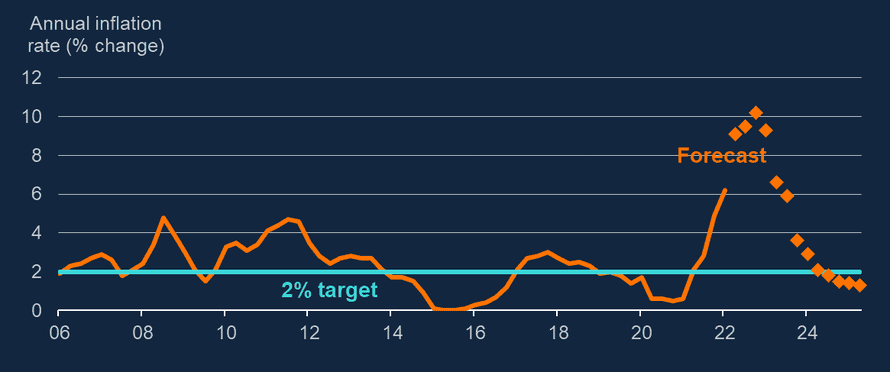

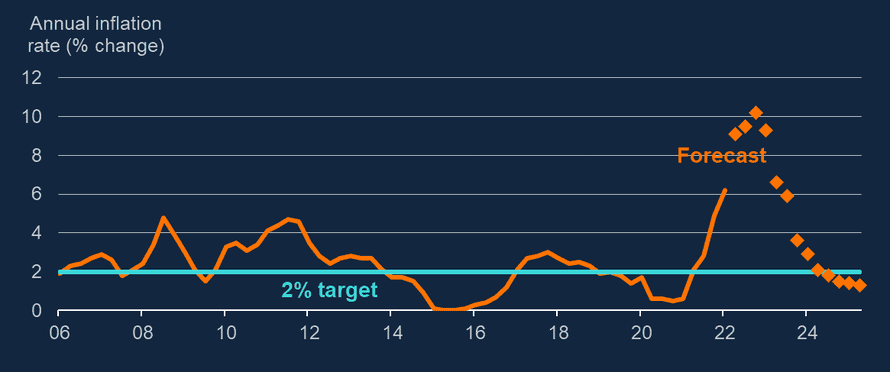

Speaking in Cardiff this morning, Huw Pill said that inflation’s surge to a 40-year high of 9% in April put him in a “very uncomfortable situation”, given the Bank is meant to keep inflation around 2%.

But Pill says this discomfort is ‘as nothing’ compared to the challenges facing poorer familier who are most hit by the current cost of living crisis.

These are difficult times for many people, especially for the less well off, who spend a higher proportion of their income on energy and food, where recent price rises have been most significant.

Current challenges are thus a salutary reminder of the importance of price stability as an anchor for wider economic stability, and a bulwark to sustaining people’s livelihoods, especially for those on lower pay and fixed incomes.

Pill explains that the Bank’s most recent inflation forecast “does not make for pretty reading”, with inflation expected to rise over 10% by the end of the year.

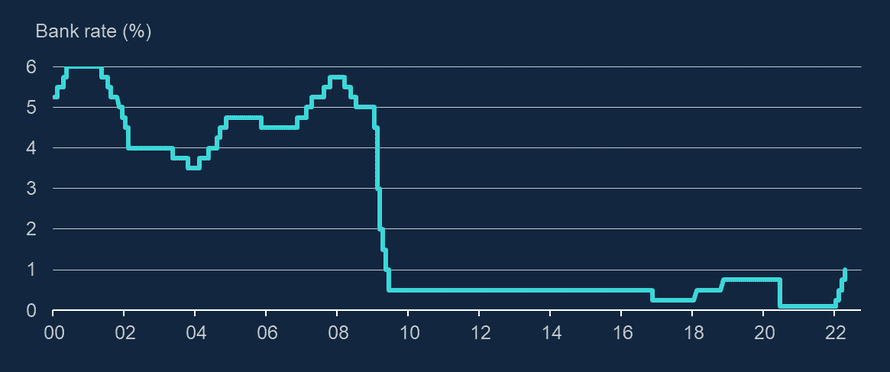

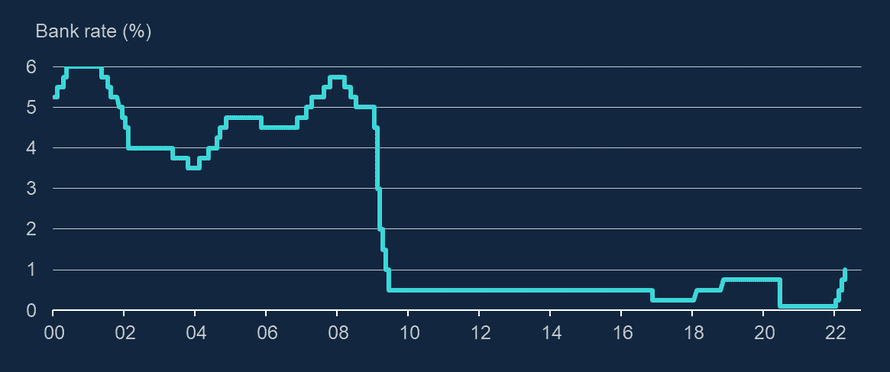

That’s why the Monetary Policy Committee voted to raise interest rates to 1% this month.

And Pill gives a clear sign that interest rates will need to rise further, as the Bank walks a ‘narrow path’. Underlying wage growth is currently strong, he says, but rising inflation will hit disposable incomes, slowing the economy.

Pill says:

On the one hand, headline inflation is clearly too high, the UK labour market is tight, wages are growing at stronger rates than would normally be deemed consistent with the inflation target, and business confidence is resilient, in part in anticipation of being able to re-establish profit margins. In short, inflationary momentum in the UK is currently strong.

On the other hand, significant increases in international energy, food and goods prices over the past year imply a substantial squeeze in UK residents’ real incomes, which will weigh on future demand and employment. Looking beyond the shorter term, UK inflation is set to fall as global commodity prices stabilise, bottlenecks in global supply chains ease, and domestic inflationary pressure dissipates as the real income squeeze opens up a margin of economic slack.

Pill says the Bank must avoid “self-sustaining, expectationally-driven” price rises -taking hold (where current high inflation drives up expectations for wages and prices)

He concludes by saying inflation is now the biggest challence since the Bank of England was given responsibility for setting interest rates, 25 years ago this month.

That celebration has come at a testing time for UK monetary policy, for the reasons I have outlined in my remarks today. With inflation forecast to rise into double digits following the very sharp rise in international energy and goods prices, this is biggest challenge the MPC has faced over the past quarter of a century.

It is in these testing times that the anchor represented by the 2% inflation target comes to the fore. Supported by the independence accorded to the MPC to pursue that target, we are able to take the sometimes tough decisions to bring inflation back to 2% and keep it there sustainably.

It is that commitment that has led me to support a tightening of monetary policy since I joined the Committee last September, and to signal today that this tightening still has further to run.

Closing summary

The Bank of England will intensify its squeeze on the economy over the coming months as it seeks to bring down the highest inflation rate in 40 years, its chief economist has warned.

Noting that Threadneedle Street was facing its toughest challenge since being granted independence in 1997, Huw Pill said “further work needs to be done” to bring the annual inflation rate back to the government’s 2% target.

Inflation soared to 9% in April as the rising cost of gas and electricity pushed household energy bills to record levels and the escalating cost of food and transport also contributed to the surge in the cost of living.

The Bank’s nine-strong monetary policy committee has raised borrowing costs at its last four meetings but Pill used a speech in Cardiff to signal further increases were needed to prevent high inflation from becoming embedded in the economy.

“In my view, we still have some way to go in our monetary policy tightening, in order to make the return of inflation to target secure,” Pill said.

Inflation has driven UK consumer confidence down to a record low, even worse than after the 2008 financial crisis:

Joe Staton, client strategy director at GfK, said:

“This means consumer confidence is now weaker than in the darkest days of the global banking crisis, the impact of Brexit on the economy, or the Covid shutdown.”

Former BoE governor Lord King said central bankers had blundered by pursuing money-printing policies, and needed to raise interest rates higher.

They shouldn’t have been printing the extra money; what governments were doing was enough to deal with the consequences of COVID. They’re now worried about inflation, when they weren’t before…

[But] it’s not all the result of the Russian invasion of Ukraine. This was foreseeable, because there was a mistaken diagnosis of what needed to be done with the pandemic.”

Economists have warned that the long-term outlook for the economy is weak, despite a surprise rise in retail sales last month.

Retail sales volumes rose by 1.4%, but the increase was driven by increased spending on alcohol, tobacco and sweet treats at supermarkets, as cash-strapped households stayed at home rather than going out socialising.

Nationwide executives have said they are “highly concerned” about the outlook for inflation, warning that rising costs could harm already struggling customers and drag down house prices.

Rishi Sunak has become the first frontline politician to be ranked among the UK’s wealthiest people, only days after the chancellor warned consumers that “the next few months will be tough” as the cost of living squeeze intensifies.

Sunak, a former hedge fund manager, and his Indian heiress wife, Akshata Murty, were named on the Sunday Times rich list as the 222nd wealthiest people in the UK, with a combined £730m fortune.

China’s central bank has cut its main mortage interest rate to stimulate its economy, cheering markets.

But economists say Beijing must take wide-ranging measure to protect its economy, as lockdowns hit growth and push up inflation.

Costs and delays at Britain’s new nuclear power station at Hinkley Point in Somerset have increased, again. It will start operating a year later than planned and will cost an extra £3bn.

Russia will stop gas flows to neighbouring Finland on Saturday morning, after Finnish state-owned gas wholesaler Gasum refused to pay Gazprom Export in roubles as Russia has demanded.

Shares in THG soared by a quarter on Friday, as investors anticipated a possible multibillion-pound bidding war for the online retailer, including a possible offer from property tycoon Nick Candy.

The digital marketing group Next Fifteen has struck a £310m deal to buy M&C Saatchi, gazumping the tech entrepreneur Vin Murria’s takeover attempt, and ending almost three decades of independence of one of Britain’s most famous advertising agencies.

HSBC is under pressure to fire a senior banker in charge of responsible investing after a speech in which he described warnings about the climate crisis as “unsubstantiated” and “shrill”, made light of major flooding risks, and complained about having to spend time “looking at something that’s going to happen in 20 or 30 years”.

Have a lovely weekend, we’ll be back on Monday…GW

After decades of planning, 13 years of construction and nearly £20bn spent, Crossrail’s Elizabeth line services are ready to roll, with the first gates finally due to open next Tuesday.

Our transport correspondent Gwyn Topham sets the scene:

This is still not the finished deal. But its crucial, magnificent core will now be open: the 13 miles of tunnels bored under central London, nine brand new cavernous stations, and digitally controlled trains offering space and speed that underground passengers have never yet enjoyed.

Over the last three years, as construction delays and overspending exposed the hubristic boasts of Crossrail bosses, talk of a British engineering triumph has been muted. Now, though, it is time to marvel again.

“These stations are like cathedrals. These trains are the longest we’ve seen in London,” says Sadiq Khan, the capital’s mayor. “It is world-leading, world-class. I challenge anyone who uses the Elizabeth line next week not to have their breath taken away – it’s just mind-blowing.”

Here’s Gwyn’s feature on the new line:

Russia will cut off natural gas to Finland tomorrow after the Nordic country that applied for NATO membership this week refused President Vladimir Putin’s demand to pay in rubles, Associated Press reports.

The latest escalation over European energy amid the war in Ukraine was announced by Finland’s state-owned energy company on Friday,

Finland is the latest country to lose the energy supply, which is used to generate electricity and power industry, after rejecting Russia’s decree. Poland and Bulgaria were cut off late last month but had prepared for the loss of natural gas or are getting supplies from other countries.

Putin has declared that “unfriendly foreign buyers” open two accounts in state-owned Gazprombank, one to pay in euros and dollars as specified in contracts and another in rubles.

Finland refused the new payment system, with energy company Gasum saying its supply from Russia would be halted Saturday.

CEO Mika Wiljanen called the cutoff “highly regrettable”, but said customers shouldn’t see disruption.

Provided that there will be no disruptions in the gas transmission network, we will be able to supply all our customers with gas in the coming months,”

The majority of gas used in Finland comes from Russia but gas only accounts for about 5% of its annual energy consumption.

#Russia announced it will stop its #gas flows to #Finland, but the Nordic nation can handle the cuts. It has a diversified #energy mix with gas accounting to one of the smallest shares (7%) among other #fuels. In total, 🇷🇺 gas imports account for 4.8% of the 🇫🇮’s energy needs. pic.twitter.com/AgM9gcf6r0

— Crystol Energy (@CrystolEnergy) May 20, 2022

Anti-corruption campaigner Bill Browder makes a good point:

Putin is doing all the hard work for us. We don’t have to stop sending him money because he’s cutting off gas to us. First, Poland and Bulgaria, now Finland. https://t.co/lN4v268sXI

— Bill Browder (@Billbrowder) May 20, 2022

Bank of America’s closely-followed ‘Bull & Bear’ sentiment indicator is now flashing that markets are in buy territory.

The slump in global markets in recent weeks means the ‘Bull & Bear’ indicator had now moved into “unambiguous contrarian buy territory”, it says.

Michael Hartnett , BofA’s chief investment strategist, says global equity markets have lost $23.4tn since their peak in November 2021, or roughly the size of US GDP.

Stock market basically dropped by 1 US economy in 6 months.

Hartnett adds that the story of 2022 is “inflation shock = rates shock = recession shock”.

The larger story of the 2020s is regime change, higher inflation, higher rates, higher volatility, & lower asset valuations, driven by trends in society (inequality), politics (populism/progressivism), geopolitics (war), environment (net-zero), economy (de-globalization), and demographics (China population decline).

Stocks are oversold, sentiment is far too bearish, according to BofA. Its ‘bull & bear’ indicators is now in “unambiguous contrarian buy territory”.

Analysts at Truist agree: “The market has become the most oversold, or stretched to the downside, since April 2020.” pic.twitter.com/41ZLgBQKeg— Jamie McGeever (@ReutersJamie) May 20, 2022

Stocks have opened higher on Wall Street, on the final session of another volatile week.

China’s cut to its mortgage interest rates has calmed some concerns over the outlook for the global economy.

The Dow Jones industrial average has gained 184 points, or 0.6%, to 31,437 points, while the benchmark S&P 500 index is 0.8% higher, after two days of falls (including the biggest one-day drop since 2020).

Craig Erlam, senior market analyst at OANDA, cautions:

The rebound may partly reflect the scale of the declines we’ve seen in the previous couple of sessions, while the cut to the five-year loan prime rate in China may also be giving global markets a bit of a lift. But ultimately, very little has changed and I expect that will continue to hold these markets back.

The rate cut announced by the PBOC is obviously good news and is clearly targeted a revitalizing the ailing property market which continues to suffer due to the crackdown last year and Covid lockdowns this. Along with other measures already announced, this could help to revive a hugely important part of the economy.

Whether it’s enough to help China hit its 5.5% growth target this year is another thing. I imagine we may see further stimulus efforts this year in order to try and get close to that as the country is facing numerous headwinds, as every other is around the world right now. What it has that others lack though is room to manoeuvre on both the fiscal and monetary front.

Boris Johnson will make a decision on whether to impose a windfall tax on oil and gas giants “soon”, according to Downing Street.

A No 10 spokesman said (via PA Media):

“Our position on that remains the same, the PM and the Chancellor have both been clear that they are not attracted to the idea of a windfall tax.

“We’ve spoken before about our desire to see the industry invest in the UK economy to benefit jobs and growth but also the Chancellor’s been clear that if that doesn’t happen no option is off the table.”

Pressed when businesses need to show investment, the spokesman said:

“We’ve never put a specific timeline on it but the Chancellor said if that doesn’t happen soon and at significant scale then no option is off the table.

“So as you see from the Chancellor’s words, if that doesn’t happen soon.”

Asked how soon, he said:

“We haven’t put a timeline on it.”

A windfall tax could be used to cut energy bills for struggling families, as Labour have called for:

Brexit opportunities and Government efficiency minister Jacob Rees-Mogg has said that there isn’t a “honeypot of business” that the Government can raid whenever it feels like.

But, oil giants BP and Shell are both returning billions of pounds to shareholders through buybacks, as well as dividends, due to the surge in cashflow from higher energy prices. So a windfall tax wouldn’t leave the industry short of funds…

German producer prices surge 33.5%

Inflation pressures are intensifying in Germany too.

Producer price inflation, which measures what manufacturers charge ‘at the factory gate’, has hit a record 33.5% per year in April.

Prices rose 2.8% in April alone.

Energy prices surged by 87.3% compared to April 2021, and by 2.5% compared to March.

There were some staggering annual price increases for energy, as Destatis explains:

Mainly responsible for the high rise of energy prices were the strong price increases of natural gas (distribution) which was +154.8% on April 2021. Power plants had to pay four times as much as one year before (+307.0%).

Industrial consumers’ prices were up 259.9%, those of resellers 170.0%.

There were also significant price increase on intermediate goods. including metals, fertilisers, prepared feeds for farm animals and wooden containers.

Fertilisers and nitrogen compound prices more than doubled (+111.7 %), while prepared feeds for farm animals increased by 52.8%.

Metals’ prices jumped 43.3%, wooden containers were up 75.0%, industrial gases leapt and prices of sawn timber by 52.3%.

Vincent Ni

With China’s economy struggling, attempts to boost flagging GDP growth are being hindered by several factors –from Covid lockdowns and the Ukraine war to growing tensions with America, our China affairs correspondent Vincent Ni writes.

At a recent online gathering of top Chinese economists, a palpable sense of urgency filled the virtual meeting room. In recent weeks, a slew of reports by Chinese and foreign economists pointed to a deteriorating economy.

Outside the country, talk of China being the engine of global economic growth no longer convinces.

During the meeting Huang Yiping, a Peking University professor and a former central bank adviser, urged Beijing to “do whatever it takes to save the economy”.

Huang was paraphrasing a line from the height of the European debt crises more than a decade ago, when the European Central Bank’s then president, Mario Draghi, said it was ready to “do whatever it takes to preserve the euro”.

Huang suggested:

“Cashflow problems have shown up for many enterprises and households. More direct support is needed for affected companies and people.”

His remarks have resonated with locked-down social media users after reports of the meeting were released on Sunday. “[He’s] a courageous Chinese intellectual,” one wrote on WeChat.

Here’s the full piece:

Today’s cut in mortgage interest rates is a start, but will Beijing go further?

BoE chief economist warns: reaction

Here’s some reaction to Huw Pill’s warning that monetary policy needs to be tightened to stop the UK’s ‘inflationary momentum’ getting out of hand.

Samuel Gee, director at Bristol-based Manning Gee Investments, says:

“It’s obvious that rates are going to rise further, but the UK economy couldn’t likely cope with quick, sharp-shock increases. They are likely to be more gradual. In the US, the Fed has already countered fears of supersized hikes.

In the UK, so much is at stake. You have people borrowed-to-a-hilt who are starkly at risk, and the Bank of England knows it. Inflation does need to be controlled, but we are coming out of a pandemic and a war in Europe isn’t helping.

We are likely to see more Government and central bank fire-fighting in the months ahead. I wouldn’t say a half-percent increase is off the table.”

Allan Monks, economist at JPMorgan, said Pill’s clear concerns about inflation suggested a majority on the MPC was now “leaning towards a more hawkish interpretation” of the bank’s recent guidance, the Financial Times reports.

Monks added:

“The risk the MPC will need to hike every meeting this year appears greater than it having to go on hold after August”.

Britain’s inflationary shock is likely to be worse than feared, Bank of England chief economist Huw Pill said as he warned price pressures were “substantial” and further interest-rate increases will be needed.

In a speech to the Association of Chartered Certified Accountants in Wales, Pill spelled out the dilemma the central bank faces as soaring inflation threatens both to become embedded in domestic price setting and depress growth by squeezing household incomes.

On balance, Pill said “the balance of risk is tilted towards inflation proving stronger and more persistent than anticipated in that baseline.”

Pakistan’s rupee has hit a fresh record low against the US dollar, as its economic crisis deepened.

The rupee fell through the 200 mark against the dollar, as the pressure on developing economies intensifies as commodity prices surge.

Pakistan’s current account deficit has spiralled out of control and its foreign exchange reserves have tumbled, prompting its government to seek a bailout extension from the IMF:

Bloomberg reports that Pakistan’s shortage of dollars threatens to spiral into a fullblown crisis.

Policy makers are in talks with the International Monetary Fund to revive a stalled loan program. Key conditions would require Prime Minister Shehbaz Sharif to raise fuel prices, which risks stoking public anger with inflation already at 13%.

Meanwhile ousted premier Imran Khan has threatened to lead street protests calling for early elections.

Yesterday, Pakistan banned imports of all non-essential luxury goods in a bid to stabilize the economy. Infomation minister Marriyum Aurangzeb told reporters.

“All those non-essential luxury items that are not used by the wider public, a complete ban has been imposed on their import,”

Former Bank of England chief criticises central banks for inflation mistakes

The former Bank of England governor has criticised the UK’s central bank for allowing inflation to surge to its highest in 40 years.

Mervyn King told Sky News that Britons must brace themselves for a “very unpleasant period”, with “considerable” interest rate hikes now needed to prevent a re-run of the 1970s.

Lord King, who ran the BoE during the financial crisis, blasted central bankers for fuelling a rise in inflation by printing hundreds of billions of pounds and dollars during the pandemic.

He said they would have to raise interest rates immediately to prevent an inflationary spiral, following a “failure of the economics profession”, with interest rates kept too low for too long, and too much “quantitative easing” (buying bonds with newly created money).

In a highly critical intervention, King says:

They shouldn’t have been printing the extra money; what governments were doing was enough to deal with the consequences of COVID. They’re now worried about inflation, when they weren’t before…

[But] it’s not all the result of the Russian invasion of Ukraine. This was foreseeable, because there was a mistaken diagnosis of what needed to be done with the pandemic.”

NEW

Ex-@bankofengland governor Mervyn King:

-We must prepare for a “v unpleasant period” with “considerable” interest rate hikes needed

-Central banks “shouldn’t have been printing extra money” during Covid

-Calls it a “failure of the economics profession”https://t.co/BGSRHvuYS5— Ed Conway (@EdConwaySky) May 20, 2022

Nationwide: Inflation surge could hit house prices

Kalyeena Makortoff

Nationwide Building Society has warned that the UK’s rocketing inflation could send British house prices into reverse.

Nationwide executives said this morning they are “highly concerned” about the outlook for inflation, a signal that the cost of living crisis could drag down house prices, as customers struggle.

Chief executive Joe Garner told journalists.

“Obviously we are highly concerned about the outlook environment.

And we are very focused on leaning into our members, and really underlining the emphasis of contacting us as early as possible.”

Garner said the building society was ready to offer a range of options to struggling customers, including interest-only payment holidays.

However, the building society, which is the UK’s second largest mortgage lender behind Lloyd’s Banking Group, explained that higher property prices, rising interest rates, and the “steep increase” in the cost of living meant housing had already become less affordable for consumers, so activity is likely to slow.

Back in the markets, the rouble has hit a four-year high against the US dollar as capital controls continue to support Russia’s currency.

The rouble has gained almost 5% to around 59.2 to the US dollar, compared to around 75 before the Ukraine war began, and the strongest since March 2018.

Restrictions on selling the rouble, and domestic tax payments that usually lead to increased demand for the currency, lifted the currency.

There has also been demand from gas buyers who have agreeed to pay for Russian gas in roubles, as demanded by President Vladimir Putin.

That all means that the rouble’s current rally doesn’t reflect the impact of the Ukraine war, and punishing sanctions, on Russia’s economy, which is expected to enter its deepest recession since the 1990s.

Reuters has more details:

The rouble has firmed by nearly 30% so far this year, despite a full-scale economic crisis, becoming the best-performing currency, artificially supported by controls imposed in late February to shield Russia’s financial sector after it sent tens of thousands of troops into Ukraine.

The rouble is driven by export-focused companies that are obliged to convert their foreign currency revenue after Western sanctions froze nearly half of Russia’s gold and forex reserves.

“Exporters are forced to sell (foreign currency) and there is no one to buy it,” a trader at an investment company in Moscow said.

Preparations for month-end taxes also boost demand for roubles, while demand for dollars and euros remains low due to disrupted imports chains and restrictions on withdrawing foreign currency from bank accounts and moving it out of Russia.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, has predicts that UK consumer confidence will recover from its current record lows once the UK provides more support in the cost of living crisis:

Does the record low level of GfK’s confidence index mean a recession is coming?

The chart below looks scary, but I think a recession will be avoided this time. A few thoughts: pic.twitter.com/4vDDIEOnci

— Samuel Tombs (@samueltombs) May 20, 2022

It’s important to look at how the components of the index are calculated:

How do you expect the financial position of your household to change over the next 12 months? Get a lot better=1 / Get a little better=0.5 / Stay the same=0 / Get a little worse=-0.5 / Get a lot worse=-1

— Samuel Tombs (@samueltombs) May 20, 2022

So the index only partially captures how much people expect finances to worsen. You are probably just as likely to report “get a lot worse” if you expect a 3% fall in real pay as if you fear being made unemployed, but these 2 outcomes have very different implications for spending

— Samuel Tombs (@samueltombs) May 20, 2022

Right now, the labour market looks solid and no leading indicator points to ↑unemployment yet. So this is the sort of environment in which households that have savings will draw on them, and others will borrow more. April’s rise in retail sales suggests they are doing just that pic.twitter.com/F9jGJBHX08

— Samuel Tombs (@samueltombs) May 20, 2022

Confidence also likely will recover when the gov’t comes up with another package of measures to support households’ incomes this summer. So provided the MPC doesn’t hike rates too fast, I expect h’holds’ real spending to fall by c.0.5% q/q in Q2, but then to edge up in Q3 & Q4.

— Samuel Tombs (@samueltombs) May 20, 2022

Earlier this week Rishi Sunak pledged to cut taxes for business in his autumn budget, as the Treasury continues to weigh up interventions to support households.

Options could include a 1p income tax cut from the autumn or a potential VAT cut, or earlier help such as an increase in the warm homes discount for the poorest families.

Kalyeena Makortoff

A new membership body has been launched as part of efforts to bring people from less privileged backgrounds into senior roles across the City.

The group, which will be known as “Progress Together”, will offer workshops, resources and mentoring schemes to people who might otherwise struggle to reach top-tier positions in financial services.

It comes as a new survey found that employees whose parents did not have professional careers themselves were 30% less likely to reach a senior position in their firms compared with their colleagues. More here.

The new nuclear power station being built at Hinkley Point in Somerset will start operating a year later than planned and will cost an extra £3bn, it has been announced.

The French energy company EDF published the findings of a review into the cost and schedule of the power station taking account of the continuing impact of the Covid-19 pandemic.

The delay means the first reactor unit is now scheduled to start operating in June 2027, a year later than planned, with costs estimated between £25bn and £26bn. EDF said this would not affect the cost to British consumers or taxpayers.

Markets cheered by China mortgage rate cut

European stock markets have rallied strongly this morning, after China cut its mortgage lending rate by a record amount (see previous post).

In London, the FTSE 100 index has jumped by 118 points, or 1.6%, recovering most of Thursday’s slide. Asia-Pacific focused insurer Prudential are the top riser. up 5.3%.

Germany’s DAX (+1.4%) and France’sa CAC (+0.8%) are also higher, while China’s CSI 300 index rallied by almost 2% on relief that the government was providing more support.

Indices Update: As of 07:00, these are your best and worst performers based on the London trading schedule:

FTSE 100: 1.07%

Germany 40: 0.88%

France 40: 0.84%

US 500: 0.60%

Wall Street: 0.43%

View the performance of all markets via https://t.co/2NUaqnUPED pic.twitter.com/fdFC9cd2bH— DailyFX Team Live (@DailyFXTeam) May 20, 2022

Pierre Veyret, technical analyst at ActivTrades, explains:

Markets surged higher everywhere from Asian shares to US Futures contracts on Friday, mostly led by Utilities and the Energy sector, as investors welcomed reassuring major monetary news from Beijing.

The “Risk-on” trading mood has registered a solid rebound during the last couple of hours as traders cheered the significantly dovish monetary decision from China after the PBoC cut one of the key interest rates by a record amount. This will provide a fresh boost to the economy, helping small businesses and mitigate the negative impacts of lockdowns in the world’s second-largest economy.

While the Bank of England prepares to tighten policy further this year, their counterparts in China have just cut a key interest rate.

The People’s Bank of China cut its main interest rate underpinning mortgage lending by the most on record, as it tries to cushion the economy from the impact of the lockdowns in major cities.

It lowered the five-year loan prime rate from 4.6% to 4.45% on Friday.

The move could boost loan demand in China, where economic growth and confidence has been hit by Covid restrictions. That has added to the downturn in the property sector, where home prices have fallen and several developers have defaulted.

ING’s Iris Pang explains:

We believe that lowering mortgage rates linked to the 5Y LPR is just part of the reason behind the large rate cut. As long-term loans are also usually linked to the 5Y LPR, infrastructure financing should benefit from this rate cut, too.

It should be clear that this rate cut is not designed to help property developers ease their financing needs. Instead, it is aimed at helping individuals to get a mortgage at a lower interest rate.

This could increase sales of residential property, which will help property developers to increase their cash flows from sales and allow them to repay debt. As such, the leverage ratio of indebted property developers should go down.

JUST IN:

China’s central bank cuts the banks’ 5-Y Loan Prime Rate #LPR by 15 bps for the first time since January, 1-Y remained unchanged.

1-year LPR at 3.7% unchanged;

5-year LPR at 4.45% from 4.60%;#PBOC cut policy loan rates and pledged more easing to stabilize the economy. pic.twitter.com/957m3a0BjC— CN Wire (@Sino_Market) May 20, 2022

Bank of England’s Pill: Inflation is our biggest challenge in 25 years

The Bank of England’s chief economist has admitted that the central bank faces its toughest challenge since independence in 1997, and signalled that interest rates need to rise further.

Speaking in Cardiff this morning, Huw Pill said that inflation’s surge to a 40-year high of 9% in April put him in a “very uncomfortable situation”, given the Bank is meant to keep inflation around 2%.

But Pill says this discomfort is ‘as nothing’ compared to the challenges facing poorer familier who are most hit by the current cost of living crisis.

These are difficult times for many people, especially for the less well off, who spend a higher proportion of their income on energy and food, where recent price rises have been most significant.

Current challenges are thus a salutary reminder of the importance of price stability as an anchor for wider economic stability, and a bulwark to sustaining people’s livelihoods, especially for those on lower pay and fixed incomes.

Pill explains that the Bank’s most recent inflation forecast “does not make for pretty reading”, with inflation expected to rise over 10% by the end of the year.

That’s why the Monetary Policy Committee voted to raise interest rates to 1% this month.

And Pill gives a clear sign that interest rates will need to rise further, as the Bank walks a ‘narrow path’. Underlying wage growth is currently strong, he says, but rising inflation will hit disposable incomes, slowing the economy.

Pill says:

On the one hand, headline inflation is clearly too high, the UK labour market is tight, wages are growing at stronger rates than would normally be deemed consistent with the inflation target, and business confidence is resilient, in part in anticipation of being able to re-establish profit margins. In short, inflationary momentum in the UK is currently strong.

On the other hand, significant increases in international energy, food and goods prices over the past year imply a substantial squeeze in UK residents’ real incomes, which will weigh on future demand and employment. Looking beyond the shorter term, UK inflation is set to fall as global commodity prices stabilise, bottlenecks in global supply chains ease, and domestic inflationary pressure dissipates as the real income squeeze opens up a margin of economic slack.

Pill says the Bank must avoid “self-sustaining, expectationally-driven” price rises -taking hold (where current high inflation drives up expectations for wages and prices)

He concludes by saying inflation is now the biggest challence since the Bank of England was given responsibility for setting interest rates, 25 years ago this month.

That celebration has come at a testing time for UK monetary policy, for the reasons I have outlined in my remarks today. With inflation forecast to rise into double digits following the very sharp rise in international energy and goods prices, this is biggest challenge the MPC has faced over the past quarter of a century.

It is in these testing times that the anchor represented by the 2% inflation target comes to the fore. Supported by the independence accorded to the MPC to pursue that target, we are able to take the sometimes tough decisions to bring inflation back to 2% and keep it there sustainably.

It is that commitment that has led me to support a tightening of monetary policy since I joined the Committee last September, and to signal today that this tightening still has further to run.

[ad_2]

Source link