[ad_1]

Central banks are raising rates rapidly in the most widespread tightening of monetary policy for more than two decades, according to a Financial Times analysis that lays bare the reversal of their previous historically loose stance.

Policymakers around the world have announced more than 60 increases in current key interest rates in the past three months, according to an FT analysis of central banking data — the largest number since at least the start of 2000.

The figures illustrate the sudden and geographically widespread reversal of the very accommodative monetary policies adopted since the global financial crisis in 2008 and boosted further during the coronavirus pandemic. Interest rates hovered near unprecedented lows in most advanced economies for the past decade, and in some cases went negative.

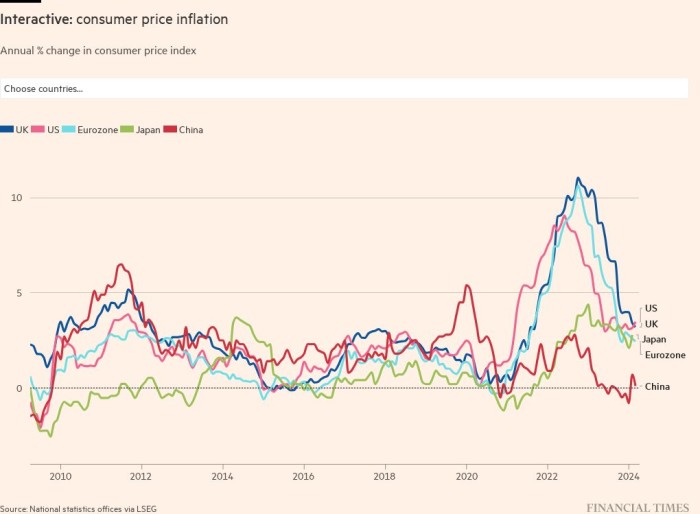

The sudden shift in policy comes as inflation has reached multi-decade highs in many countries, fuelled by soaring energy and food costs since Russia invaded Ukraine in February.

Jennifer McKeown, head of global economics service at Capital Economics, a research firm, said: “The world’s central banks have embarked on the most co-ordinated tightening cycle in decades.”

Among the 55 key policy rates that have recently increased are those of the Federal Reserve and the Bank of England, which have both called time on decades of ultra-loose monetary policy and responded to surging prices with rate rises at successive meetings.

Christian Keller, economist at Barclays, said: “The tightening cycle is truly a global phenomenon.”

In early May the Fed raised its benchmark policy rate by 50 basis points to a range of 0.75 per cent to 1 per cent, the largest increase since 2000. The Bank of England has raised rates at the past four meetings, with May’s increase taking the main rate to 1 per cent.

The European Central Bank looks set to raise borrowing costs for the first time since 2011 in July and end its eight-year experiment with negative rates in September. The Canadian, Australian, Polish and Indian central banks are all expected to raise rates in the coming weeks.

Despite this, rates are still low by historical standards and economists warned that the recent increases are just the beginning of a global tightening cycle.

McKeown said that of 20 major central banks around the world, 16 are likely to raise interest rates over the next six months. Tightening is expected to be fastest in the US and UK. Markets expect an increase in policy rates by at least 100 basis points by the end of this year or early next year in the eurozone, Canada, Australia and New Zealand.

Keller said the widespread trend made it more likely policymakers would consider more substantial moves: “Announcing unexpectedly larger or earlier policy steps feels easier if everyone else is doing them.”

Emerging markets in Latin America embarked on tightening cycles last year, as their economies were damaged by the pandemic. Brazil has raised rates 10 times in just over one year to 12.75 per cent, up from only 2 per cent in March last year. Mexico, Peru, Colombia and Chile have also raised borrowing costs.

Silvia Dall’Angelo, economist at the investment management company Federated Hermes, said central banks in emerging markets “have been more reactive to the appearance of elevated inflation”.

In Africa, Ghana, Egypt and South Africa have all increased their rates.

While inflation has been lower in East Asia, the Bank of Korea last Thursday raised its benchmark rate for the second consecutive month, and Bank Negara Malaysia surprised markets with a 25 basis point rise earlier this month.

One major economy bucking the trend is China, where mounting economic damage from widespread virus restrictions and troubles in the property sector prompted officials to cut the one-year loan prime rate by 10 basis points from 3.8 per cent to 3.7 per cent. Private lenders have also lowered their mortgage rates.

The Bank of Japan has maintained its pledge to keep yields at zero, including by expanding its balance sheet if necessary.

The Bank of Russia, which aggressively raised rates last year and at the start of its invasion of Ukraine, has cut them three times in recent months, reflecting the stabilisation of the rouble.

[ad_2]

Source link