[ad_1]

China’s latest measures to help homebuyers will spur mortgage demand while ringfencing banks from the default risk of builders.

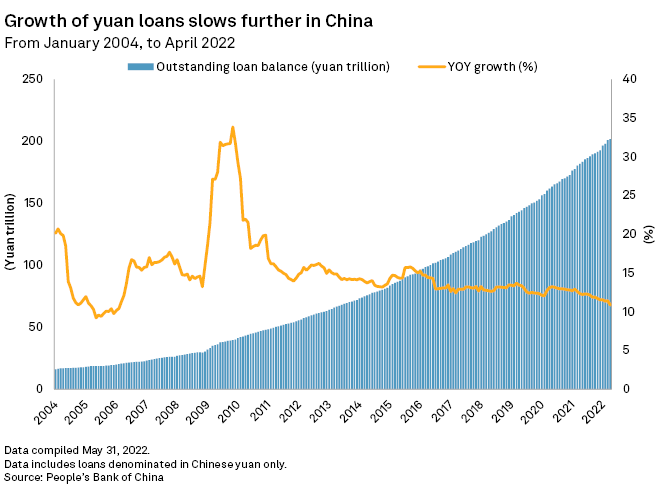

Growth in home loans, which account for about one-fifth of total bank loans in China, is set to rebound after a slowdown in recent months. The government has eased mortgage costs through cuts of interest rates, relaxed some rules on ownership of multiple properties and urged banks to lend more to homebuyers.

The rebound will likely be modest and offer a limited boost to overall lending. Many homebuyers may still stay on the sidelines as their confidence hinges on the financial health of the builders, which has yet to recover, analysts said.

“Policy easing so far has been concentrating on the demand side and little has been done about the over supervision on the supply side,” said S&P Global Ratings credit analyst Esther Liu.

Recent measures aimed at reviving housing loan demand while keeping a tight grip on developers’ leverage highlight the delicate balancing act Beijing has faced since the downturn in the property sector last year.

A recovery in home sales is critical for restoring cash flow for developers. The government has so far not eased funding access for developers because that could increase credit risk for the financial system and undo previous efforts to unwind excessive borrowings of the property sector.

A liquidity crunch continues to weigh on the property sector, after some of the nation’s largest developers, such as China Evergrande Group and Sunac China Holdings Ltd., missed coupon payments on their bonds as recently as May. The sector faces falling sales, limited access to loan and bond markets as well as government restrictions on using proceeds deposited in their escrow accounts from home presales.

About 40% of Chinese developers were in “financial trouble” as of end-2021, according to a June 1 report by Ratings. The nonperforming loan ratio of the property sector was estimated at 6.0% as of end-2021, Ratings said. It was higher than the overall nonperforming loan ratios of between 0.56% and 3.63% of Chinese banks for the same period, according to the China Banking and Insurance Regulatory Commission.

Modest recovery

The central bank cut two key interest rates on mortgages in the space of a week in May. After lowering the mortgage rate for first-time homebuyers, the People’s Bank of China slashed the benchmark five-year loan prime rate for the second time this year by 15 basis points to an all-time low of 4.45%. Local authorities in major cities such as Chengdu and Hangzhou also lifted in mid-May some restrictions on owning more than one residential property per household to encourage home purchases.

The rate cuts offer room for banks to further cut the mortgage loan rate after the significant decline in household loans, a May 15 research note by Credit Suisse said. They also show “senior regulators’ increasingly supportive stance on end-user housing demand amid the overwhelmingly lackluster sentiment in the physical market”.

Home prices started falling sharply in the fourth quarter of 2021, according to the Bank for International Settlements. In April, both property sales by value and by square feet in 70 Chinese cities fell a little over 40% from a year ago, according to China’s National Bureau of Statistics.

The pace of housing loan growth slowed to 7.7% in April from 8.9% in March, according to a May 20 research note from J.P. Morgan. A rate cut may marginally improve loan growth, the note said.

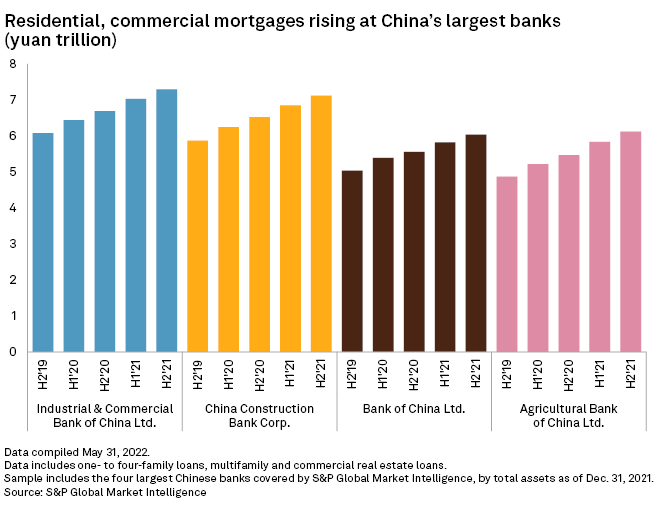

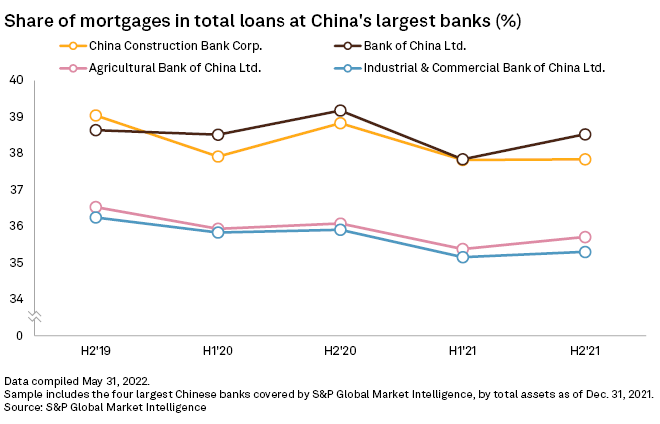

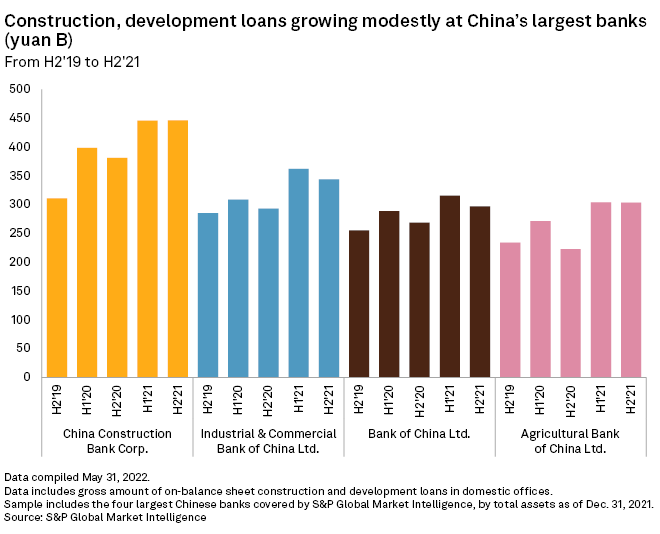

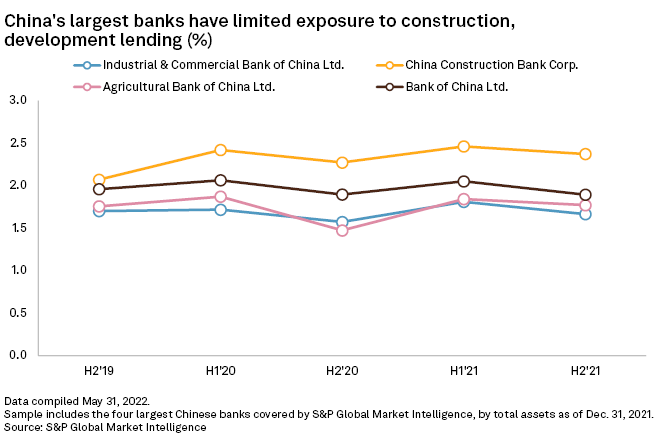

Residential and commercial property loans at major Chinese banks have grown slowly, mirroring the nation’s slowing overall loan growth amid an economic slowdown. The proportion of mortgages to total loans also declined marginally in end-2021 from end-2019, according to S&P Global Market Intelligence.

Ringfencing elevated risk

Demand for home loans will not grow stronger unless consumers regain confidence that developers will not default on their projects, analysts said.

”Policymakers are willing to tolerate a certain degree of defaults, in either the bond market or in wealth management products, as long as developers hold on to the three red lines,” said Daisy Li, a Hong Kong-based China fund manager at EFG Asset Management.

The regulators have placed strict limits on how much a developer can borrow if it breaches any of the three “red lines”. The red lines refer to three key conditions developers need to adhere to: maintaining a liability-to-asset ratio below 70%, net gearing of at least 100% and cash-to-short-term-debt ratio of at least 100%.

Banks’ exposure to developers remains limited due to these restrictions. “No more than 10 privately owned developers [out of hundreds], other than state-owned, are on banks’ trust list,” said Eric Wang, Shanghai-based banking analyst at CMB International Capital Corp. Ltd.

Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. did not respond to queries from Market Intelligence.

As of June 1, US$1 was equivalent to 6.69 Chinese yuan.

[ad_2]

Source link