[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

CNA Financial (NYSE:CNA) recently released its first-quarter results.

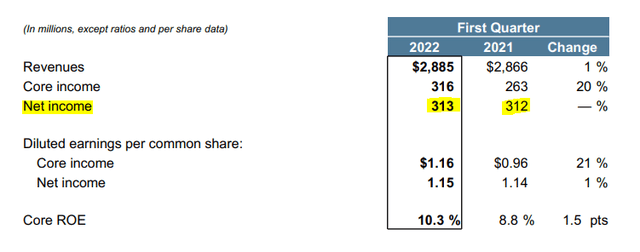

Although the company was affected by the increase in the interest rates, which affected both book value and fair value of non-redeemable preferred stocks, the net income remained flat at $313 million.

CNA Financial Presentation

Source: CNA Financial Presentation

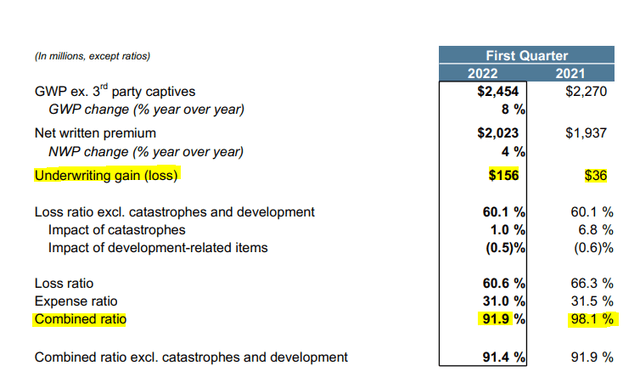

Furthermore, the insurer achieved the lowest quarterly combined ratio in five years, at 91.9%. Improved margins for all segments drove the 6.2-point drop in the combined ratio on a year-over-year basis. As a result, the insurance company’s underwriting profit surged from $36 million to $156 million.

CNA Financial ended 2021 very well and has started 2022 on the right foot with improved underwriting margins.

The upcoming interest rate increases might affect the company’s book value in a short-term view as the fair value of preferred stocks and fixed-income securities might drop.

Nonetheless, it should positively affect the net investment income from a medium/long-term perspective, as the average interest yield of the renewed fixed-income portfolio would be higher than now.

P&C Operations’ Improved Margins Fueled Steady Quarterly Income

The P&C segments posted a quarterly and annual underwriting gain of $156 million, vs. $36 million one year ago in the same period.

CNA Financial Presentation

Improved margins in all segments fueled the higher underwriting income.

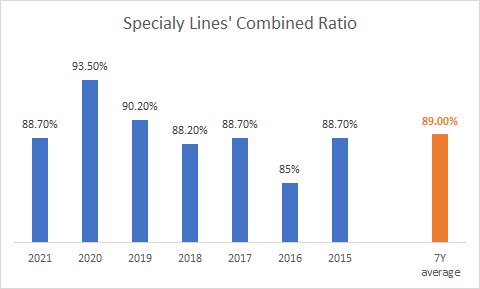

The specialty business remains the cash cow of the company. From 2015 to 2021, the combined ratio was almost always equal to or below 90%. The only exception was 2020 when the company suffered an increase in claims activity due to COVID-19. Although the claims activity was higher in 2020 than in prior years, the combined ratio remained excellent.

Annual Report

Source: Financial Reports (figures aggregated by the author)

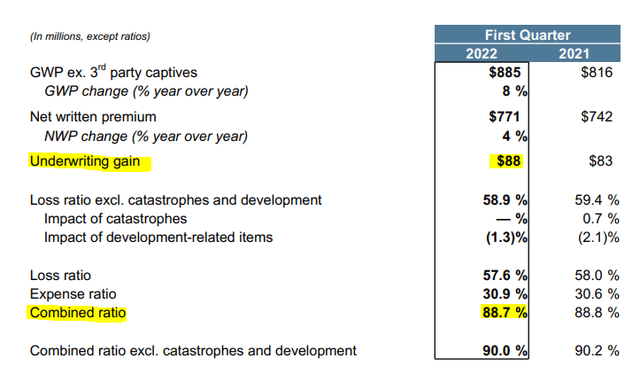

In Q1 2022, the segment delivered steady results, with an underwriting gain of $88 million, resulting from a combined ratio of 88.7%.

CNA Financial Presentation

Nonetheless, it is not a surprise, as the segment delivers steady and recurring profits. However, the situation improved significantly for the two other business divisions: the commercial business and the international activities.

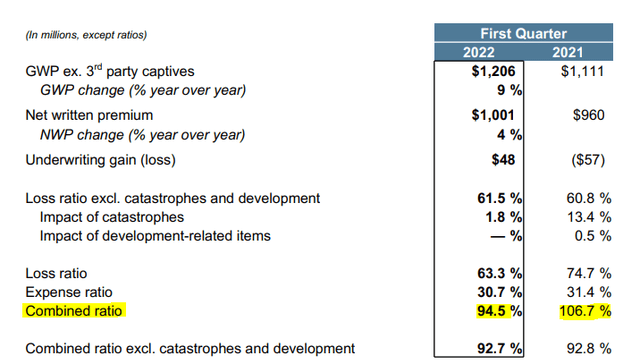

The commercial business recorded a combined ratio of 94.5% vs. 106.7% in Q1 2021.

CNA Financial Presentation

The main driver of the underwriting margin improvement was the drop in catastrophe losses. Catastrophe losses were $16 million, or 1.8 points of the loss ratio, for the three months ended March 31, 2022, as compared with $115 million, or 13.4 points of the loss ratio, for the three months ended March 31, 2021.

Nonetheless, the underlying loss ratio (excluding catastrophe losses and run-off impact) increased by 0.7 points due to a shift in the business mix associated with the property quota share treaty the company purchased during the second quarter of 2021. The property coverages, which have a lower underlying loss ratio than most other commercial coverages, now represent a smaller proportion of net earned premiums.

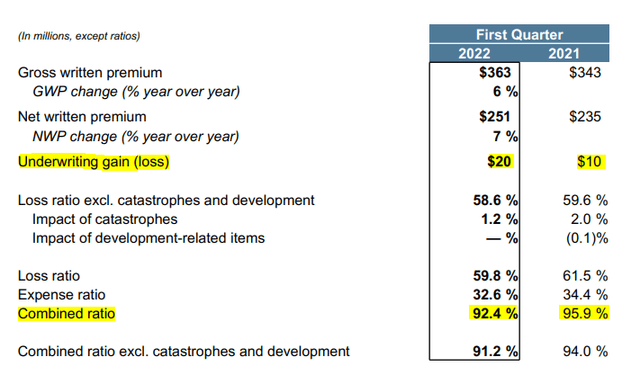

Last but not least, the international activities recorded tremendous results, led by an improvement in both the loss and expense ratio. With a drop in the combined ratio to 92.4% and a growth in premiums (a 7% increase in net written premiums and a 4.7% growth in net earned premiums), the pre-tax underwriting profit doubled to $20 million.

CNA Financial Presentation

Although the segment remains the smallest one in terms of turnover, the active de-risking policy will certainly bear its fruits, with higher underwriting gains over the next quarters.

The company remains well-positioned in the specialty market, resulting in strong results from the specialty division. Depending on the catastrophe costs and the impacts of the underwriting initiatives launched to improve the loss ratio on both commercial and international sides, the FY2022 underwriting income might be higher than in 2021.

Living In A Rising Rate Environment

The Federal Reserve moved to tamp down soaring inflation in the US, announcing in May the sharpest rise in interest rates in over 20 years. The Fed’s benchmark interest rate was raised by 0.5 percentage points to a target rate range of between 0.75% and 1%. The hike was the largest since 2000.

Rising US Treasury rates could significantly change how insurers operate. The search for yield will be less challenging than it was when rates were near zero. Insurance carriers will be able to consider rebalancing portfolios, perhaps moving back to more traditional investments and relying less on alternative asset classes.

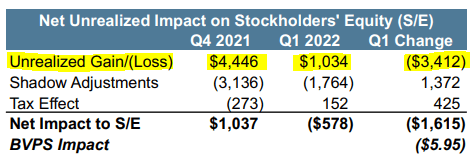

While the rising rate environment positively impacts the outlook for investment income, from a balance sheet perspective, it has reduced the net unrealized investment gain position to $1 billion at quarter end, affecting the book value accordingly.

CNA Financial Presentation

Although CNA’s book value has been adversely affected by the changes that occurred in the fixed-income market, the insurer might be able to benefit from a higher interest rate environment.

Generally speaking, insurance companies will benefit from rising rates and might be in a position to increase risk premiums for standard products and reinvest the money at a higher yield.

I expect CNA to follow the same trend, taking advantage of rising rates to generate more financial income without deteriorating the credit quality of its bond portfolio. At the same time, I also expect CNA to increase its rates to keep up with claims inflation and maintain profitability above most of its peers.

[ad_2]

Source link