[ad_1]

Major digital asset exchanges are shedding hundreds of workers in an abrupt reversal from the industry’s breakneck expansion as a two-year hot streak gives way to a crypto chill.

US-listed Coinbase on Tuesday announced plans to lay off nearly a fifth of its workforce, amounting to more than 1,000 people, joining rivals including Gemini, Crypto.com and BlockFi in cutting headcount as this year’s tumble in crypto prices stifles the trading activity that is the industry’s lifeblood.

“If there isn’t trading volume there is no money . . . it looks like it is going to be tough for quite some time,” said Julian Sawyer, former chief executive of crypto trading venue Bitstamp.

The market value of the world’s 500 biggest crypto tokens has slumped from a high of $3.2tn in November to less than $1tn this week, wiping out years’ worth of gains in major coins such as bitcoin and ether.

The pullback mirrors a broader decline across global financial markets but has been more severe in the most speculative asset classes at a time when central banks are backing away from the stimulus they supercharged in 2020.

Crypto investors tend to trade much more actively during bull markets. Now, sliding volumes are eating into the once juicy fees exchanges earn by facilitating trading.

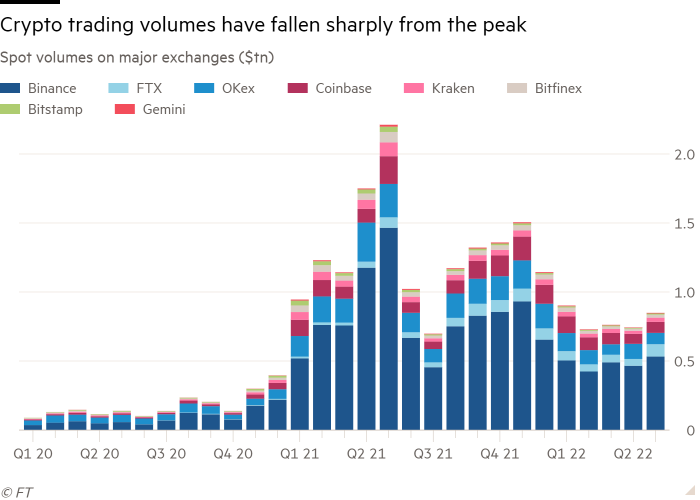

Spot trading volumes across major crypto platforms averaged around $800bn a month from March to May, less than half the level for the same period in 2021, according to Financial Times calculations based on CryptoCompare data.

Coinbase had expanded to around 6,000 employees from 3,730 at the end of last year as it rode the exuberance in crypto markets.

Rivals that boomed in recent years are also tearing up their growth plans. Crypto exchange Gemini said in early June it would lay off 10 per cent of its staff in “turbulent market conditions” that the founding Winklevoss brothers said may “persist for some time”. In recent days Crypto.com also said it would cut 5 per cent of its workforce, around 260 people, and crypto lending platform BlockFi will lay off a fifth of its workforce, roughly 170 people

Brazil’s Mercado Bitcoin also recently laid off 90 people, around 12 per cent of its employees. Director Fabricio Tota said the exchange went from 200 to 700 in just under a year in 2021.

“When you grow that fast, you don’t grow in an organised way. So it’s time to start searching for inefficiencies, and to be more organised,” Tota said.

Coinbase was already facing a backlash both inside and outside the company. Last month it signalled plans to cut back and even rescinded some job offers. Chief financial officer Alesia Haas said on a panel interview last week that “we are operating in an uncertain time”.

John (not his real name) had quit his job and was preparing to move from Europe to London for a Coinbase job. “Everything here was packed up. Any move is a big deal, you get everything in order, you say goodbye to people, I was seeing someone here. The whole thing just came crashing down,” he said. After his UK visa application collapsed, he was left trying to return to his old job.

Rick Chen, head of public relations at employee information sharing platform Blind, said Coinbase had reassured people that offers would not be rescinded. “To have the whiplash of a few weeks later where that’s not the case, I haven’t seen anything like this,” he said. Coinbase pointed to a blog post and twitter posts from senior managers and made no further comment.

A former Gemini senior executive said the company’s recent announcement on cuts is just the tip of the iceberg, claiming the exchange “overhired” in last year’s crypto bull market.

“Ten per cent is completely understated. Without letting people know, Gemini were letting significant people go since March,” the former employee said. Gemini declined to comment.

Charley Cooper, managing director of blockchain software company R3, warned that “hubris” often enveloped the crypto industry.

“The laws of economics apply to crypto too. It’s very hard to convince people in mainstream finance that you’re serious about business if you constantly believe that your asset class is immune from the laws of economics,” he said.

Increasing regulation of cryptoassets has also added costs for operators. “If you do it properly, the overhead for regulatory stuff is enormous because we have to dive into the old world and keep the pace of the new world,” said Eric Demuth, chief executive of Austria-based exchange Bitpanda.

But the chill that exchanges feel may depend on their business model, such as whether they offer derivatives trading or rely on institutional traders for revenues.

Over the past three months, trading in derivatives that facilitate bets on coins’ future direction is down 17 per cent compared to peak levels, much less than the decline for spot, according to CryptoCompare.

Crypto exchange FTX, which has 300 employees, said it remains “strongly profitable”. Binance, the largest exchange by volume, said it will continue its pace of hiring. “We believe that cooler markets offer the best opportunity for organisations to invest in or acquire great projects at a more favourable price point,” Binance said.

OKex’s managing director, Lennix Lai, said the exchange plans to add 30 per cent to its 2,800-strong workforce in the next year.

But for people such as John it has been a harsh lesson.

“I would love it if people had a long enough memory to punish companies that behave like this, but unfortunately we live in a world with a one-week memory on the most scandalous issues,” he said.

[ad_2]

Source link