[ad_1]

Death claims and payouts for life insurance companies touched a record high in 2021-22 as the second wave of the Covid-19 pandemic playedhavoc. The sector is however, more upbeat about prospects in the new fiscal and believe the impact of the pandemic on their balance sheet has been contained.

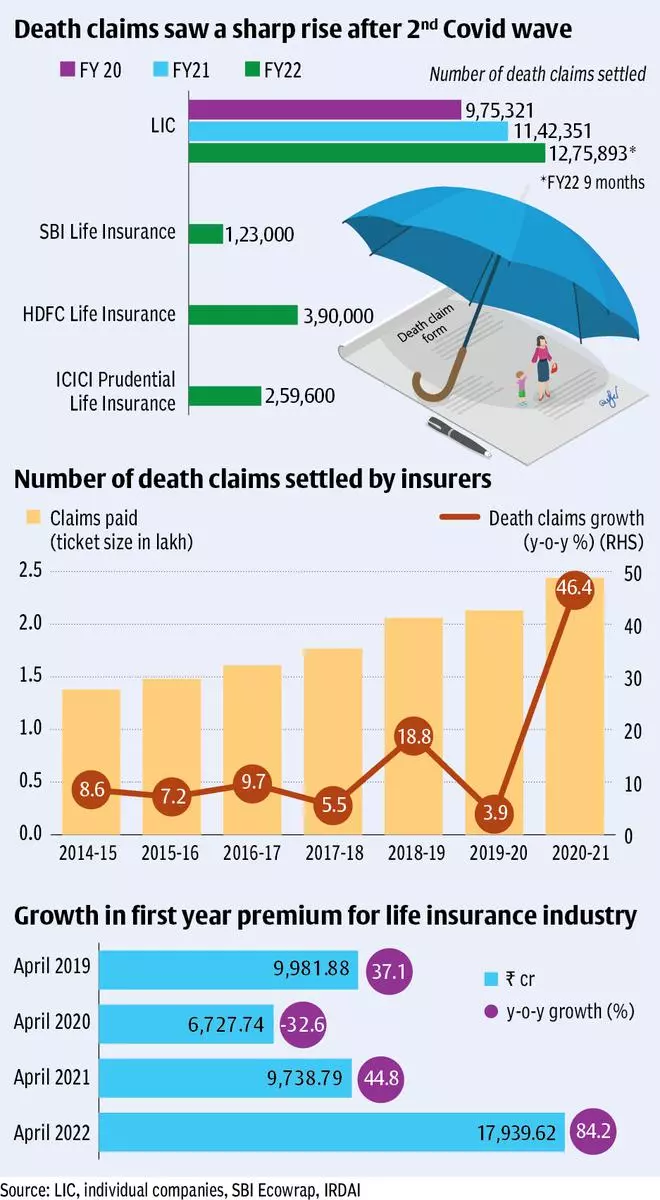

The country’s largest life insurer—Life Insurance Corporation of India received 12.75 lakh death claims in the first nine months of 2021-22 as against 11.42 lakh in the full fiscal of 2020-21, according to its public disclosure.

“Our insurance claims by death (net) increased during the pandemic,” LIC said in its final offer document filed with the ROC.

For fiscal 2019, 2020, 2021 and the nine months ended December 31, 2021, LIC’s insurance claims by death (net) were ₹16,963.77 crore, ₹17,341.81 crore, ₹23,483.33 crore and ₹29,310.73 crore respectively, on a consolidated basis.

Fourth quarter results of listed life insurers such as SBI Life Insurance, HDFC Life Insurance and ICICI Prudential Life Insurance also reveal elevated claim pay outs in 2021-22.

FY22 claims could be 3x

While full fiscal data for death claims for the industry is yet to be worked out, industry players say it is likely to be at least three times that of 2020-21.

“Mortality experience has risen three to four times. In that sense, the pandemic played out very adversely for the industry but in terms of awareness and digitisation, the insurance industry has actually grown,” noted an insurer.

A significant part of the death claims across the industry are due to the Covid-19 pandemic.

The Reserve Bank of India’s Financial Stability Report in December 2021 said the life insurance industry received 1.38 lakh claims totalling to ₹13,347 crore for Covid related deaths between April 2020 to September 2021.

“Of these, 1.29 lakh death claims amounting to ₹11,059 crore were settled,” the report said.

ICICI Prudential Life Insurance said its total Covid-19 related claims in 2021-22 was ₹2,107 crore as against ₹354 crore in 2020-21.

But with the third wave of the pandemic in January and February this year resulting in milder infections and less hospitalisations, life insurers are hopeful that claims will no longer be elevated. Higher vaccinations are also expected to help.

Focus on growth

The focus now is on growth. IRDAI data reveals that first year premium of life insurers grew by a whopping 84.21 per cent in April 2022 to ₹17.939.62 crore as against ₹9,738.79 crore in April 2021.

While part of this is due to the low base of last year there are expectations that the awareness for life insurance that was created by the pandemic will continue.

“We believe that the life insurance industry is geared to register robust growth over the long term, given the under penetration of life insurance in India and the higher protection gap. Additionally, pandemic related uncertainties have highlighted the benefits of life insurance,” Axis Securities said in a recent note.

Published on

May 20, 2022

[ad_2]

Source link