[ad_1]

The Federal Reserve building is seen before the Federal Reserve board is expected to signal plans to raise interest rates in March as it focuses on fighting inflation in Washington, U.S., January 26, 2022. REUTERS/Joshua Roberts/File Photo

Register now for FREE unlimited access to Reuters.com

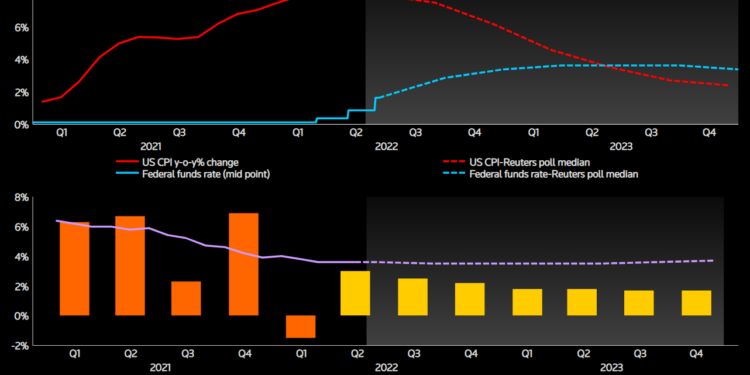

BENGALURU, June 22 (Reuters) – The Federal Reserve will deliver another 75-basis-point interest rate hike in July, followed by a half-percentage-point rise in September, and won’t scale back to quarter-percentage-point moves until November at the earliest, according to economists polled by Reuters.

Last week the Fed hiked the federal funds rate by three-quarters of a percentage point, its largest rate increase since 1994, after official data just a few days earlier showed inflation unexpectedly rose despite expectations it had peaked. read more

The latest poll results, released on Wednesday before Fed Chair Jerome Powell was due to appear before the Senate Banking Committee as part of his twice-yearly monetary policy testimony to Congress, show momentum is still behind the U.S. central bank doing more, not less, despite rising recession concerns and a steep sell-off in financial markets. Bond yields are up sharply and major Wall Street equity indexes are already trading in a bear market, defined as 20% down from their peak.

Register now for FREE unlimited access to Reuters.com

In the June 17-21 Reuters poll, nearly three-quarters of economists, 67 of 91, expected another 75-basis-point U.S. rate hike in July. That would take the fed funds rate to a range of 2.25%-2.50%, roughly the neutral level where the Fed estimates the economy is neither stimulated nor restricted.

A strong majority expect the central bank to hike its policy rate by another 50 basis points in September, with opinion more split on whether it will hike by 25 or 50 basis points in November. A majority expect the Fed to raise rates by 25 basis points at its December meeting.

That would take the fed funds rate to a range of 3.25%-3.50% by the end of this year, 75 basis points higher than thought in a poll published just two weeks ago.

Powell last week signaled that a pause in the current tightening cycle would only be possible after a meaningful decline in inflation, which currently looks to be a more distant prospect than thought just a few weeks ago.

“Since the Fed is still underestimating the inflation problem … not recognizing that a wage-price spiral has already started, we expect they will have to raise rates faster than they now expect,” Philip Marey, senior U.S. strategist at Rabobank, wrote in a note.

“Unfortunately, the hiking path is also likely to be followed by a recession.”

Inflation will remain above the Fed’s 2% target until at least 2025, according to its own projections and a separate Reuters poll.

Although the Fed was expected to shift down to 25-basis-point rate hikes in November, a significant minority, around 40%, expected a 50-basis-point hike at that month’s meeting. Only a handful said the Fed would pause its rate hikes at some point this year.

Around three-quarters of respondents, 68 of 91, saw the end-year rate at 3.25%-3.50% or higher, in line with the Fed’s own “dot plot” showing policymakers’ projections.

Aggressive rate hikes come with their own risks, as reflected in the Fed’s economic projections where forecasts for the U.S. unemployment rate were raised significantly and economic growth was predicted to average below trend.

The poll predicted only one 25-basis-point hike in the first quarter of next year, pushing the federal funds rate to 3.50%-3.75%, the possible terminal rate.

The Fed was expected to pause in the second and third quarters of 2023 and cut rates by 25 basis points in the final quarter of next year, according to the median forecast from a smaller sample. But forecasts for where the fed funds rate will be by the end of 2023 ranged between 2.50%-2.75% and 4.25%-4.50%, underscoring high uncertainty.

Despite Powell saying the Fed was not trying to induce a recession, a few primary dealers have either started predicting one as early as this year or have brought forward their recession calls.

Register now for FREE unlimited access to Reuters.com

Reporting by Prerana Bhat and Indradip Ghosh; Polling by Swathi Nair and Susobhan Sarkar; Editing by Paul Simao

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link