[ad_1]

Underperformance of stocks and bonds in a potential stagflationary environment may also be positive for gold, the WGC adds.

H1 2022 performance

Gold finished the first half of the year 0.6% higher, closing at $1,817/oz. It initially rallied as the Ukraine war unfolded and investors sought high-quality, liquid hedges amidst increased geopolitical uncertainty.

However, gold gave back some of those early gains as investors shifted their focus to monetary policy and higher bond yields. By mid-May, gold price had stabilized in response to the tug of war between rising interest rates and a high-risk environment.

This was also reflected in both COMEX net long positioning and gold ETF flows, the latter of which saw strong investment early in the year before giving back some gains in May and June. Yet, by the end of June, gold ETFs had amassed $15.3 billion (242 tonnes) of inflows year-to-date.

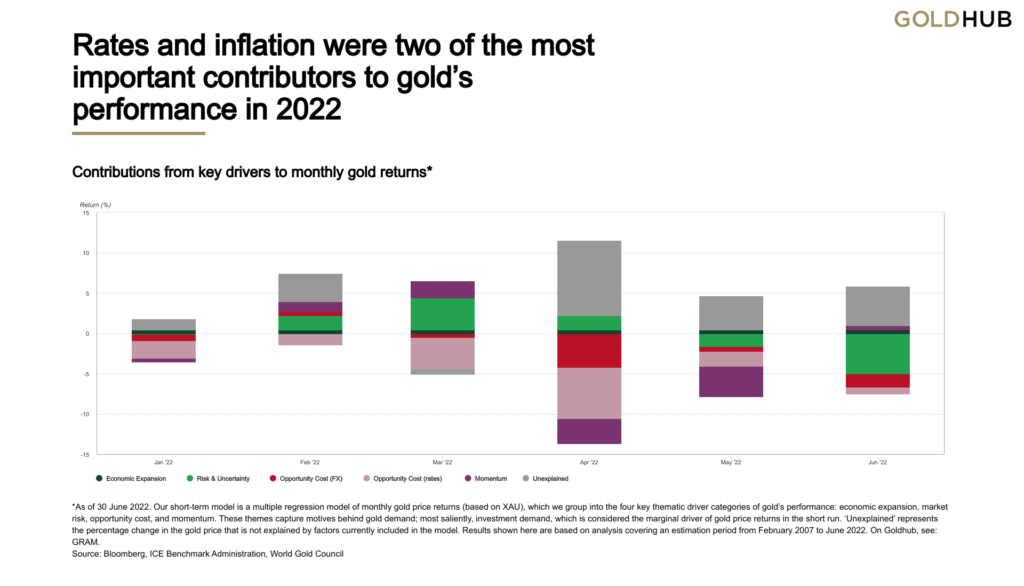

The WGC’s gold return attribution model (GRAM) corroborates this. Rising opportunity costs – both from higher rates and a stronger dollar – were key headwinds to gold’s performance year-to-date, while rising risks – from inflation as well as geopolitics – pushed gold higher for much of the period.

The Council believes that the geopolitical risk premium is also represented in the larger-than-normal ‘unexplained’ element of its GRAM model in recent months, which has made a strong positive contribution to gold’s price performance in tandem with the prolonged Russia-Ukraine war.

Further, at first glance, gold’s flat year-to-date performance may seem dull, but it was nonetheless one of the best performing assets during H1. It not only delivered positive returns, but it did so with below average volatility. As such, gold has actively helped investors mitigate losses during this volatile period, the WGC says.

H2 2022 outlook

Looking ahead, the WGC believes that investors will continue to face significant challenges during the second half of the year. Expectations of future monetary policy decisions – expressed through bond yields – have historically been a key influence on gold price performance.

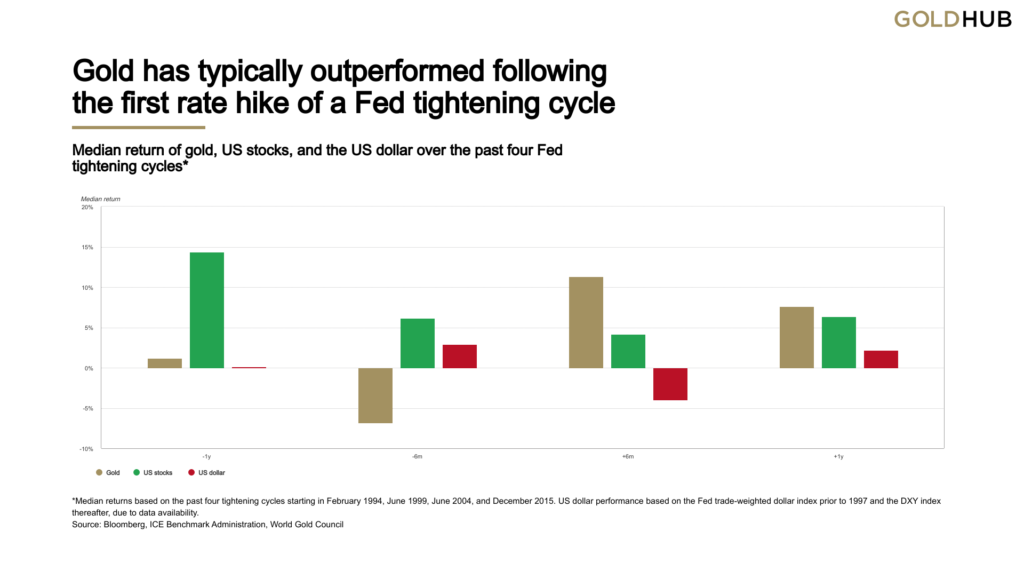

Historical analysis by WGC shows that gold has underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike. Contrastingly, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.

The Council also notes that while most market participants still expect significant policy rate increases, some analysts argue that central banks may not tighten monetary policy as much as expected. Their reasons include potential economic slowdowns that may result in contractions.

As such, it expects inflation to remain high due to lingering commodity-related supply chain disruptions from the pandemic and the Ukraine war, as well as tight labour markets.

WGC data shows that gold has historically performed well amid high inflation. In years when inflation was higher than 3%, gold’s price increased 14% on average, and in periods where US CPI averaged over 5% on a year-on-year basis – currently at about 8% – gold has averaged nearly 25%.

Also, gold has outperformed other commodities in higher inflationary periods, which has yet to happen this time around. However, WGC analysis suggests that gold lags other commodities in commodity-led inflationary periods, and catches up and outperforms over the subsequent 12-18 months.

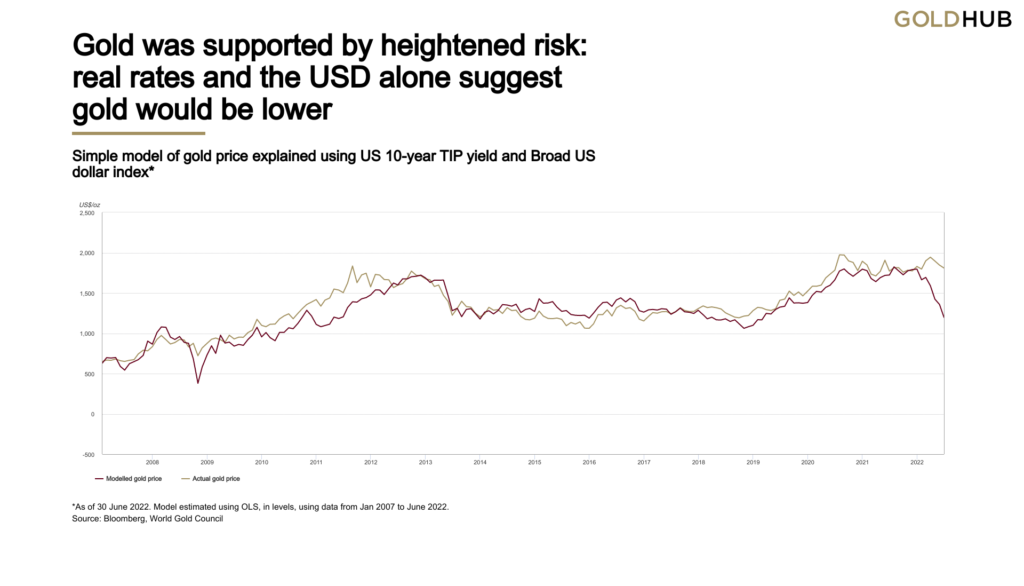

Still, the gold market is expected to face two important headwinds in H2 2022: higher nominal interest rates and a potentially stronger dollar. However, the negative effect from these two drivers may be offset by other, more supportive factors, including: high, persistent inflation, market volatility and the need for an effective hedge, the Council predicts.

[ad_2]

Source link