[ad_1]

Gold’s performance as a safe asset among other asset classes has improved in the recent phases of financial cycles, the Reserve Bank of India (RBI) said in its annual report for 2021-22 on Friday.

According to the central bank, gold is a unique asset with attributes of financial assets.

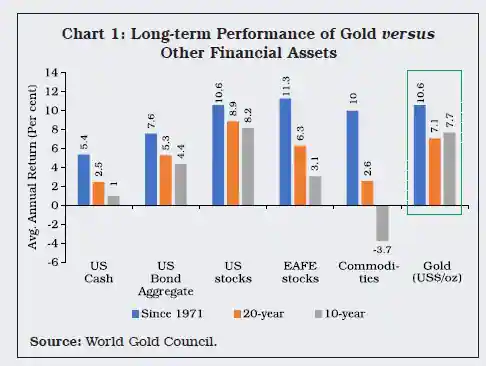

“Gold acts as a diversifier and is a vehicle to mitigate losses in times of market stress. Gold has delivered positive returns over the long run, often outperforming other major asset classes (see chart),” it said in the annual report.

View Full Image

Citing a research paper written by Kuntara Pukthuanthong and Richard Roll in 2011, the central stated that the price of gold in terms of US dollar increases while the US dollar depreciates against other currencies. They paper further showed that the fall in price of gold in USD terms can be associated with currency depreciation in every country.

RBI further stated that as per earlier studies and empirical findings, gold’s price is driven by the performance of USD.

“The filtered credit, equity and property cycles have unique characteristics in terms of amplitude and duration which is well expected from the financial markets. In a sample of 21 years, both cycles peaked before the two international financial events (2001 market crash and 2008 global financial crisis),” RBI said.

However, it was observed that the equity cycle reaches peak before the credit cycle. This can be explained due to the nature of credit and equity markets as credit build-up and wind down takes a longer time than changes in the equity indices. Both the cycles witness highest peaks before the global financial crisis.

This observation was supported by Claessens, Kose and Terrones (2011) that recoveries coinciding with booms in credit and housing markets are stronger.

According to RBI, the observations across the various phases of the different financial cycles imply that in addition to providing a greater risk hedge to the US dollar, gold’s performance as a safe asset among other asset classes has also improved in the recent phases of financial cycles.

[ad_2]

Source link