[ad_1]

Mehsana resident Arvind Patel, who is into the business of decorating “mandaps” for events and gatherings, borrowed Rs 7.2 lakh under the Pradhan Mantri MUDRA Yojana (PMMY). He used the loan to expand his business. “Earlier we used to employ eight persons, now we employ 12,” Arvind said as he virtually interacted with Prime Minister Narendra Modi at the “Garib Kalyan Sammelan” Tuesday.

When PM Modi asked if he was returning the loan to the bank on time, Arvind replied in the affirmative. In response, the PM appreciated the small-time entrepreneur for generating employment under PMMY, launched in April 2015 and provides loans upto Rs 10 lakh to non-corporate and non-farm small and micro enterprises.

Arvind was one of the many beneficiaries with whom the PM spoke to virtually while addressing the event from Shimla. In his speech at the event in Shimla, PM Modi said that 70 per cent of MUDRA beneficiaries were women who had become entrepreneurs and were providing employment.

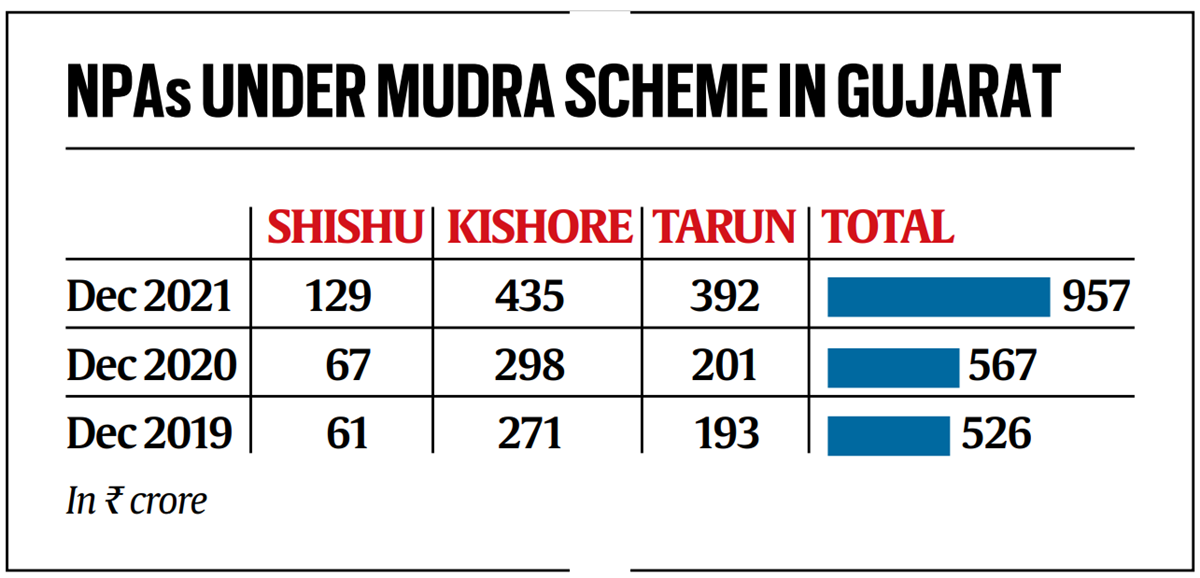

However, it is not a very rosy picture for banks who have lent money under the Central scheme in Gujarat during the past seven years of its launch. The scheme has seen a number of defaults in the state with lenders seeing their Non-Performing Assets (NPAs) rise by 69 per cent in the past year.

According to the latest available figures from State Level Banker’s Committee (SLBC), banks in Gujarat have an NPA of Rs 957 crore, 9.13 per cent of the total outstanding amount as of December 2021. The NPAs under PMMY have swelled up by 69 per cent (see table) in the past one year compared to December 2020 as loans taken by small borrowers turned bad due to Covid lockdown-induced strains.

Non-performing assets (NPAs) under the Mudra scheme in Gujarat

Non-performing assets (NPAs) under the Mudra scheme in Gujarat

If the bad loans of individual banks under the scheme are taken into consideration, then Canara Bank, at 56 per cent, has the highest percentage of NPAs, followed by Bandhan Bank (24.63 per cent), State Bank of India (22.36 per cent) and Punjab National Bank (22.7 per cent).

Among the total Rs 957 crore NPAs under the MUDRA scheme, the highest percentage of bad loans are in Shishu (loans up to Rs 50,000) and Tarun (loans in the Rs 5-10 lakh range). While 9.91 per cent (Rs 129 crore) of the outstanding Shishu loans are NPAs, the percentage of bad loans in Tarun is 9.71 per cent (Rs 392 crore).

[ad_2]

Source link