[ad_1]

Only by determining the correct taxable income, the individual can know the correct income tax amount payable by them. An income can come from various sources like salary, rent, capital gains from shares and mutual funds etc. The total taxable income is cataegorised as following as per the Income Tax laws:

a) Income from salary

c) Income from capital gains

d) Income from business and profession

e) Income from other sources

Income under the head ‘Salary’

Individuals can claim some tax exemptions and deductions from this income in case they have chosen the old tax regime. For this, submission of documentary proof is mandatory.

In case of pensioners, the pension received from employer will be taxable under the head, ‘Income from salary’.

Income from house property

To know income under this head, the individual must be well-acquainted with these following concepts:

a) Self-occupied property

As the name suggests, self-occupied property is the property that is occupied by the individual himself/herself. Income from self-occupied property will be nil. If a taxpayer has more than 2 houses, they can claim any two houses as self-occupied property. Moreover, the individual can claim deductions of up to Rs 2 lakh if the property has an ongoing home loan.

b) Rental property

Property which has been given on rent during the financial year is called rental property.

c) Deemed to be let out

This is the property which is empty and does not qualify as ‘Self-occupied property’.

Here’s how to calculate income from house property:

Step 1: Compute the Fair Rent (i.e., expected rent from the similar property) and Municipal Value (valuation as per municipal authorities). Take the higher value of the two. This higher value is termed as expected rent.

Step 2: Compare the actual rent received/receivable for the year with the expected rent computed in Step 1. The higher value will be the Gross Annual Value (GAV) of the house. Remember, if a property is covered under the Rent Control Act, then expected rent cannot exceed the standard rent.

Step 3: Calculate the Net Annual Value (NAV) by deducting municipal taxes paid during the year from GAV. Remember, GAV will be nil for self-occupied property. No deduction of municipal taxes is allowed for self-occupied property.

Step 4: Deduct 30 per cent standard deduction from NAV. This is offered to cover the expenses made for house maintenance and doesn’t require documentary proof. Note that this deduction is not available for self-occupied property.

Step 5: Deduct the total amount of interest paid on the home loan taken, if any, to purchase the said house. This deduction is available for all the properties. The final figure arrived at this step will give you an income from house property. This may be a positive or negative value.

In the case of self-occupied property, the GAV would be taken as nil and maximum deduction of interest paid would be limited to Rs 2 lakh. In the case of rental property, there is no limit on maximum deduction on the amount of interest paid. Do keep in mind that the set-off of losses under the head of house property from the other heads of income will be restricted to Rs 2 lakh.

Income from capital gains

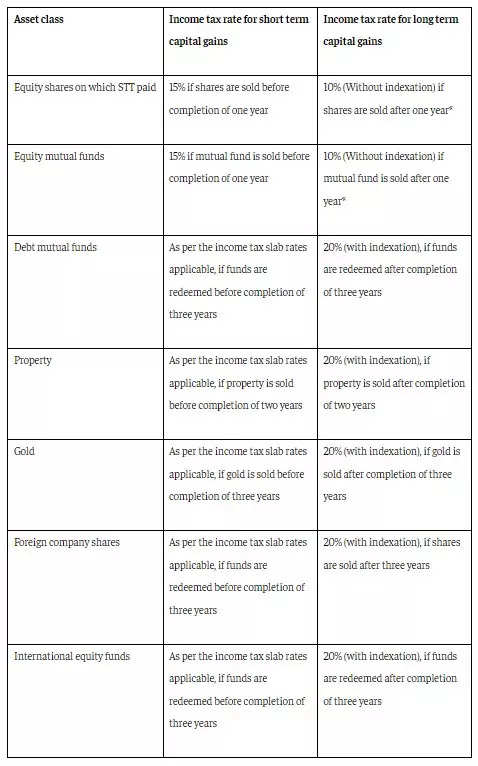

Gains made from sale of assets such as house, mutual fund units, equity shares etc. are capital gains. These are of two types – short-term capital gains (STCG) and long-term capital gains (LTCG). The type of capital gains occurred depends on how long the asset has been held by the individual. The holding period for each asset class varies. There are different income tax rates for capital gains.

Income tax rate of capital gains for different asset class

Income from business and profession

Individuals having their income from business or profession such as lawyers, CAs, freelance writers etc. are required to report their income under this category. Individuals can claim several expenses to run a business that are not allowed to a salaried individual like travelling expenses, stationary expenses, overhead expenses etc.

Income from other sources

Any income which does not fall under the income heads mentioned above, is required to be reported under the final head, ‘Income from other sources’. These generally include interest income from bank accounts, post office savings scheme, bank fixed deposits, family pension, pension received from insurance company etc. Dividends received from shares and mutual funds are also required to be reported under this head.

Tax liability amount

Once you are done calculating the income from all the sources, you will arrive at your ‘Gross taxable income’ for the financial year. From the gross taxable income, you will be required to claim deductions under section 80C, 80D etc., provided if you have chose the old regime. After claiming deductions, you may arrive at net taxable income. The tax liability will be calculated on this.

[ad_2]

Source link