[ad_1]

So the Fed Gets Ready to Walk Away from the Bond Market, and All Kinds of Stuff Happens.

By Wolf Richter for WOLF STREET.

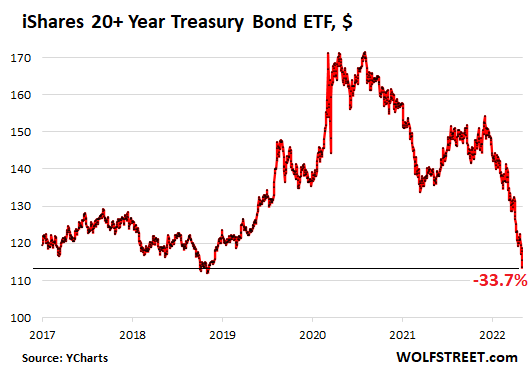

The price of the iShares 20+ Year Treasury Bond ETF [TLT], which tracks an index of Treasury securities with long maturities, dropped another 1.5% on Friday, after having dropped 2.7% on Thursday. It has plunged 21% year-to-date and 33.7% from the peak in August 2020. In return for this plunge in price, investors get a yield that has risen to 3.0%.

August 2020 marked the peak of the greatest bond-market bubble in US history. It was when the 10-year Treasury yield hit historic lows while our favorite hype mongers predicted that it would drop below zero and become negative. But this bond bubble is blowing up. And this is what the “bond massacre” looks like for investors who’d thought they’d invested in a conservative instrument, when in fact they’d bought a high-risk bet on the continuance of the bond bubble, a bet on long-term interest rates going negative. And WHOOSH went their money:

Holy-Moly Mortgage Rates.

Mortgage rates are shooting higher relentlessly. The daily measure of the average 30-year fixed mortgage rate by Mortgage News Daily reached 5.64% on Friday, the highest in the data going back to 2009.

The weekly measure by Freddy Mac of the average weekly 30-year fixed mortgage rate, which lags behind a little, spiked to 5.27% the highest since June 2009.

Holy-Moly Mortgage Payments.

Home prices have spiked and mortgage rates have spiked on top of it by over two percentage points and more. How much difference does it make in terms of the monthly payment?

In 2021, a home bought at the national median price at the time of $326,300, with 10% down, and financed at the average 30-year-fixed mortgage rate at the time of 3.09%, came with a monthly payment of $1,251.

In 2022, a home bought at the median price of $375,300, with 10% down, and financed at 5.27% came with a monthly payment of $1,869.

In other words, the mortgage payment jumped by nearly 50%, and related expenses of property taxes and insurance also increased. This 50% jump in cost of homeownership at the current price is going to wipe out demand from big layers of potential buyers.

Most people, when they apply for a mortgage, get a rate that is guaranteed for a certain period of time, such as three months. Many current buyers still have rate locks that were obtained in prior months, and they’re not fully feeling the spike in mortgage rates. But people who get their mortgages today are feeling it.

The volume of purchase-mortgage applications has already dropped substantially as has the volume of home sales. And over the next few months, the new reality in the housing market will become more apparent.

Interest rate repression, including through QE, caused the biggest housing bubble ever. Interest rate increases, including through QT, are going to unwind it. It’s the Fed’s effort to get the housing bubble under control before it tears up the financial system again.

The Fed finally thinks about cracking down on inflation.

The Fed has ended QE, and this week it raised short-term policy rates a second time, this time by 50 basis points. It also confirmed what it had hinted at in the minutes from the prior meeting that it would reduce the assets on its balance sheet starting on June 1 by not replacing maturing securities.

This Quantitative Tightening or QT has been discussed for months, and there were no surprises in the announcement of QT, and the bond market has been anticipating it and reacting to this anticipation. Yields have shot higher, which means that prices of bonds with long maturities have dropped – and not just a little, as demonstrated by the iShares 20+ Year Treasury Bond ETF.

The 10-year Treasury yield rose by 7 basis points on Friday to 3.12%, the second day in a row of closing above 3%. It’s now just a hair from the high in the prior tightening cycle when the yield peaked at 3.24% on November 8, 2018. When the 10-year yield moves beyond 3.24%, it will be the highest since 2011:

The two-year Treasury yield, which had spiked in the prior months in anticipation of many hikes in short-term policy rates, has over the past few trading days remained roughly in the same range, and on Friday closed at 2.72%, down a tad from the recent high last Tuesday of 2.78%, which had been the highest since January 2019.

For the two-year yield, it has been a huge move in just seven months. The magic number is 2.83%, beyond which you have to go back to 2007 to find higher yields.

Future bond buyers benefit from the higher yields.

Current holders of long-term bonds are having to sit through the bond massacre, after decades of having been coddled by the greatest bond bull market ever.

But future buyers get a much better deal, being able to buy bonds at lower prices with higher yields. These yields may still not be enough to compensate for inflation, but very little compensates for inflation as the Everything Bubble has begun to deflate, certainly not stocks and cryptos, which have already cratered, and real estate is shaping up to be next.

And those future buyers still face rising yields after they buy the bonds, meaning lower prices for their bonds after they bought them. But hey, that’s the bad breath of the Everything Bubble the next day.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link