[ad_1]

ICICI Home Finance Company Limited (ICICI HFC) is a wholly-owned subsidiary of ICICI Bank Ltd and is a Housing Finance Company regulated by the Reserve Bank of India (RBI). ICICI Housing Finance Company’s fixed deposits are rated FAAA/Stable by CRISIL, MAAA/Stable by ICRA, and AAA/Stable by CARE, and the company made an interest rate revision on these deposits on May 30, 2022. Based on the revision, ICICI Home Finance is now offering a maximum rate of 7% to the general public and 7.25 per cent to senior citizens.

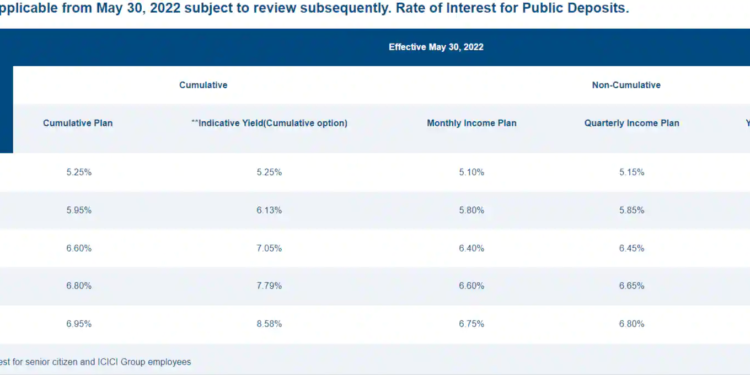

ICICI Home Finance Interest Rates On FD For Public Deposits

According to the interest rates in effect from May 30, 2022, the company is currently offering a 5.25 per cent interest rate on 12- to 24-month cumulative deposits. The interest rate applicable to cumulative deposits of 24 to 36 months is 5.95 per cent, 6.60 per cent for cumulative deposits of 36 to 60 months, 6.80 per cent for cumulative deposits of 60 to 84 months, and 6.95 per cent for cumulative deposits of 84 to 120 months. The company provides a maximum interest rate of 6.75 per cent on non-cumulative deposits of 84 to 120 under the monthly income plan, 6.80 per cent under the quarterly income plan, and 6.95 per cent under the yearly income plan on non-cumulative deposits of 84 to 120. On public deposits of less than ₹2 crore, a 0.25 per cent additional interest rate would be applied to elderly citizens and ICICI Group workers.

View Full Image

ICICI Home Finance Interest Rates On FD For Other Than Public Deposits

Based on interest rates effective May 30, 2022, ICICI HFC is now offering a maximum rate of 6.95 per cent on cumulative deposits of 84 to 120 months and a maximum rate of 6.75 per cent on non-cumulative deposits under the Monthly Income Plan, 6.80 per cent under the Quarterly Income Plan, and 6.95 per cent under the Yearly Income Plan.

View Full Image

ICICI HFC Special Scheme Rates for Public Deposits

ICICI HFC provides a 6.85 per cent interest rate on cumulative deposits of 39 months, 6.95 per cent on cumulative deposits of 45 months, and 7.00 per cent on cumulative deposits of 65 months on a special fixed deposit scheme. A monthly income plan will have a maximum rate of 6.80 per cent, a quarterly income plan will have a maximum rate of 6.85 per cent, and a yearly income plan will have a maximum rate of 7.00 per cent under the Non-Cumulative deposit option.

View Full Image

[ad_2]

Source link