[ad_1]

“That has led to a significant decline in commodities prices denominated in US dollars such as iron ore,” GF Futures analysts wrote in a note.

Meanwhile, thin profit margins at steel producers and overall steel output controls in China have curbed production increases and dented demand for steelmaking ingredients, GF Futures said.

The most-active iron ore futures on China’s Dalian Commodity Exchange, for September delivery, plunged as much as 7% to 756 yuan ($112.71) per tonne, the lowest since March 16.

They ended 4.1% lower at 779 yuan a tonne, extending losses to the third day.

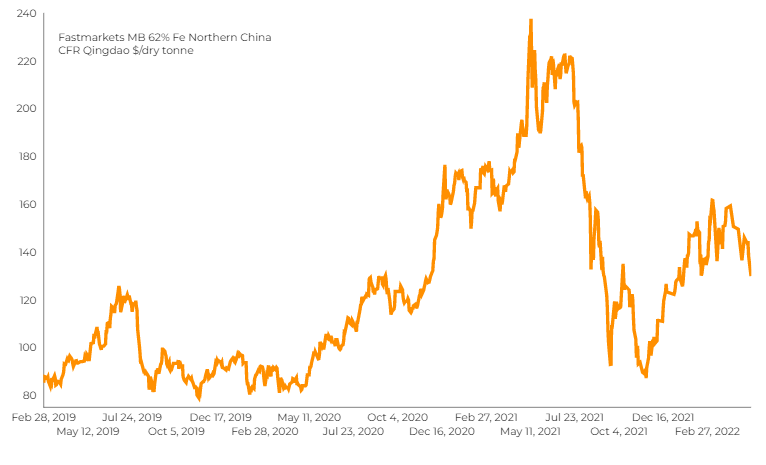

Benchmark 62% Fe fines imported into Northern China fell 6.18%, to $129.92 per tonne, the lowest since January 18.

China’s central bank said on Monday it would step up support for the slowing economy, while closely watching domestic inflation and monitoring policy adjustments by developed economies.

(With files from Reuters)

[ad_2]

Source link