[ad_1]

Following the first cash rate hike in more than a decade, lenders have been quick to pass on the rate rise to borrowers, with 95 per cent of lenders raising interest rates 0.25 per cent according to Canstar.

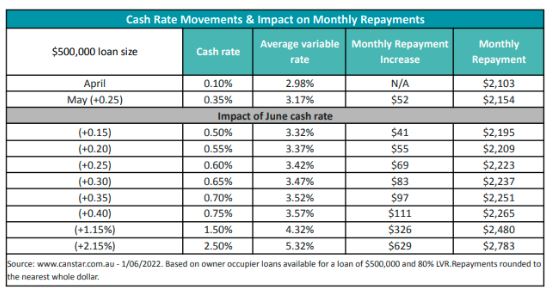

The 0.25 per cent average rate increase saw monthly repayments on a 30-year loan rise by $52 to $2,154 per month for a $500,000 loan with more pain ahead for borrowers.

The Reserve Bank of Australia is widely tipped to increase the cash rate again this month, with the ANZ predicting a 40 basis point jump.

Canstar’s finance expert, Steve Mickenbecker said he expects the RBA to continue tightening, which will put pressure on borrowers.

“With almost all of the 96 lenders on Canstar.com.au having increased rates, by 0.25 per cent on average, borrowers are already feeling the pinch,” Mr Mickenbecker said.

“Unfortunately the first increase in repayments in 11 years is just a taste of what is to come, and puts borrowers on notice that now is the time to financially prepare as best they can.”

According to Canstar, on May 1 prior to the cash rate rise, the lowest variable rate available was 1.58 per cent, however as at June 1, this is now 1.83 per cent – a difference of 0.25 per cent.

The expectation tomorrow (June 7) is for at least another 0.25 per cent rise in the cash rate, which would add a further $52 per month to the repayments for those with a $500,000 loan according to Canstar.

Should the RBA push 0.4 per cent, those same borrowers would be hit with $111 per month in extra repayments.

Mr Mickenbecker said borrowers should start preparing in the event the RBA does reach its terminal rate of 2.5 per cent.

“A forecast 2.5 percent cash rate in a couple of years adds $681 to monthly repayments on a $500,000 loan,” he said.

“It is too late to start planning for this when confronted by a monthly bill from the bank for $2,783 after your repayments have already risen.

“There are still eight loans below 2 per cent and borrowers must refinance on to a lower base before further interest rate increases come through.

“The other part of the plan once you have secured a lower rate has to be to put the savings on the repayment aside to get the loan ahead of schedule, which will help when the going gets tougher.”

While pressure will be rising on borrowers, the silver lining is that savers might finally start seeing higher interest on their term deposits according to Mr Mickenbecker.

“There are green shoots of hope for savers that they will start to see better returns in years to come, as banks chase retail savings,” he said.

“But the start has been slow, with only 47 per cent of banks on Canstar.com.au increasing savings interest rates in May and 81 per cent increasing term deposit rates.”

Mr Mickenbecker said while average savings rates remained low it was still worth chasing the highest available rates to seek out the best return.

“Rate increases have been split between the base rate, and promotions and bonuses, making headline rates no more than a guide,” he said.

“Savers should ensure they can achieve the bonus conditions and be prepared to move their account to another bank when any four or five month promotional period is over.”

[ad_2]

Source link