[ad_1]

Asia-Pacific’s life insurance industry recorded 7% growth in 2021, the highest since 2016, due to increased insurance awareness as macroeconomic imbalances highlighted the importance of financial security in the wake of COVID-19 pandemic, says GlobalData, a leading data and analytics company.

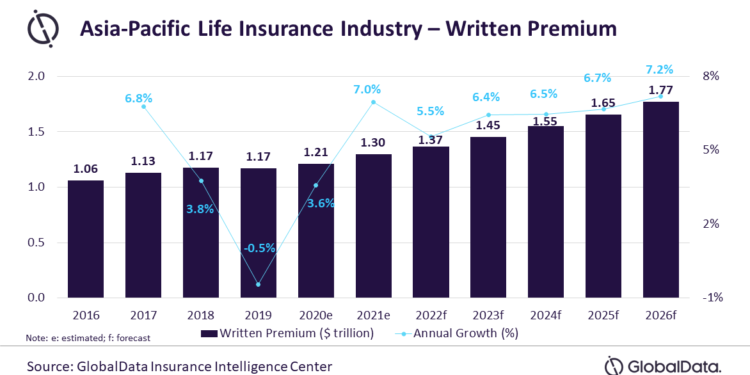

As per GlobalData, the life insurance industry written premiums in the Asia-Pacific region are expected to grow at a compound annual growth rate (CAGR) of 6.5% over 2021–2026 from $1.30 trillion in 2021 to $1.77 trillion in 2026.

Deblina Mitra, Senior Insurance Analyst at GlobalData, comments: “Despite the economic challenges in 2020, the life insurance industry bounced back as the COVID-19 pandemic highlighted the importance of life insurance for financial security. The industry’s growth doubled in 2021 aided by the economic recovery.”

China, Japan, Taiwan, South Korea, and India were the top five regional markets, accounting for 85% of the region’s consolidated written premiums in 2021. China and India were the major growth drivers with double-digit growth in 2021 and are expected to maintain a CAGR above 7% over 2021-26.

Japan, Taiwan, and South Korea are among the most saturated life insurance markets. These markets are expected to record a CAGR of 4.7%, 3.8%, and 3.1%, respectively, over 2021-26.

Personalization, mental health, well-being, and environmental, social, and governance (ESG) were some of the key trends witnessed in the APAC life insurance industry. Examples of personalization include the AIA Connect app by AIA Hong Kong, which guides customers in recognizing the protection gap with their existing life policies through cloud computing and AI.

With an increase in cases, mental health’s inclusion in life insurance was a notable development in the last couple of years. For example, Australia-based TAL partnered with virtual healthcare provider Teladoc Health to provide a tailored treatment plan.

Regional insurers including Nippon Life and Dai-ichi Life in Japan, Shinhan Life in South Korea, and Axa and Manulife in Hong Kong increased their ESG compliant investments as part of sustainable practices. These trends are expected to gain strong traction over the next five years.

Mitra concludes: “The life insurance industry in the Asia-Pacific region is expected to maintain steady growth over the next five years, driven by its underpenetrated emerging markets, improvement in the standard of living, and increased insurance awareness. Furthermore, the industry will see major insurtech developments to address demographic challenges and provide personalized insurance.”

[ad_2]

Source link