[ad_1]

According to a new report from Redfin, the typical home for sale found a buyer in just 15 days —the fastest pace on record— during the four-week period ending May 8.

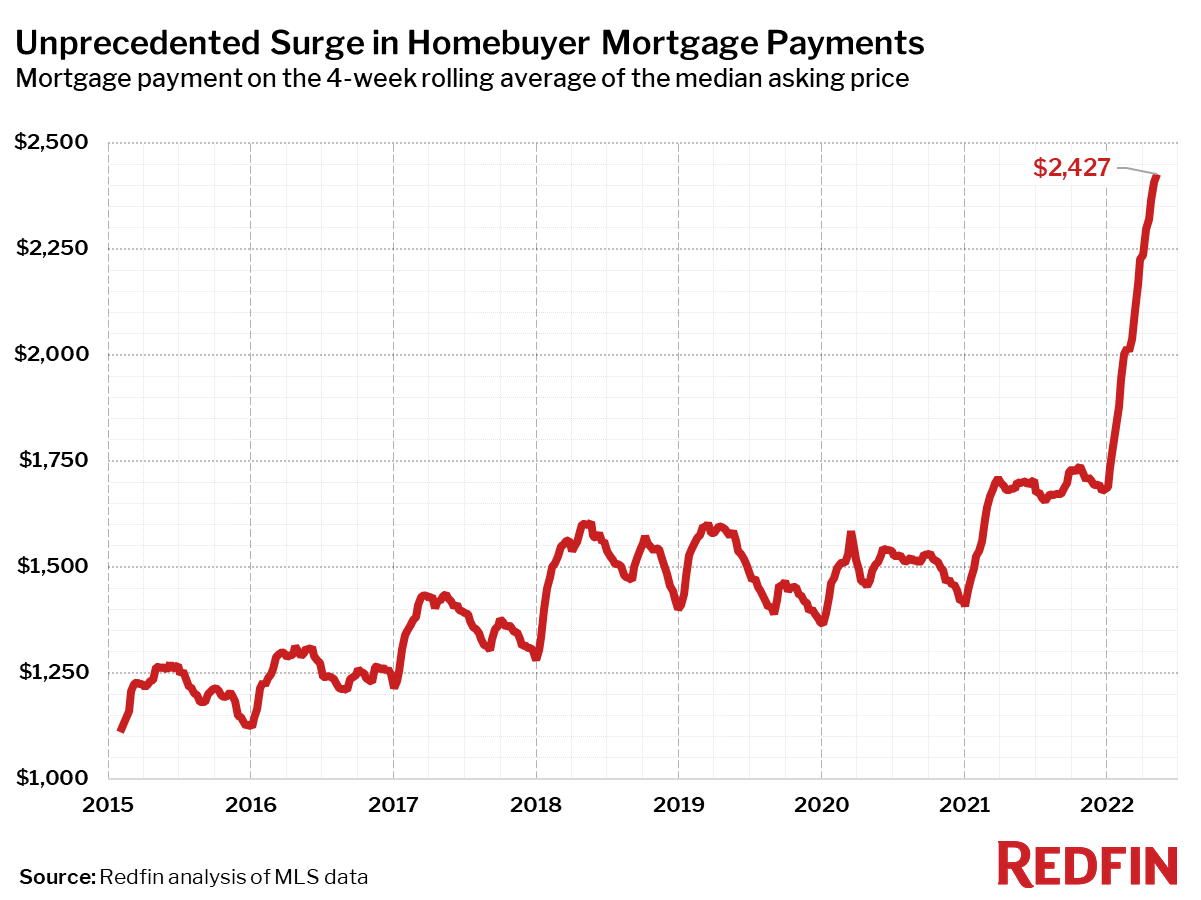

Pending sales fell 6%, the largest year-over-year decline since June 2020 when the initial pandemic shock to the housing market was gradually wearing off. Many of the buyers who haven’t yet been priced out by skyrocketing housing costs have been rushing to snatch homes off the market before they become even more expensive. The typical homebuyer’s monthly mortgage payment is now $2,427 —a record high— up 44% from $1,685 a year earlier.

“Rising mortgage rates have taken a notable bite out of demand,” said Redfin Chief Economist Daryl Fairweather. “But still, homebuyers who remain in the market are facing stiff competition, especially for the most desirable homes. Given the lack of homes for sale, it would take a much larger drop in demand for buyers to really feel like the market has truly turned in their favor.”

The share of homes for sale with price drops shot up to a seven-month high of 16% during the four-week period as early-stage homebuying demand as measured by Redfin’s Homebuyer Demand Index in the latest week fell 7%—the largest annual decline since April 2020.

“We are seeing more price drops in recent weeks and homebuyers are starting to find some relief from competition,” said Salt Lake City Redfin Real Estate Agent Rin Barrett. “People who have been looking for a long time and were consistently getting beat out by other buyers are starting to get their offers accepted. They may be settling for a home that’s not in an ideal location or needs some work, but they’re happy because a few months ago even those seemed impossible to win. However, desirable homes in prime locations are still selling fast and for a premium, with no apparent slowdown so far.”

Leading indicators of homebuying activity:

- Fewer people searched for “homes for sale” on Google—searches during the week ending May 7 were down 6% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index—a measure of requests for home tours and other home-buying services from Redfin agents—was down 7% year over year during the week ending May 8. It dropped 19% in the past four weeks, compared with an 11% decrease during the same period a year earlier.

- Touring activity from the first week of January through May 8 was 30 percentage points behind the same period in 2021, according to home tour technology company ShowingTime.

- Mortgage purchase applications were down 8% from a year earlier, while the seasonally adjusted index increased 5% week over week during the week ending May 6.

- For the week ending May 12, 30-year mortgage rates increased to 5.3%—the highest level since June 2009.

Key housing market takeaways for 400+ U.S. metro areas:

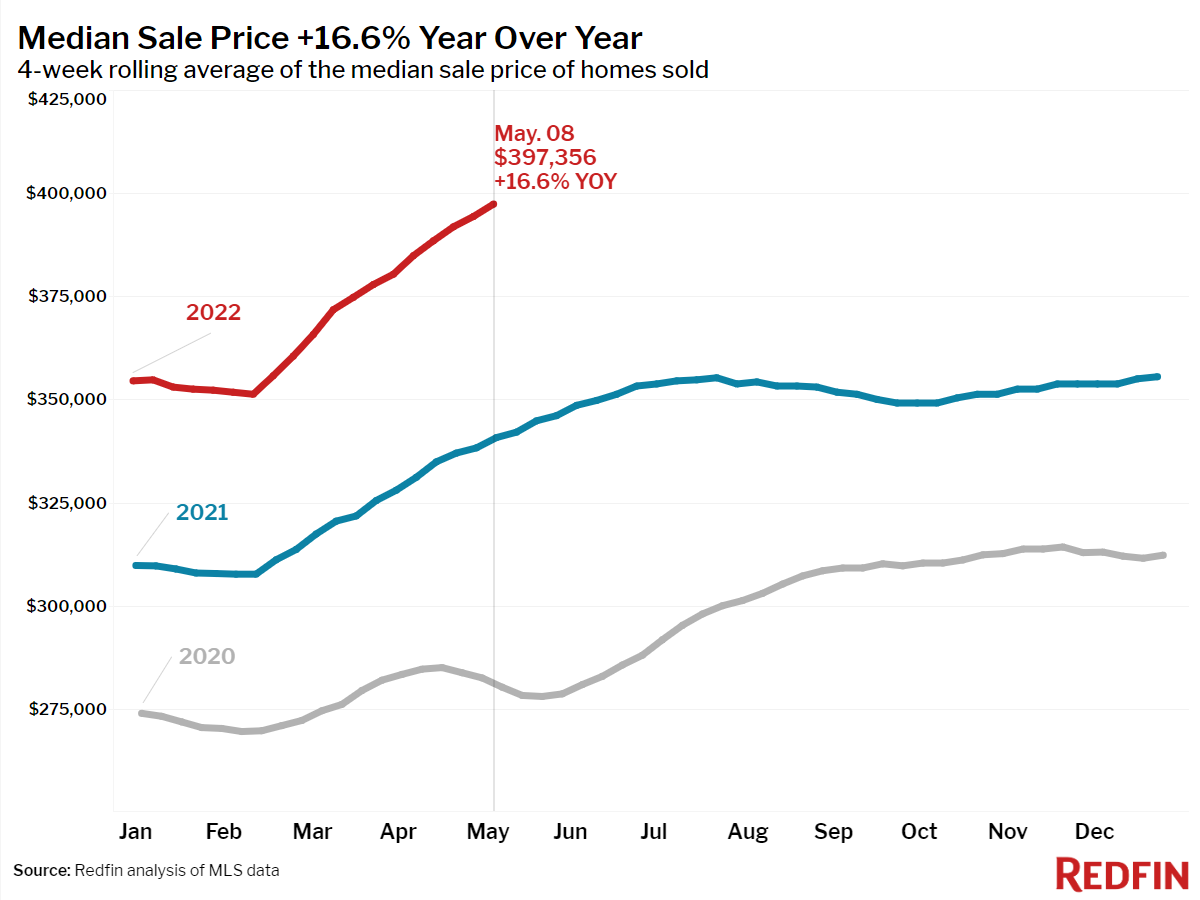

- The median home sale price was up 17% year over year—the biggest increase since August—to a record $397,356.

- The median asking price of newly listed homes increased 17% year over year to $411,350, a new all-time high.

- The monthly mortgage payment on the median asking price home rose to a record high of $2,427 at the current 5.3% mortgage rate. This was up 44%—an all-time high—from $1,685 a year earlier, when mortgage rates were 2.94%.

- New listings of homes for sale were down 5% from a year earlier, and have been down year over year for a majority of the time since September 2021.

- Active listings (the number of homes listed for sale at any point during the period) fell 17% year over year.

- 56% of homes that went under contract had an accepted offer within the first two weeks on the market, up from 54% a year earlier, down less than a percentage point from the record high during the four-week period ending March 27.

- 42% of homes that went under contract had an accepted offer within one week of hitting the market, up from 41% a year earlier, down less than a percentage point from the record high during the four-week period ending March 27.

- Homes that sold were on the market for a record-low median of 15 days, down from 20.2 days a year earlier.

- A record 57% of homes sold above list price, up from 48% a year earlier.

- On average, 4% of homes for sale each week had a price drop. Overall, 16.1% dropped their price in the past four weeks, up from 11.7% a month earlier and 9.2% a year ago. This was the highest share since late October.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to an all-time high of 102.8%. In other words, the average home sold for 2.8% above its asking price. This was up from 101.3% a year earlier.

To view the full report, including charts and methodology, click here.

[ad_2]

Source link