[ad_1]

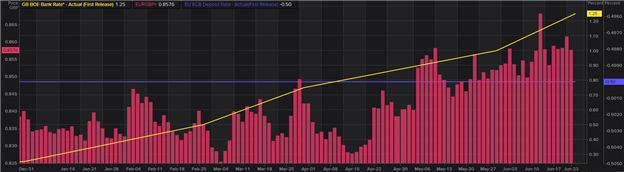

After a strong end to 2021 for the pound, 2022 has seen a change in fortunes for EUR/GBP bears. This is partly due to the market’s overexuberance in pricing rate hikes from the Bank of England (BoE) in late 2021 which has since unveiled itself in EUR/GBP price action. My bias for euro appreciation against the British Pound comes from the current interest rate differential between the European Central Bank (ECB) and the BoE. Looking at the graphic below, we can see the steady rise in EUR/GBP under the backdrop of a relatively hawkish BoE and a dovish ECB.

EUR/GBP (PINK) VS ECB DEPOSIT RATE (PURPLE) AND BOE BANK RATE (YELLOW)

Chart prepared by Warren Venketas, Refinitiv

Now that Q2 has ended, the ECB’s patient approach is seemingly shifting to one open to more aggressive tightening measures. This should (in theory) support the euro which has been resilient against the Sterling amidst several headwinds within the eurozone including the Russia/Ukraine conflict as well as its concerns with EU periphery bond yields. The ECB is behind the curve and should it delay further, higher rate hikes would be necessary–at significant economic cost.

TECHNICAL ANALYSIS

EUR/GBP WEEKLY CHART

Chart prepared by Warren Venketas, IG

The long-term view on the weekly chart shows several long upper wicks recently which may point to short-term downside but these do not take away from the long-term bullish outlook. The converging EMA’s (20 and 50-day highlighted in blue) could be developing into a bullish crossover which will further augment the upside bias. I will look for a confirmation weekly close above the psychological 0.8600 resistance zone for additional validation with a limit target at subsequent resistance targets.

EUR/GBP DAILY CHART

Chart prepared by Warren Venketas, IG

The daily chart reflects much of the same as the weekly EUR/GBP chart with the rising wedge chart pattern (black), pointing to possible short-term downside. A break below wedge support may trigger this bearish correction perhaps towards 0.8530 and 0.8500, while a move beyond 0.8500 could invalidate the long-term view. For now, short-term resistance targets (0.8600 and 0.8721) remain in favour as we look forward to changes in the fundamental, monetary policy dynamic in Europe and the United Kingdom.

Key resistance levels:

-0.8721

-0.8600

Key support levels:

-20-day EMA

-0.8530

-50-day EMA

-0.8500

[ad_2]

Source link