[ad_1]

Evolution is all about looking forward. – Gerard Piqué

I find it hard to focus looking forward. So I look backward. – Iggy Pop

As financial professionals, we’re expected to look forward and provide pathways for our clients. Our success as navigators, though, relies on our track records, so lookbacks are needed. Gerard Piqué, meet Iggy Pop.

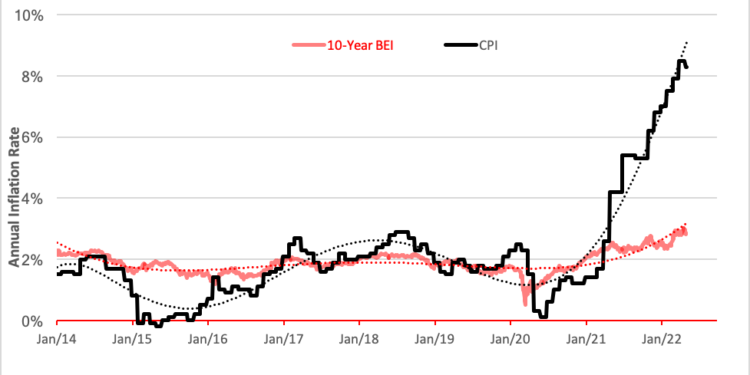

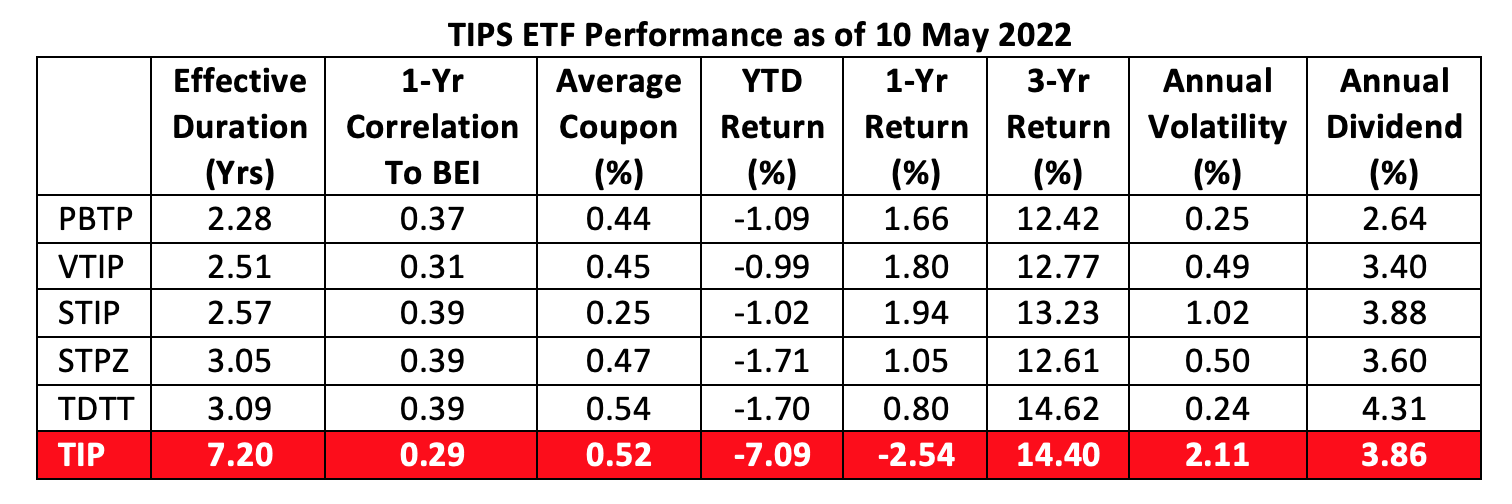

Sometimes the future’s fairly clear. Like a year ago when we ventured a take on inflation. Specifically, we forecast an imminent 3% target for the 10-year breakeven inflation (BEI) rate.

We hit that mark in April and may be headed for another 50-basis-point upsurge before too long. That said, it looks like inflation’s going to be a backdrop for further tumult in both the equity and credit markets for some time to come.

Here’s where that forward-looking thing comes in.

Let’s assume, for the moment, that inflation persists. What can a portfolio owner or manager do to hedge against its ravages?

Long-term clinical evidence has shown the most consistent bulwark has been Treasury Inflation-Protected Securities, or TIPS. But TIPS are not without risk—interest rate risk to be exact. If the Fed’s in a tightening mood, a TIPS’ market value is vulnerable, perhaps more so than conventional Treasury paper of similar maturity. It behooves a prudent investor or advisor, then, to consider mitigating this risk by shortening the duration of his or her TIPS exposure as much as is tolerable.

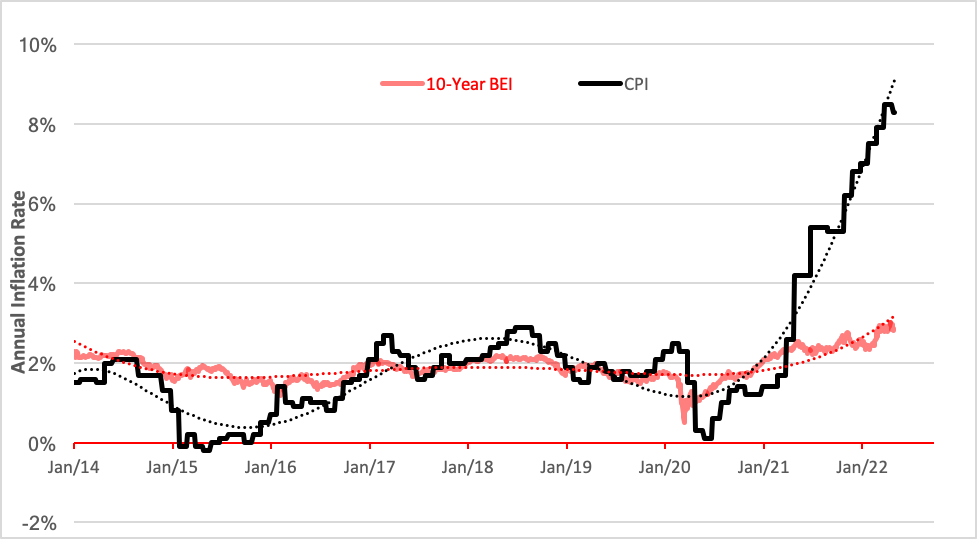

While shorter-maturity TIPS historically have exhibited less interest rate risk, they’ve also been better correlated to inflation. The interplay between inflation correlation and interest rate risk is an important one: Shorter-term bonds are less affected by interest rate movements and react more to inflation expectations. A shift in inflation sentiment is more clearly reflected in shorter-term TIPS. Shorter-term TIPS are less volatile, to boot, than their longer-term cousins.

These characteristics are plainly evident in the table below which compares the performance of five of the shortest duration exchange-traded TIPS funds to that of the longer-term category giant, the iShares TIPS Bond ETF (TIP).

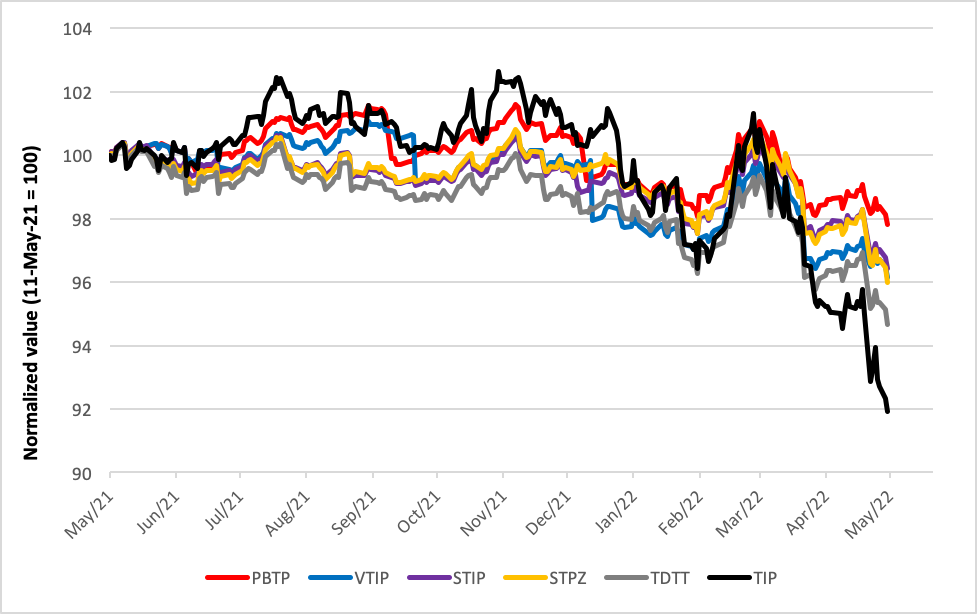

TIPS ETF Price Performance (May 2021- May 2022)

The Invesco PureBeta 0-5 Year U.S. TIPS ETF (PBTP) offers broad exposure to the short end of the domestic TIPS market through a market-weighted portfolio of 22 securities with maturities between one month and five years. The fund is small with only $118 million under management but it’s this year’s fastest growing short-term TIPS ETF attested by a positive net fund flow of $53 million to date. The fund’s 7 basis point (0.07%) expense ratio, together with its low duration, makes the fund attractive as a cash management tool. PBTP pays quarterly dividends and is rebalanced monthly.

Even lower costs-just 4 basis points–inure to holders of the Vanguard Short-Term Inflation-Protected Securities ETF (VTIP). Like PBTP, the $20.6 billion Vanguard fund holds 22 securities and pays quarterly dividends. In contrast to the Invesco fund, though, VTIP’s growth has been the slowest in our table. While a year-to-date inflow of $1.3 billion seems large, it only represents 6% of the fund’s current assets.

It’s rare that Vanguard gets bested on the cost front but the iShares 0-5 Year TIPS Bond ETF (STIP) offers coverage of the short-term TIPS market at a rock bottom annual expense of only 3 basis points. STIP’s $11.9 billion portfolio is populated by 20 securities and appears a bit top heavy with 77% of its heft concentrated in ten issues. This year, inflows have amounted to 28% of the fund’s present size.

What distinguishes the $1.5 billion PIMCO 1-5 Year US TIPS Index ETF (STPZ) from the portfolios considered above is its exclusion of paper with less than 12 months ’til maturity. STPZ’s 21-issue portfolio is even more concentrated than STIP’s. Fully 82% of the PIMCO ETF’s assets are parked in its top ten issues. At 20 basis points, STPZ is also the most expensive of the funds in our table. PIMCO’s fund has grown by $208 million this year representing 14% of its asset base.

Finally, there’s the $2.1 billion FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (TDTT) which approaches the TIPS market with a very specific mandate–maintaining a weighted average portfolio duration of three years. TDTT’s managers accomplish this by investing in a combination of TIPS with maturities ranging from one to ten years, though most of the heavy lifting is done with securities with less than five years to run. Derivatives may be employed from time to time to steer the portfolio towards its target. Investors pay 18 basis points annually to hold TDTT. Inflows this year account for 33% of the fund’s size.

Conclusion

Obviously, the primary motivation for investing in TIPS is to hedge against corrosive inflation but keeping duration low while the Fed is in a combative stance is where the benefit accrues best. Apparently, this notion is resonating with investors as evidenced by the rotation in the TIPS market. This year, the iShares TIP fund has suffered a $4.5 billion net outflow while our table of five short-term TIPS ETFs have collectively raked in $5.6 billion in new net assets.

Low-duration TIPS ETFs will likely benefit from increasing inflation and further Fed tightening–at least in comparison to funds stuffed with longer-dated paper. Our table provides investors and their advisors with products affording the highest obtainable correlation to inflation expectations going forward.

Take THAT, Iggy Pop.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.

[ad_2]

Source link