[ad_1]

The Arizona Cardinals, instead of using their first-round pick to select a player in the 2022 NFL draft, used it in a trade to acquire receiver Marquise “Hollywood” Brown.

Some feel it was too much to give up for a receiver of his talent. Others view as a worthwhile trade.

The deal was the 23rd overall pick in exchange for Brown and the 100th overall pick.

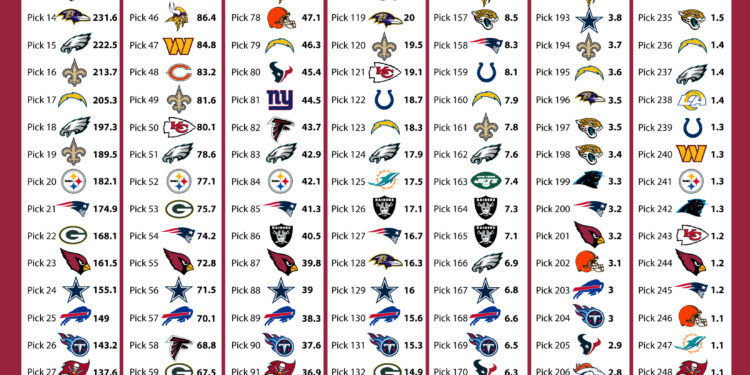

Using a trade value chart for the draft, we can see how Brown the player was valued.

The 23rd overall pick is worth 161.5 points. The 100th pick is 30.6 points. If we are matching up points for both sides, Brown was worth 130.9 points, which is what the 28th or 29th pick in the draft.

Would anyone have questioned had the Cardinals traded back from the 23rd pick to the 28th or 29th pick and then gotten the 100th pick in return?

Probably not, especially if the Cardinals didn’t have anyone they loved with the 23rd pick.

The 28th pick was defensive tackle Devonte Wyatt and the 29th was offensive lineman Cole Strange.

If given the choice of Wyatt or Strange or two years of Brown, a 90-catch, 1000-yard receiver already, is the deal worth it?

Exchanging sure production and fit to unproven production, this seems like a good deal for the Cardinals.

Listen to the latest from Cards Wire’s Jess Root on his podcast, Rise Up, See Red. Subscribe on Apple podcasts or Spotify.

Latest show:

Previous shows:

and

[ad_2]

Source link