[ad_1]

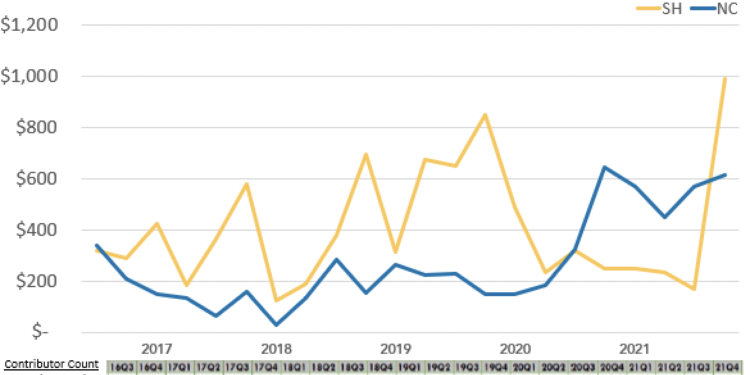

New mini-perm and bridge loans for senior housing hit a record high of almost $1 billion in the fourth quarter of 2021, suggesting some lenders are for the time being more comfortable with doling out shorter-term, lower-risk loans.

That’s according to newly published data from the National Investment Center for Seniors Housing & Care (NIC).

In total, lenders doled out more than $3.8 billion in the fourth quarter of 2021; $2.26 billion in senior living, and $1.57 in nursing care. Of the amount lent for senior living projects, $991 million came by way of mini-perm/bridge loans and $236 million by way of new construction loans.

That is a five-fold increase for mini-perm/bridge loans on a same-store basis from the third quarter of 2021, representing the largest quarterly increase since NIC began its lending trends survey in 2016.

Mini-perm/bridge loans have amortization periods of typically three and five years. Borrowers typically use them as intermediary financing following a construction loan, but before they secure a longer-term mortgage loan.

The rise in mini-perm/bridge loan volume with the decrease in new construction loan volume could reflect a fastidious selection process, according to NIC Chief Economist Beth Mace.

“Lenders are still issuing loans, but some may be wanting more evidence of occupancy and rate performance before issuing permanent loans,” she added. “No one wants to see projects fail to thrive, so it may be that some lenders are being selective with lending as the market continues to recover.”

New issuance of construction loans slowed 59%, a development that was “a little surprising,” Mace noted.

“But it may simply be timing, however,” she added.

Together, the amount lent out via mini-perm/bridge loans and new construction loans increased 3.2% in 4Q2021, a smaller rate of growth than the 6.2% increase seen the previous quarter.

The NIC report also showed that delinquent loans in senior living increased slightly in 4Q2021, after two straight quarters of decline following pandemic-era highs seen in 2020.

Delinquent loans were up 10 basis points from the prior quarter in 4Q21, and accounted for 1.1% of total loans issued in senior living – well within “the variability seen in the delinquencies data prior to the pandemic,” according to the report.

[ad_2]

Source link