[ad_1]

A loan against property is a secured loan given to someone who owns a property in his name. Whenever you have a requirement for funds, you can pledge your residential or commercial property to use it as collateral.

It helps you borrow money using your property as collateral and repay through EMIs. A major benefit of this loan is that you can hold on to your property and raise funds for any of your bigger financial requirements simultaneously.

It is easy to apply for and get this loan if your property is legal and meets all the terms and conditions of the lending institution. You can keep your property documents ready along with your identity details to apply for the loan. One can either go to the nearest bank branch or apply online for this loan. Often banks give lucrative deals to their existing customers with a good track record or salary account. However, you must compare terms and conditions, services, interest rates and additional charges applicable to different circumstances before applying for the loan.

Also, it makes sense to choose an institution that takes lesser time to process your loan, as if you need the money immediately, you cannot get stuck with a lender who delays the processing of your loan. Before applying for a loan against property, you also need to remember your property value, loan requirement, EMI amount, interest rates, tenure and additional charges.

The interest rate and tenure are the two most important factors. If the tenure is longer, your interest will increase on the borrowed loan, but if you keep the tenure short, your EMI amount will go up. So you need to strike a balance and take a call considering your repayment capacity. Often the tenure of this loan ranges between 12 and 240 months, but this may vary from institution to institution, according to Bankbazaar.

You can borrow a loan against property to address your monetary problems pertaining to business expansion, your child’s higher studies, marriage, medical emergency, etc. Since it is a secured loan, banks are less apprehensive, and processing the loan takes place quickly if your property papers are in order as per the lender’s requirement.

This loan helps you retain your property. When an emergency strikes, you don’t need to look for a property buyer, just go to the nearest bank and apply for a loan. Other benefits of this loan are higher loan amount, lower interest rate and flexible tenure. When it comes to an amount, it depends on your property value. You can borrow Rs 10 lakh to Rs 1 crore and above as per your financial needs and the current market value of your property.

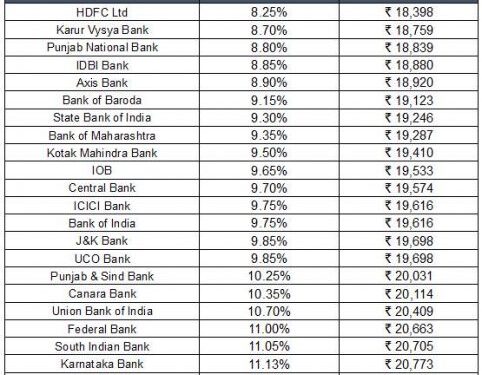

Besides, you must also inquire about the processing fee, pre-closure charges, repayment terms and other conditions before signing a loan agreement with your lender. The below table will help you compare the interest rates of more than 20 banks and the EMIs for the loan of Rs 15 lakh for 10 years.

Interest Rates & EMIs on Loan Against Property of Rs 15 Lakh for 10-Year Tenure

Compiled by BankBazaar.com

Note: Interest rate on Loan Against Residential Property (LAP) for all listed (BSE) Public & Pvt Banks considered for data compilation (excluding small finance banks); Banks for which data is not available on their website are not considered. Data collected from respective bank’s website as on 28 June 2022. Banks are listed in ascending order on the basis of interest rate i.e. bank offering lowest interest rate on LAP is placed at top and highest at the bottom. Lowest interest rate offered by the banks on LAP is shown in the table (irrespective of loan amount and tenure). EMI is calculated on the basis of Interest rate mentioned in the table for Rs 15 Lac Loan with tenure of 10 years (processing and other charges are assumed to be zero for EMI calculation); Interest mentioned in the table is indicative and it may vary depending on bank’s T&C.

[ad_2]

Source link