[ad_1]

Sales of pending homes fell 3.9% in April, as the housing market continues to adjust to a world of rising prices and higher mortgage rates, the National Association of Realtors reported on Thursday.

The report comes two days after new home sales slumped nearly 17% in April. Sales of new homes are now down about 27% from a year ago.

“Pending contracts are telling, as they better reflect the timelier impact from higher mortgage rates than do closings,” said Lawrence Yun, NAR’s chief economist. “The latest contract signings mark six consecutive months of declines and are at the slowest pace in nearly a decade.”

As mortgage rates rise, with the 30-year fixed rate loan now above 5%, Yun forecasts pending-home sales to be off by 9% this year, while home price appreciation slows to 5% by the end of the year. That would be a sharp drop from recent gains of nearly 20% annually.

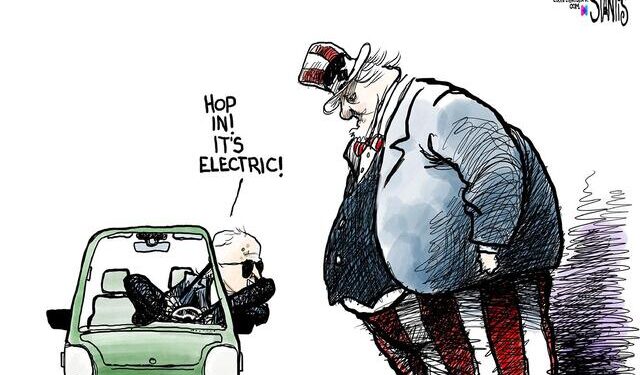

Political Cartoons on the Economy

“As we look ahead to the summer months, we continue to expect year-over-year declines in total pending home sales after the extremely hot market we witnessed in the summer of 2021,” Ruben Gonzalez, chief economist of Keller Williams, said. “We expect to see inventory finally start to accumulate slowly toward more normal levels and away from the unprecedented lows of the last couple of years.”

The Federal Reserve is working feverishly to bring inflation under control, as prices have risen at an 8.3% annual clip recently. Housing prices and stock prices have both been on the rise over the past couple of years, as the Fed kept interest rates low and Congress provided stimulus to offset the economic harm from the coronavirus. Stocks have already fallen nearly 20% from the peak this year, close to an official bear market.

As prices stabilize and inventories grow, some real estate experts predict buyers will find a more affordable environment later this year, although they will encounter higher borrowing costs.

“The real estate refresh continues, building on the past two weeks of momentum with active listings’ biggest year-over-year jump in our data history,” said Realtor.com Chief Economist Danielle Hale.

“Recent inventory improvements are expected to eventually tip market conditions in a buyer-friendly direction, and one we expect to provide relief from surging asking prices later in the year,” Hale added.

[ad_2]

Source link