[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

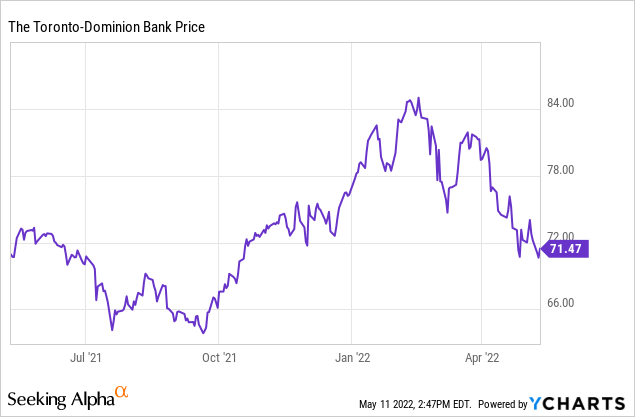

TD Bank (NYSE:TD) is a staple holding for many Canadian and American income-seeking investors. In 2020 and 2021, after rates went to near 0 and after plenty of fiscal stimulus, Canadian banks’ stocks not only saw a rebound but a solid rally. In 2021, TD’s stock provided a 36% annual return for its investors. That being said, the party appears to be ending as Canadian interest rates surge which I believe will sedate earnings growth as HELOCs, mortgage loans, and various other retail bank loans witness a decline. Finally, although I believe the next 6-18 months for TD will be problematic, I would be looking to either add or take a position if a large enough drawback eventuates.

TD: Great Retail Bank Segment, But Poor Economic Conditions

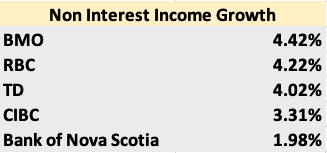

There is no doubt that TD Bank has an incredibly robust retail banking segment, the company has almost 27 million clients worldwide and approximately a 3rd of the Canadian population banks with TD Canada Trust. Additionally, the company has developed adequate positioning within the U.S. market becoming a top 10 largest American banks. However, with 2022 Canadian mortgage rates soaring to 4.5% and with the BoC’s 50 basis point rate hike, it appears that the cheap money provided by the Bank of Canada is beginning to dry up. The result of the credit tightening is expected to hinder financial services growth but is expected to impact retail banking earnings the most. This is problematic for all of the tier 1 Canadian banks but TD appears to be positioned worse than its peers. To begin with, when comparing TD to their largest competitor Royal Bank of Canada (RY), you’ll notice that retail banking makes up a minority of RBC’s revenue at only 40%, whereas with TD which represents 58% of the bank’s revenue. Moreover, when it comes to non-interest income growth, TD is in the middle of the pack of the tier 1 banks.

Excel

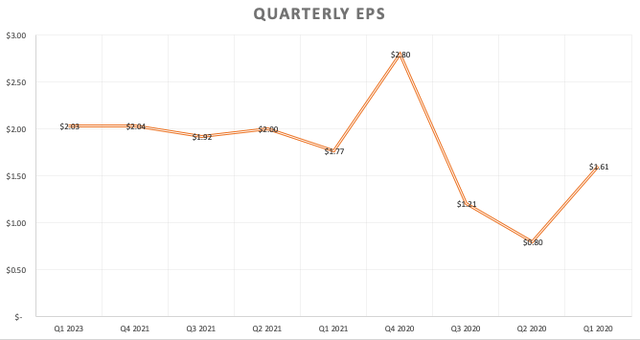

The reason TD lags behind Bank of Montreal (BMO) and RBC is because TD’s income depends more on HELOC financing, mortgages, and various other retail loans. Whereas with BMO and RBC both have strong capital market and commercial banking segments. Lastly, when looking at TD’s quarterly earnings per share since 2020, you can see a fair correlation between EPS growth and cheap money and economic recovery.

Notice how in quarters 3 and 4 of 2020 we saw impeccable EPS growth primarily due to economic recovery from reopening, fiscal stimulus, and low interest rates. This led to TD increasing its EPS by 51% and 131% in those two quarters respectively, however, EPS growth has become stagnant ever since. With the recent stagnant EPS growth, combined with the BoC ending their QE program in Q4 of 2021 and a 50 basis point rate hike in the first half of 2022, TD’s prosperous retail segment, along with the rest of its operations’ future performance concerns me in quarters 2 through 4.

Inflation, Mortgage Stress Test, and Consumer Credit are All Signaling Lending Decline

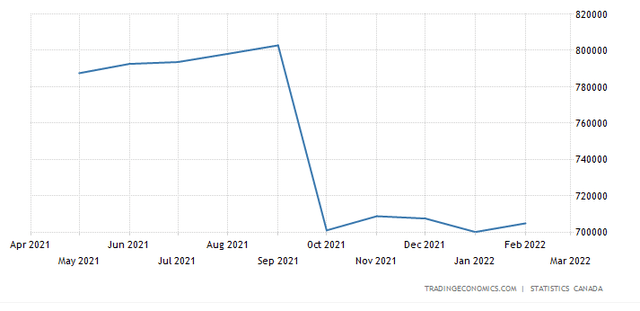

In addition to interest rate hikes, inflation, stress tests, and consumer credit data are all pointing towards lending decline. Firstly, although mortgage rates have increased, prior to that the Office of the Superintendent of Financial Institutions (OSFI) increased the stress test credit departments that banks utilize to determine a client’s qualification for a mortgage to 5.25%. This may not be the rate the client will pay on their mortgage, but it’s needed in order to qualify for a mortgage at a tier 1 Canadian bank. Now that interest rates are rising, it will become increasingly difficult for Canadians to get approved for a mortgage, in turn possibly hurting TD’s Canadian clientele. Secondly, inflation and economic stagnation appear to be reducing consumer sentiment with declining consumer credit data for Canadians.

It almost appears that inflation and stagnation became a precursor to declining consumer credit and that a consumer credit decline could lead to a lending decline in late 2022. This is problematic to TD’s retail business segment, whose Canadian retail banking segment made up 60% of their most recent quarter’s net income.

Valuation

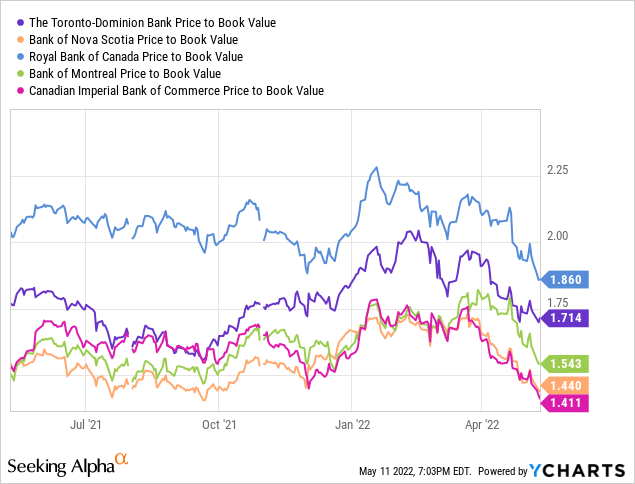

TD Bank is overvalued when looking at the company’s Price-to-book ratio relative to the other tier 1 banks.

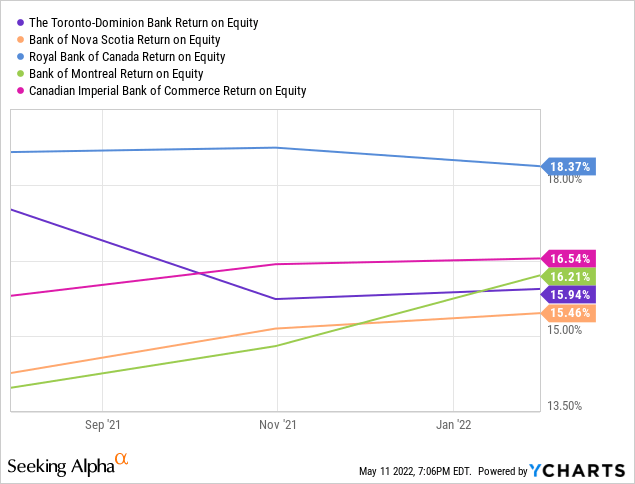

TD’s P/B ratio is on the higher side and the company doesn’t even have superior operating performance. When looking at the previous year’s return on equity comparison for the big banks, you see that TD’s higher than average price-to-book ratio is not justifiable.

Due to a higher P/B ratio than its peers and a lower ROE, my consensus is that TD’s stock is currently slightly above price.

Conclusion: Wait For A Potential Drawback and Average Down

Due to higher interest rates, inflation, consumer credit declines, and mortgage stress tests, I suggest that investors looking at TD wait until the end of 2022 or early 2023 before taking or adding to their position. The company has impeccable brand recognition, a robust retail banking segment, and operates in an extremely narrow moat industry. That being said, the economics appear to be problematic for the cyclical retail banking sector. Shareholders need to hang on tight, 2022 appears to be a bumpy ride.

[ad_2]

Source link