[ad_1]

Indian Bank, a public sector lender, has raised interest rates on domestic term deposits of less than ₹2 crore. The bank announced the change on June 1, 2022, and as a result of the revision, the bank has raised interest rates on various tenors, promising 2.80 per cent to 5.35 per cent on deposits of 7 days to 5 years and above.

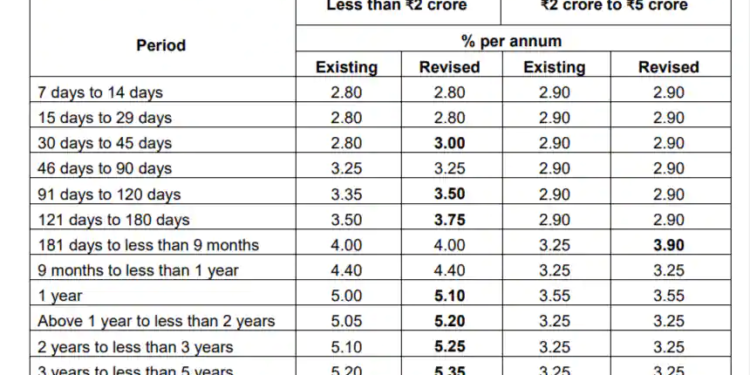

Indian Bank FD Rates

The bank will continue to give a 2.80 per cent interest rate on deposits held for 7 to 29 days, while the interest rate on deposits maintained for 30 to 45 days has been raised from 2.80 per cent to 3.00 per cent, a 20 basis point increase. The bank will continue to provide a 3.25 per cent interest rate on term deposits with a maturity period of 46 to 90 days, while the interest rate on fixed deposits with a maturity period of 91 to 120 days has been raised from 3.35 per cent to 3.50 per cent, a 15 basis point increase. On term deposits of 121 days to 180 days, Indian Bank will now provide an interest rate of 3.75 per cent, up from 3.50 per cent previously, a 25-basis-point increase.

The bank will continue to provide interest rates of 4.00 per cent and 4.40 per cent on deposits maturing in 181 days to less than 9 months and 9 months to less than 1 year. The interest rate on one-year term deposits has been raised from 5.00 per cent to 5.10 per cent, a 10 basis point increase; on deposits of more than one year but less than two years, the interest rate has been raised from 5.05 per cent to 5.20 per cent, a 15 basis point increase; and on term deposits of two years but less than three years, the interest rate has been raised from 5.10 per cent to 5.25 per cent, a 15 basis point increase.

The interest rate on deposits of 3 years to less than 5 years has been raised from 5.20 per cent to 5.35 per cent, a 15-basis-point increase; on deposits of 5 years, the interest rate has been raised from 5.25 per cent to 5.35 per cent, a 10-basis-point increase; and on deposits of more than 5 years, the interest rate has been raised from 5.15 per cent to 5.35 per cent, a 20-basis-point increase.

For the benefit of senior citizens, Indian Bank has mentioned on its website that “Additional rate of interest payable would be 0.50% p.a. for amount up to ₹ 10 crore for all tenors over the card rate in respect of Short Term Deposits, Fixed Deposits and Money Multiplier Deposit Schemes. Similarly, for Recurring Deposit accounts, additional interest rate would be eligible for the period from 6 months to 120 months (In multiples of 3 months).”

View Full Image

[ad_2]

Source link