[ad_1]

BlackJack3D/E+ via Getty Images

COVID-19, which stands for coronavirus 2019, is clearly still with us, and insurers have a clear view of progress in dealing with the virus, seen in the transcripts of insurers’ Q1 earnings calls.

During Q1 2022, “the number of U.S. COVID cases were at their highest levels of the pandemic,” The Hartford Financial Services (HIG) Chairman and CEO Chris Swift said during the company’s April 29 earnings call. But both cases and deaths have rapidly declined in March and April, he added. And while predicting pandemic impacts “is impossible,” “with cases and tests at their current levels, we are cautiously optimistic about the remaining quarters of 2022.”

And COVID is influencing pricing, “we are seeing a modest amount of claims coming in from long COVID that meet the definition of a long-term disability,” The Hartford’s (HIG) Swift said. And that’s “dictating some of the pricing expectations that are changing to get more rate in the book to cover some of that. So, yes, long COVID is real, and we’re trying to manage it the best we can from a claims side and then also from an economic side.”

Unum Group (NYSE:UNM) observed the mortality impact shifting back to the elderly population. For most of 2020 into early months of 2021, COVID-related mortality affected the elderly population more than the working age population. But in H2 2021, COVID-related mortality shifted to an increased level of impact among working age population. In Q1 2022, that’s now shifted back to the elderly population.

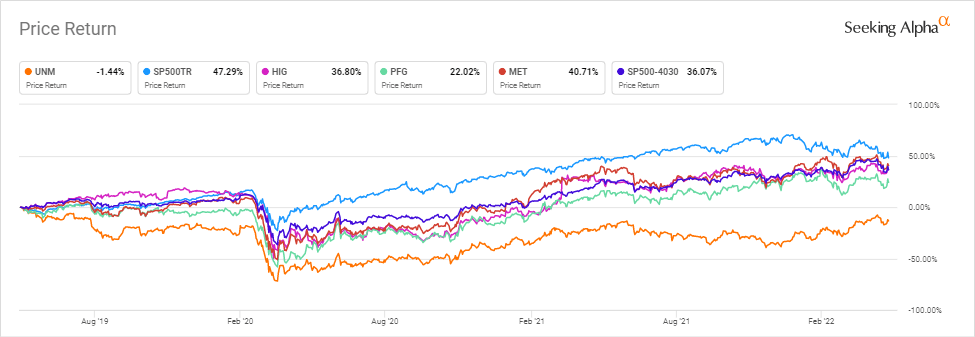

While many insurers’ stocks have been improving recently, they’re still catching up to the S&P 500 Index, when looking at a three-year timeline. Note the dark blue line in the graph below represents the S&P 500 Insurance Index.

That has affected Unum (UNM) in two ways, President and CEO Rick McKenney said on the company’s earnings call. “Higher mortality among the elderly population resulted in higher mortality in the claimant block for our long-term care business, which drove a lower interest adjusted loss ratio in the first quarter of 2022,” he said.

In Q4 2021, COVID-related mortality in the U.S. population was estimated at 127K, with ~35% of those deaths among the working age population. In Q1 2022, the mortality count rose to ~153K. The impact on the working age population fell to ~24%, McKenney said.

In its Group Life block, Unum (UNM) estimated that COVID-related mortality claims declined to an estimated 1,400 claims in Q1 from 1,725 claims in Q4 2021.

The company also saw a rapid decline in COVID infection rates and hospitalization rates through Q1, which had a “favorable impact on our short-term disability results.” That helped drive improvement in Unum US group disability benefit ratio during the quarter.

At Principal Financial Group (PFG), “COVID continues to impact results in RIS (Retirement and Investment Solutions)-Spread and U.S. Insurance Solutions,” said CFO Deanna Strable. ” With approximately 153,000 U.S. COVID-related deaths in the quarter, the net $30M after-tax impact was at the higher end of our rule of thumb.”

In MetLife’s (MET) U.S. Group Benefits results, the company saw strong growth in its current customer base, reflecting higher enrollment, higher employment level, and higher salaries. “Although COVID-19 life claims remain elevated, the Group Life mortality ratio fell sequentially 250 basis points to 103.8%,” said MET CEO and President Michel Khalaf. He also noted the declining percentage of deaths under age 65 to 23% in Q1 2022 from 33% in Q4 2021.

While predicting the course of the virus has been complicated by the emergence of variants, Unum (UNM), for its plans, assumes that the ” national mortality related to COVID will decline significantly in the second quarter and remain at lower levels for the balance of 2022.”

For a broad search of COVID-19 and insurance in conference call transcripts, click here.

Use SA’s stock screener to rate the stocks of life insurers

Last week, MetLife (MET) Q1 earnings topped Wall Street estimates on lower COVID-19 life insurance claims.

[ad_2]

Source link