[ad_1]

Panuwat Dangsungnoen/iStock via Getty Images

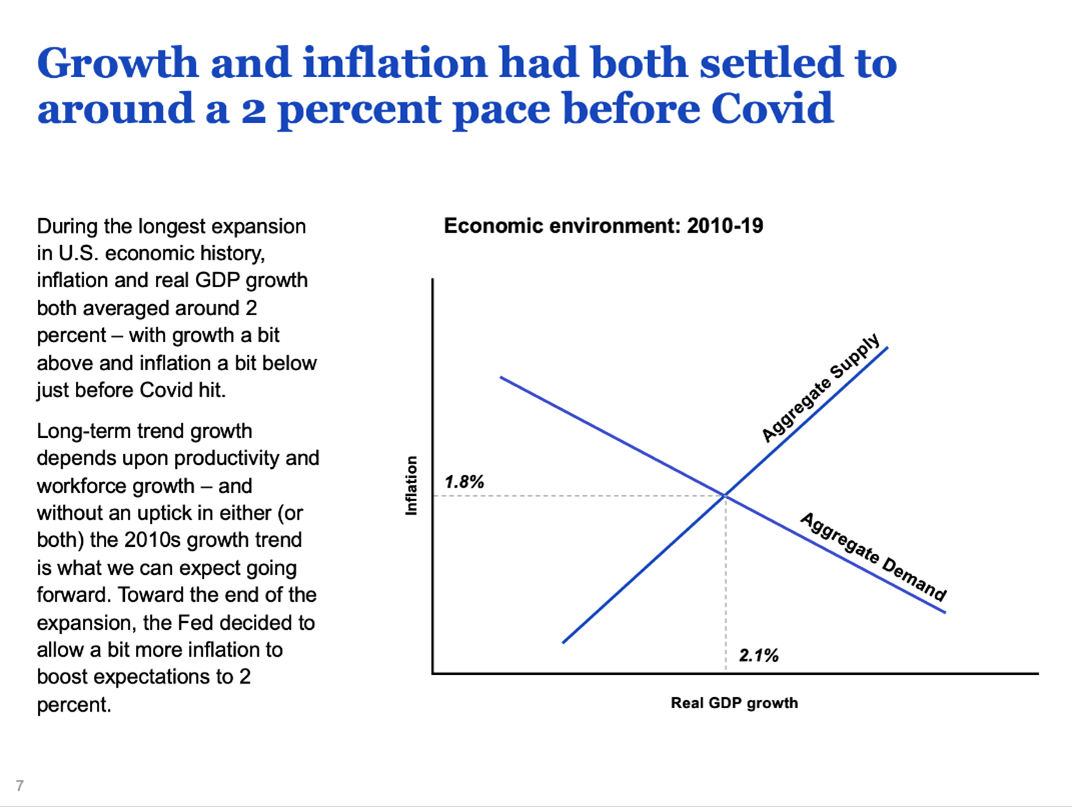

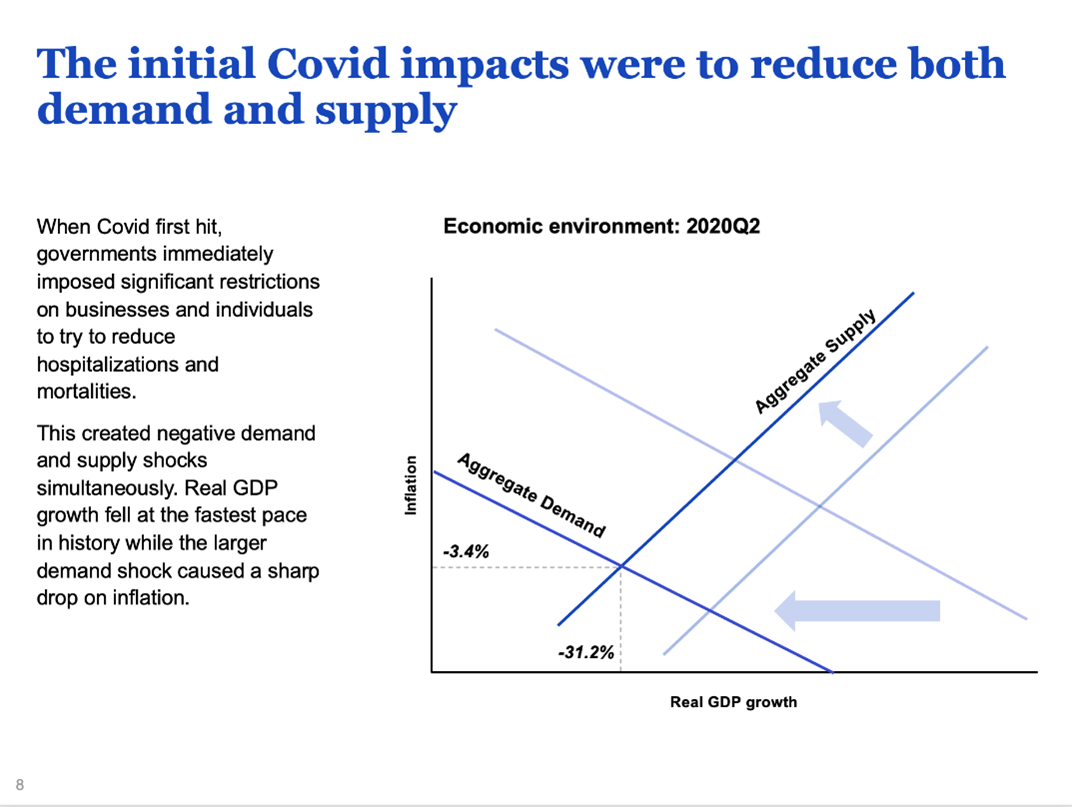

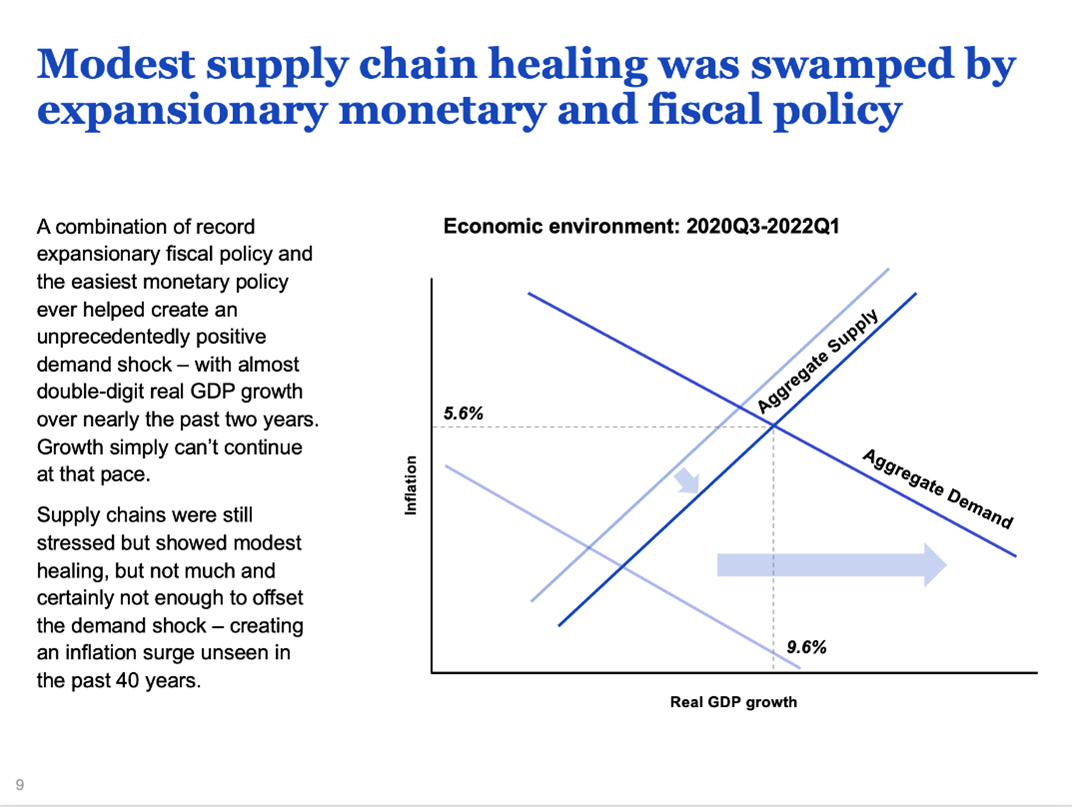

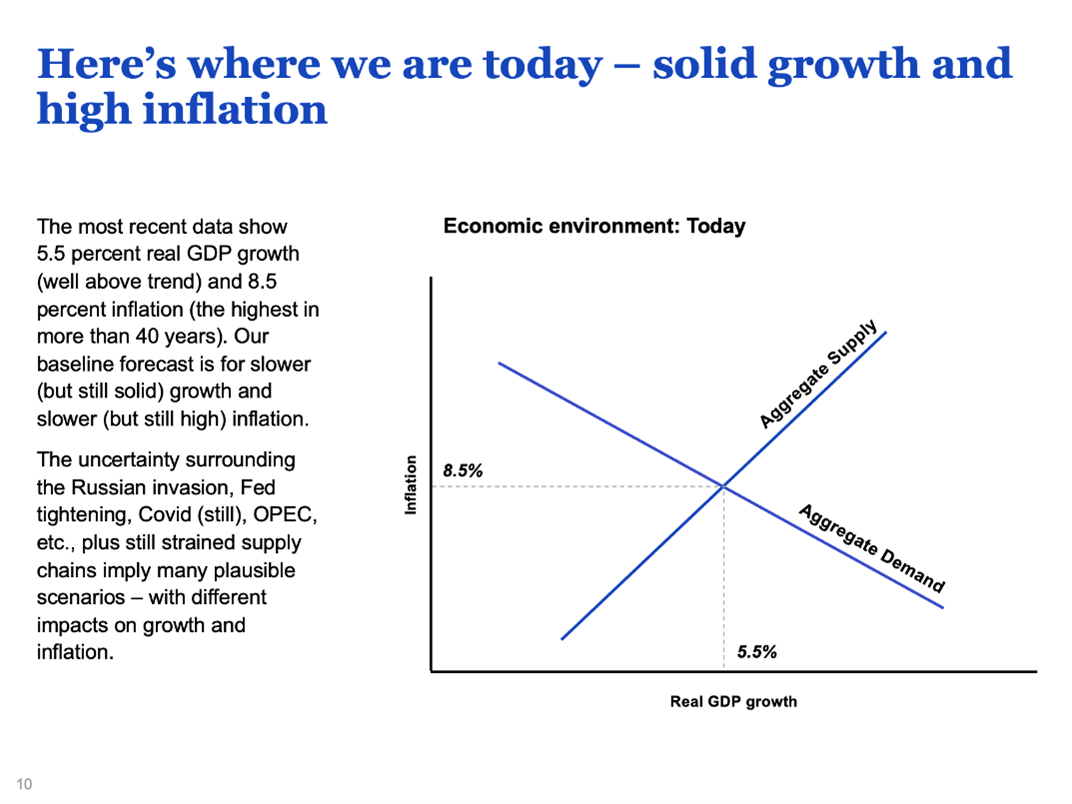

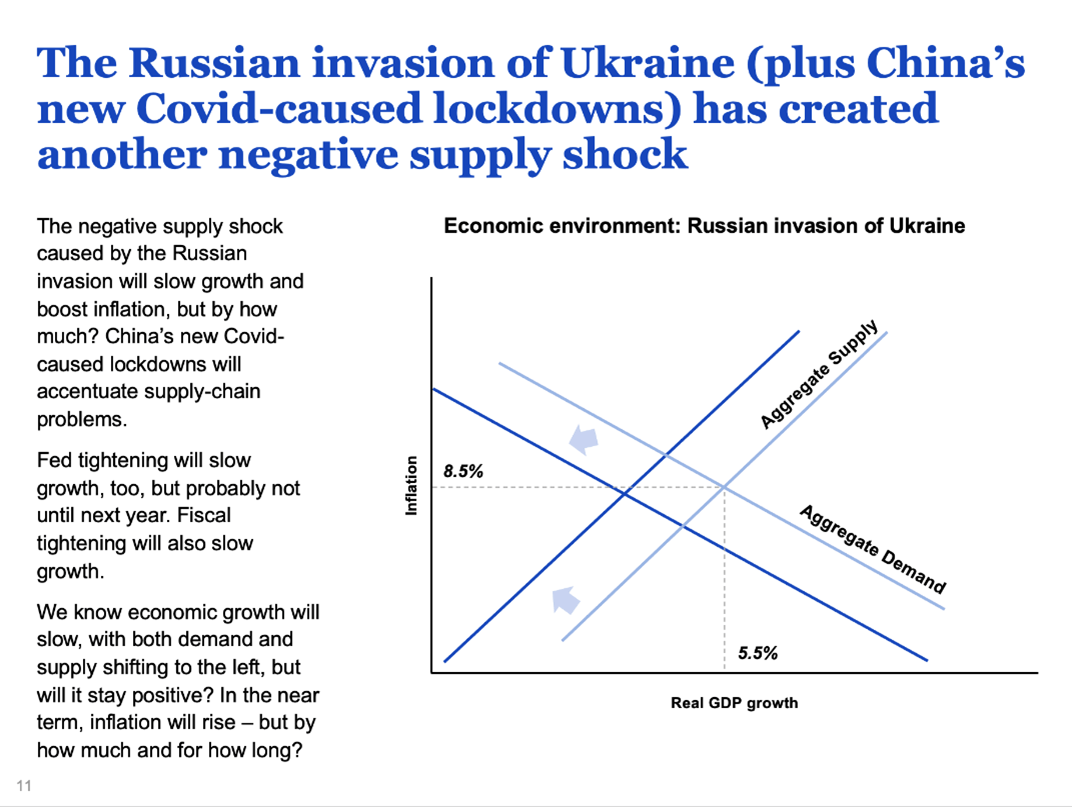

We are going to open this commentary with five of the slides used at the April 27 USF-GIC virtual (and in person) conference on the Russia-Ukraine war and its impacts. The five-part series, “Ukraine: What’s Next?” is a collaboration between the University of South Florida and the Global Interdependence Center. Nationwide Chief Economist David Berson presented on current economic themes and various impacts on inflation in recent years, culminating with the Ukraine crisis. These slides were part of Berson’s presentation package. The slide set is a terrific depiction of the nature of the intersection of the aggregate supply shock and the aggregate demand shock that we have experienced and how it has changed economic metrics.

Here are the five slides in order and the commentary attached to each.

These slides are part of the full conference public presentations. We thank David Berson for permission to share them with our readers.

Let’s get to the takeaways.

We have written previously about how hard it is for the Federal Reserve to determine policymaking interest rates when there is a simultaneous aggregate demand shock and aggregate supply shock (“Two Links & a Rant: Tax-Free Munis, Quantitative Tightening, & Trolls in the Media,”). We can see that in these slides. We have also written how the present circumstances are a “double whammy,” since the pairing of these two aggregate shocks has occurred twice in two years and the recovery from the first pairing of shocks was not complete before the second shock pairing hit.

David Berson sent me this note:

“Did you know that in the 293 quarters since 1948 Q1, there are only five instances in which the U-3 [unemployment] rate was below 4.0 percent and real GDP was negative? Yes, 2022 Q1 was one of them.”

The others?

1953 Q31953 Q41969 Q42020 Q1

Readers may note that 2020 Q1 was the initial pandemic shock quarter. Also note that the 1969 Q4 shock coincided with the Hong Kong flu pandemic of 1968–69. It was also coincident with the Vietnam war. Readers may recall that the Hong Kong flu killed an estimated 4 million people worldwide.

Also note that 1953 Q3 and Q4 coincided with the Korean War; there was no pandemic raging at the time. The deadly Asian Flu pandemic exploded later, in 1957–58.

So what is the takeaway here? Finding a neutral real interest rate in periods of coincident epidemic shock and war shock is nearly impossible. The shocks are large, and aggregates are difficult to estimate.

There is one other important distinction to consider when thinking about the neutral real interest rate. The question was raised in a private conversation I had with a central banker, so I will preserve anonymity but raise the question.

Is there a difference between a desired neutral real interest rate for financial market agents and a desired neutral real interest rate for the real economy and its agents? This question is a sophisticated way to seek out the differences between Main Street and Wall Street.

Those of us in the financial market arena tend to focus on the neutral real interest rate in financial market terms. Policymakers focus on the real economy. We tend to assume that both Main Street and Wall Street see the neutral rate as the same or a similar number.

But are we correct? I’m not so sure. In a duel double whammy scenario, it is nearly impossible for Main Street and Wall Street to be aligned, especially when it comes to the neutral real interest rate.

Let me conclude.

We have discussed how hard it is for central banks to make policy decisions when there is a double whammy of shocks. We have argued that the cacophonous critics who troll the central banks add nothing helpful to these conversations. We argue that the research on these questions is complex and requires skills. There is a concentration of such skills in the intellectual power residing in the Federal Reserve and in other central banks.

We have also argued that it is okay to say, “I don’t know.” There is nothing wrong with that. It is the “I know it all” attitude which is the most worrisome.

We thank David Berson for the slide set that makes issue of the intersection of aggregate demand shocks and aggregate supply shocks more readily understandable for our readers.

Here’s our own best estimate. And please remember that it is an ESTIMATE. The flat US Treasury term structure at about 3% from 2 years to 30 years is saying that the neutral nominal rate in the medium term is closer to the 3% level than to the 6% level others have defined as the higher extreme. The next issue is, how much of the nominal rate is inflation (and inflation expectations) and how much is real? History gives us a guide that the longer-term neutral real rate is close to zero for the riskless sovereign debt of the United States. That would imply that the inflation component is around 3%.

So we conclude that the market-based pricing mechanism is favoring the lower 3% natural rate as the nominal outcome once these double-whammy shocks run their course and settle down to some meaningful equilibrium.

We shall find out. If we’re anywhere close, the 4%, high grade, tax free municipal bond is presently very, very cheap. We’re positioning selected bonds for our separately managed account clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link