[ad_1]

With inflation topping 8% by some estimates, real interest rates have hit a low not seen in the U.S. since the aftermath of World War II. In fact, they have turned negative.

Real interest rates measure the interest one is receiving net of the inflation rate (that is, the interest rate minus inflation). Current estimates have real interest rates somewhere between negative 6% and negative 7%.

Often investors get spooked when negative real interest rates appear, since it means they are losing money (in a real sense) by holding on to safe assets like Treasury bills or T-Bonds. And many speculate that it is this loss of wealth that forces investors into riskier positions.

SHARE YOUR THOUGHTS

How are you changing your investing approach for today’s economy? Join the conversation below.

We decided to examine this phenomenon and see how different asset classes perform when real interest rates turn negative and stay negative for a while.

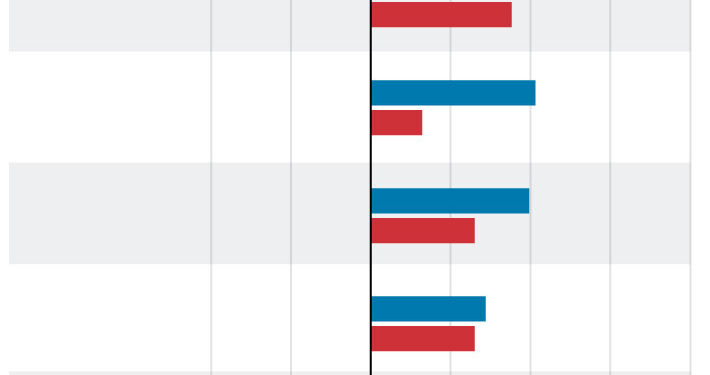

The upshot: Historical data shows that when real interest rates go negative, the riskiest asset classes (emerging-markets stocks, small-caps, etc.) have done extremely well in the first half of such a cycle—outperforming safer assets by over 1.5 percentage points a month. Yet this reverses in the second half of the cycle: On average, the riskiest assets have underperformed by over a percentage point in the second half of a negative-rate cycle.

The research

To investigate this issue, research assistants Jaehee Lee and Natalia Palacios helped me gather interest-rate data (based on T-bills), inflation data and mutual-fund-return data for various asset classes over the past 50 years. We then examined periods during the past half-century when real interest rates went negative and stayed negative for more than a month. We found seven such periods, the average length of which was 2.5 years. Next we divided each such cycle into a first and a second half to examine how the performance of the different asset classes compared during the two halves.

Different Story

Performance during the first half and second half of a negative real interest-rate cycle

Average monthly return*

Two findings are worth noting. First, during the first half of a negative-rate cycle, the riskiest mutual funds performed best. Emerging-markets funds, U.S. small-cap funds and international-stock funds averaged 1.96%, 1.13% and 1.03% returns a month, respectively. This is far superior to all other equities, and far better than the average bond fund, which had average returns of 0.35% a month during this period.

The flip side

Yet everything flipped as the cycles matured. In the second halves, the riskiest funds underperformed. For instance, emerging-markets funds lost an average of 1.13% a month. So while investors were seeking risk in the first half, it appears they quickly ran away from it the longer the U.S. remained in a negative real interest-rate environment.

As for the present situation, the current negative-rate cycle began in the second quarter of 2020. That means, if our pattern holds true, lots of investors likely have shifted over to riskier assets already. But, since we are still in the cycle, approaching the beginning of the third year, it’s impossible to know yet where the first half ends and the second begins. Thus, even if we haven’t fully hit the point where investors move out of riskier positions, judging by historical data, it can’t be far off.

Dr. Horstmeyer is a professor of finance at George Mason University’s Business School in Fairfax, Va. He can be reached at reports@wsj.com.

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2]

Source link