[ad_1]

At 9:42 IST, shares of YES Bank were trading 1.1 percent higher at Rs 13.38 on BSE. The stock has nosedived 91 percent in the past three years.

YES Bank share price performance so far

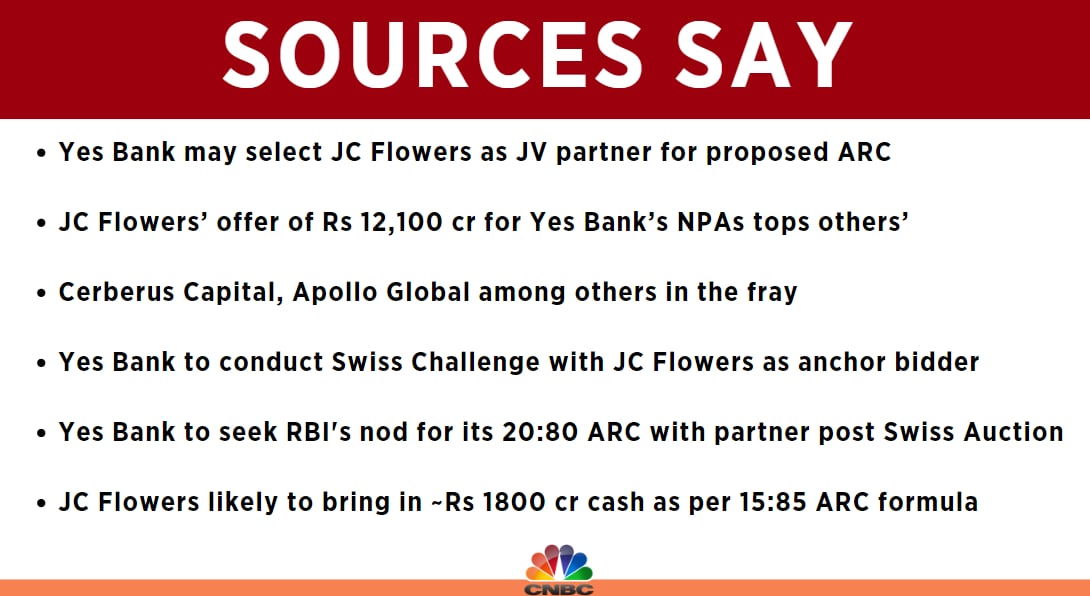

YES Bank share price performance so farYES Bank has shortlisted US-based private equity firm, JC Flowers, as its joint venture partner for its proposed asset reconstruction company (ARC), said two people directly aware of the matter on the condition of anonymity.

The bank is understood to be in the final stages of formalising its agreement with JC Flowers.

Also Read |

This is the second attempt by YES bank to set up its own ARC after the Reserve Bank of India turned down its earlier proposal in March last year. The bank had thus proposed a new structure, where it would hold 20 percent stake in the proposed ARC, and its foreign joint venture partner would own 80 percent stake.

Here’s what sources told CNBC-TV18

Here’s what sources told CNBC-TV18This deal will result in the largest ever transfer of bad loans from a bank to an ARC in one go, and also help YES Bank become a net-zero non-performing assets (NPA) bank.

Provision for bad loans, the money set aside from the profit to cover losses from unpaid loans in the future, has dropped 95 percent between January and March 2022.

Earlier in May, Prashant Kumar, Managing Director and Chief Executive Officer at YES Bank, told CNBC-TV18 in an interaction that the bank had recovered Rs 13,000 crore worth of defaulted loans in the last two years and may recover another Rs 5,000 crore in the next 12 months.

[ad_2]

Source link