[ad_1]

Author’s Note: This is the shorter version of a premium article posted on iREIT on Alpha back on the 24th of May 2022.

AleksandarGeorgiev/E+ via Getty Images

Dear Subscribers,

The Swiss stock market is one of the safest and most conservative on earth – and the Zurich Insurance Group AG (OTCQX:ZURVY), is one of the top five global insurers, excluding the Chinese markets.

This mammoth of a company delivers insurance to 210 countries, and in this article, we’ll take a deeper look at it and see what we got.

Let’s get going.

Zurich Insurance Group – Reviewing the company

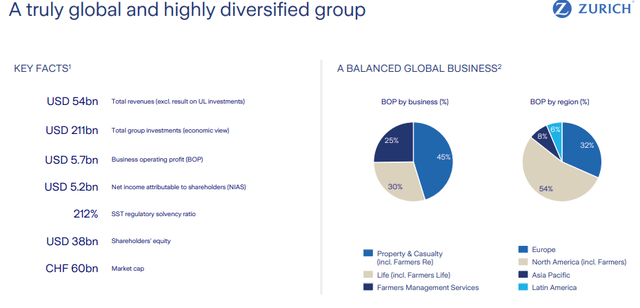

This company has insurance premiums of over $50B per year. The company considers itself to be at a second-place market share worldwide in the non-life insurance business, right behind global market leader Allianz (OTCPK:ALIZY). However, in terms of gross written premiums, the company is in a fourth position.

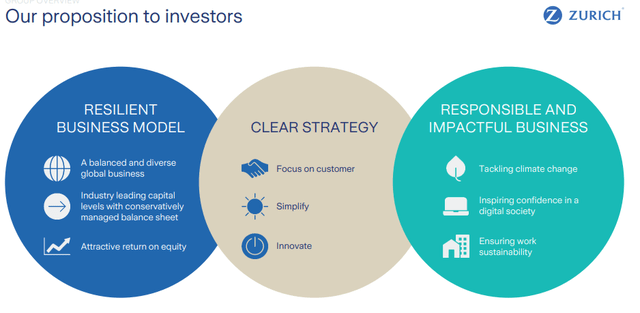

Zurich Insurance Strategy (Zurich Insurance IR)

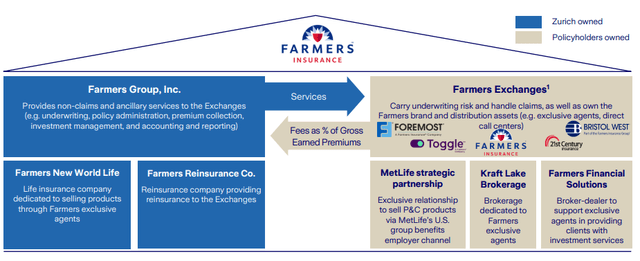

The ranking difference depends on the somewhat strange construction of Zurich’s US business. Farmers is Zurich Group’s main market brand for personal insurance in the US, providing homeowner, auto, and life insurance, with more than 20 million policies. Yet, it is only Farmers Management Services that belong to Zurich, the latter performing the management services for Farmers Group and receiving management fees. The insurance business belongs to Farmers Exchanges, which is managed by Zurich although not owned. Farmers Exchanges are three reciprocal insurers owned by their policyholders.

The name Zurich insurance group came about in 2012 at the AGM. The subsidiary and farmer’s exchange acquired MetLife (MET) P&C insurance business back in 2020. With MET being the largest life insurer in the US, the result of this transaction has been a nationwide presence to Farmers Exchange as well as access to new distribution channels that can accelerate company growth. This includes a 10-year exclusive distribution agreement through which Farmers Exchanges will offer their personal lines products on MetLife’s industry-leading US Group Benefits platform, which today reaches 3,800 companies and 37 million employees.

I cover a lot of insurance businesses, and I know the business area well. It’s become common practice for insurance companies like ZURVY to improve the health of its balance sheet by selling life back-books to free up capital in the life insurance business and to increase profit. ZIG announced therefore in January 2022 that it is selling a life insurance portfolio essentially in a run-off to Portuguese GamaLife (backed by Apax Partners). This move will free up around $1.2B in tied-up equity and raise the solvency by almost 11ppt – and the current indications are for the company to sell even more of its life back-books in Germany in order to free up capital in the life insurance business.

As a note to those somewhat uninitiated in insurance, back-books are collections of policies that are no longer sold but are still on the sheet as premium-paying policies.

Zurich Insurance Group (Zurich Insurance IR)

Unlike its Swiss name suggests, ZURVY is actually a company with a primary NA exposure. Only 32% of the company’s cash comes from Europe. The company is the #4 in US commercial, #3 in US Crop, #3 and #4 in LATAM P&C and Life, #4th insurance company in EMEA, and has excellent positions in APAC as well.

From 2016-to 2019, it radically changed its organization, simplified IT, product, and services, and over-delivered on a $1.5B savings program that reduced corporate expenses. For 2020 and forward, including 2022, the company seeks an RoE of above 14% and EPS growth of over 5%.

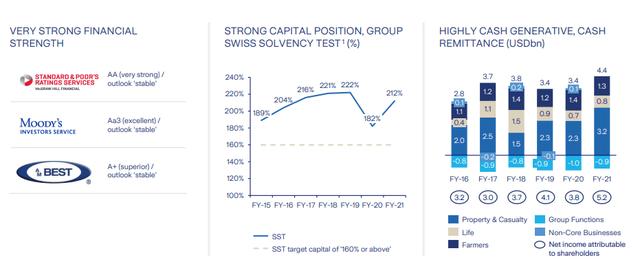

This is one of the best-rated companies in the entire world, with Swiss-type solvency.

Zurich Insurance (Zurich Insurance IR)

The company’s operations are found in P&C (Property & Casualty), Life, Farmers, as well as Investment / Capital Management.

All of these segments are working well, and the company works with consistent, high reserving approaches, low volatility, and good balanced footprints and business mixes. The company is one of the world’s leading commercial insurers, a global #2 in Commercial Insurance Rankings by Net earned premiums behind Chubb (CB). The company also boasts incredible underwriting profitability, coming in at 93.8% retail.

Famers is one of the most interesting plays that the company has here. It’s the #6 in the largest personal line market in the entire world, and with an aforementioned massive national footprint and presence, with a very unique business structure.

Farmers Insurance (Zurich Insurance IR)

Yeah, Buffet with GEICO, Progressive (PGR), State Farm (STFGX), Allstate (ALL), and USAA (USAAX) are bigger than Farmers. But Farmers is the second largest in entire West USA, with solid market positions across other areas as well. It has a nice footprint in distribution, with a solid diversified product mix, and most of the management services business is fee-based.

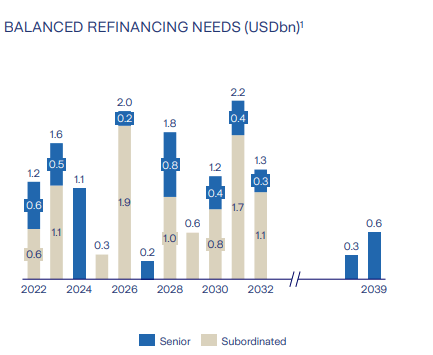

The company has an average low debt cost, as well as a well-managed maturity profile, maturities primarily in 2026, 2028, and 2031.

Zurich Debt Financing (Zurich Insurance IR)

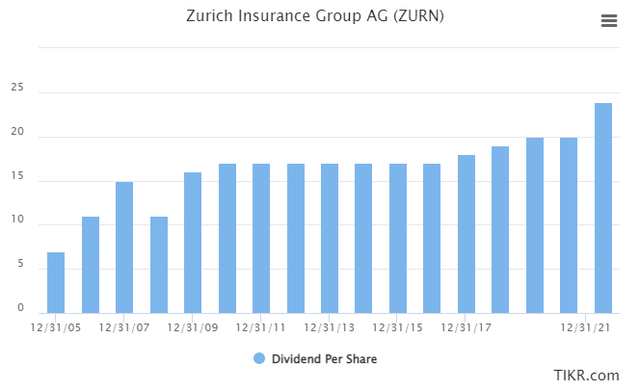

The company ignored the pandemic in terms of its dividend. It continued to raise the dividend at an average of 5%, and targets a Net income payout of 75%, with a current minimum dividend target of 22 CHF based on FY2021. This gives the company a current yield of 5% to a price of 423 Swiss Francs for the share we currently have for the native share.

The 2021 results were quite excellent. Those results were above consensus expectations, with net income (attributable to shareholders) up 36% YoY, over $900M above forecast expectations.

The company saw revenue increases of almost 18.5%, and RoE is now 16.4% on a net basis, compared to 13% for 2020, easily reaching that 14% RoE target minimum. The special construction of the US business is delivering a stable, pre-tax profit mix from the management service program, as well as MET’s previous P&C insurance businesses.

Because the market could certainly go there. At 14% RoE or above, it’s one of the most profitable insurance operations on this planet, and the valuation reflects this, given that it’s above most.

This is a quality insurance business – it’s smaller than Allianz, and it doesn’t have Reinsurance, Like Munich (OTCPK:MURGY), but it’s a superb business nonetheless. I have a small watchlist position for the time being, but I’m open to expanding this holding by quite a bit going forward.

Let’s look at company risks for a moment or two.

Zurich Insurance – Risks

Very few risks exist to a swiss company like this. Not all of its operations are profitable. This might not be a surprise – every company has nonprofitable segments, and Zurich is targeting to exit or turnaround these markets. This is more of a statement of general business fact than risk, but it is a risk, nonetheless.

There are concerns with the ownership structure of Farmers Exchanges. This is managed, but not owned by Zurich. Instead, Farmers Exchanges are three reciprocal insurers owned by their policyholders – and this is a risk to the company, as it’s uncommon.

Also, you might realize that I mention that the company sells its life back-books in order to free up capital. The reason they’re doing this is obviously that these books aren’t as profitable as the company would like them to be – which is the reason they’re selling. Because when they sell, they can increase profitability to these.

Aside from these few things?

Not much risk to Zurich. As I said – It’s a swiss, global insurance business. It’s been around for a very long time. It’s “all quality”, and the worst thing that can be said for it is that not all operations are as profitable as the company would like them to be.

When that’s the worst that can be said, we’re pretty well off.

Zurich Insurance’s valuation

The valuation for this company is interesting – because there’s an upside virtually to every single perspective that we can look at. The company claims it’s more balanced than its immediate peers, with two strong pillars of non-life business in NA and Europe. The question is how advantageous this is in a globalized economy. Because of this doubt, I won’t give the company any sort of premiumization for that part of its structure in the P&C/Life compared to peers.

The Farmer’s business is different. Zurich owns only Farmers Management Services which gets relatively stable management fees from Farmers Exchanges. It does not, therefore, have the earnings volatility of the insurance business, as long as Farmers Exchanges does not go bust, and has less equity capital risks. While there are risks to this structure as mentioned, it’s more of a positive than a negative given typical earnings volatility in this sector among less capitalized peers.

In NAV, as mentioned, I don’t apply any sort of premium to either General, Global Life, or Farmers. I Give them P/Es of 9.5X to 10.5X, higher for Farmers due to earnings stability, and lower for General P&C insurance, where I don’t see much of a reason to assign or give them any consideration.

This still brings us to a net asset value of around 82B CHF, which on a per-share basis at 572M net of treasury shares comes to 550 CHF per share.

This is something I view as “too much” – so we’ll be considerate in how exactly we weigh these forecasts. Looking at the various targets, no matter how we slice it, we end up at valuations well above 490 CHF per share. We could argue for as high as 525, even when considering the company’s somewhat inflated P/B, but I would go toward the 500 CHF mark. That becomes my price target for this company, which is about at or slightly below the level of equity analysts, and slightly above the targets given by S&P Global. 18 S&P global analysts give the company targets of 370 CHF on the low side, and 560 CHF on the high side. Currently, 12 analysts out of those 18 have the company as a “BUY” or “Outperform”.

I view this company as having an upside of at least 15% at its current valuation.

Thesis

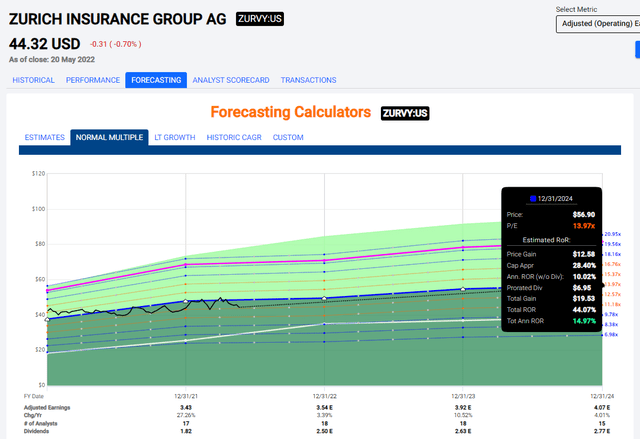

Zurich Insurance is a quality company at a decent valuation and a 5% yield. The company’s ADR is called ZURVY, and it’s a liquid sort of ADR with a decent, 6% average EPS growth estimate from FactSet. The company’s overall upside and valuation are somewhat different for ADR, being around 3X higher than for the native in terms of P/E.

The company has an upside of around 15% annualized to a 5-year average of 14X P/E. This is solid, and an upside I can go for and consider to be valid.

Zurich Insurance Upside (F.A.S.T graphs)

Even if the company trades as low as 10-11X P/E, you still won’t go into the negative, but deliver annual returns of 1-8%, which still is solid, given the 5% yield and the AA-rating in terms of credit. The company also has a solid sort of dividend history, not cut meaningfully for a very long time.

Zurich Insurance Dividend History (Tikr.com)

2022 expectations are quite excellent and based on that, I view this company as a significant “BUY” at these valuations.

[ad_2]

Source link