[ad_1]

Image source: Getty Images

Offering the benefits employees value at a price you can afford is a key strategic challenge for businesses of all sizes. Learn how to provide a benefits package that helps you attract top talent.

Employee benefits administration is a key driver of business success. A competitive benefits package helps you recruit great employees and keep them happy on the job.

And with roughly 30% of revenue going to employee benefits, it pays to make sure you’re getting a good return on your investment. Effective benefits administration ensures that you’re putting your benefit dollars to good use.

Overview: What is benefits administration?

Benefits administration is the creation and management of a company’s employee benefits package to promote company goals. As straightforward as that sounds, it is incredibly challenging in practice.

A benefits administrator might be talking retirement funds one minute, helping an employee through a family crisis the next, and interpreting antidiscrimination law after that.

Benefit administration involves managing monetary and non-monetary benefits. An exhaustive list would be impractical. As an example, Google employees get free haircuts and spa treatments, but following are the most common types of benefits:

- Health insurance including medical, dental, and vision

- Life and disability insurance

- Retirement benefits such as pensions and 401(k) contributions

- Paid leave including holiday, personal, sick, caretaker, maternity/paternity, disability, and bereavement

- Child care and adoption assistance

- Education benefits such as company-provided training, tuition assistance, and professional development support

- Commuter expenses, parking passes, housing assistance, and relocation assistance

- Work-life balance benefits such as flex time, remote work days, casual attire, pets-at-work policies, and on-site child care

- Food, from free coffee and snacks to occasional meals to on-site cafeterias

- Entertainment benefits such as parties, trips, picnics, retreats, and game nights

- Office amenities such as standing desks, rec rooms, on-site gyms, breastfeeding rooms, and quiet spaces

- Performance recognition programs such as employee-of-the-month programs, cash awards, and honorary gifts

Fortunately, there are strategies and resources to help businesses of any size administer benefits successfully and keep employees happy. Read on to discover what benefits administration entails and how to get a better return on your employee benefits investment.

5 steps to a successful benefits strategy

The following steps will help you create a benefits package that serves your company’s goals and your employees’ needs.

Step 1: Craft a competitive package

Employee benefits are no longer standard fare tacked onto a compensation package. They’re a huge part of your company’s offer, reflecting your culture, your values, and what it’s like to come to work for you every day.

Creating a benefits package that attracts the kinds of employees you’re looking to hire can give you a major edge over competitors with lackluster offerings.

But benefits are expensive, eating up nearly a third of revenue on average. Health care costs, in particular, are a sticking point for small businesses. Employers paid more than $13,000 per employee on average for health care coverage in 2019, according to Mercer.

Yet health insurance consistently tops the list of most desired employee benefits.

So how do you get the luxury amenities you want at the price you can afford? By approaching your benefits package like any other strategic initiative: with research, planning, and results measurement.

Tips for crafting a competitive benefits package

Following are tips for crafting a competitive package:

- Benchmark your offerings: Roughly 56% of small businesses provide health care insurance, so offering that highly coveted benefit can be a key differentiator. Find out what other companies of your type and size are offering as part of your planning process. Resources such as the Society for Human Resource Management’s (SHRM) 2019 Employee Benefits Survey, Kaiser Foundation’s Employer Health Benefits Survey, and Mercer’s annual health benefits survey provide helpful benchmarking data.

- Research local competition: While work is becoming increasingly dispersed, most businesses rely heavily on local talent. Local recruiting firms or your human resource (HR) staff’s professional network can help you size up the competition.

- Consider demographics: Employers are personalizing benefit packages to suit the varying needs of a multigenerational workforce. Tuition reimbursement, for example, is having a moment as graduates enter the workforce with massive loan debt. Whether you decide to offer flexible benefit packages or not, it pays to tailor your benefits to the makeup of your existing workforce and the workforce you want to attract.

Step 2: Manage benefit costs

Budgeting for benefits is a major pain point for small businesses. In a survey by the Commonwealth Foundation, for example, small business owners who offer health care coverage said the cost of providing it was the number one challenge facing their businesses.

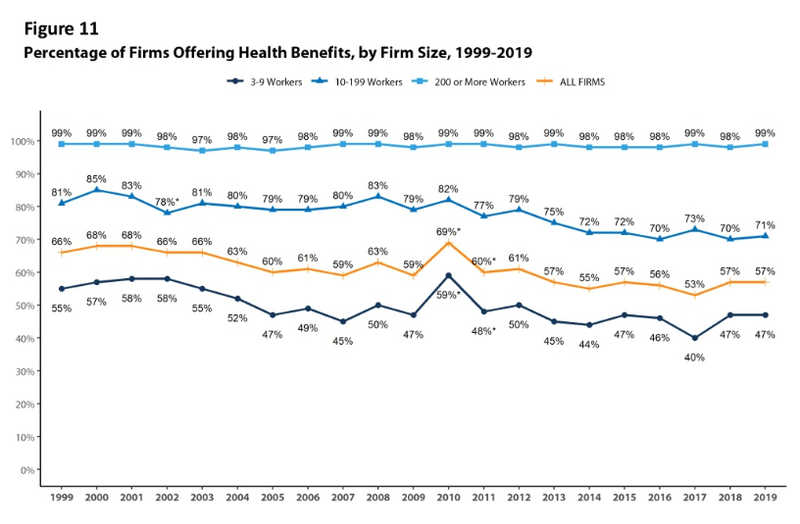

Roughly 57% of businesses with fewer than 200 employees provide health insurance benefits, according to the Kaiser Foundation. Image source: Author

But there are steps you can take to get more items from your employees’ wish list into your benefit budget.

Tips for managing benefit costs

Consider these tips for managing benefit costs:

- Forecast and budget: Using the wealth of data available, plan ahead for the likely costs of your benefits plans. Revisit your benefit budget at least quarterly as part of your company’s HR planning to see how well your forecasts are holding up.

- Consult your tax advisor: With so many tax implications of your benefit choices, it’s critical to include a tax expert in your planning. Many small businesses miss out on tax breaks because they simply weren’t aware of them.

- Pursue cost savings: There are many strategies for reducing benefit costs, but you have to go looking for them. In health care, for example, many employers are turning to telemedicine, high-deductible plans, and health savings accounts to stretch their budgets. Tap experts such as your health care broker or tax advisor for cost-saving ideas, and don’t hesitate to negotiate.

- Consider non-monetary benefits: Benefits such as flexible schedules and telecommuting are highly popular with employees. Consider low- and no-cost benefits that can add appeal to your benefit offerings without a major hit to your bottom line.

Step 3: Administer benefits efficiently

The heart of benefits administration is, of course, administration. Tasks such as onboarding and offboarding employees, providing benefits training, tracking usage such as paid leave, and managing open enrollment make up the bulk of a benefit administrator’s job.

An efficient benefits management process can save precious staff hours for employee management and other core HR functions.

Tips for efficient benefits administration

The following practices will help you administer benefits efficiently:

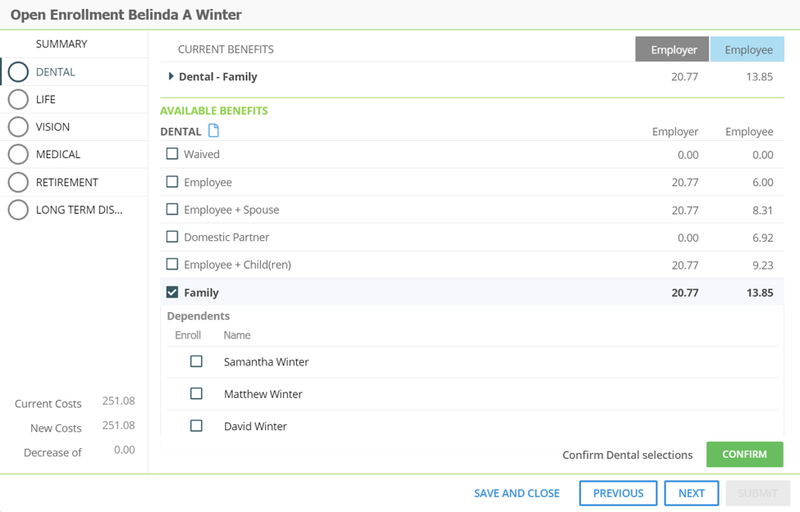

- Use appropriate software: HR software makes the work of administering benefits manageable. Benefit administration systems that automate labor-intensive tasks such as leave-tracking can save your HR staff many hours of painstaking paperwork and deliver more reliable results.

- Simplify where you can: Look for innovative ways to simplify your benefit offerings and policies. For example, many employers are combining personal, sick, and caretaker leave into a paid leave bank. It’s a win-win: simpler for you and popular with employees.

Step 4: Ensure compliance

A single lawsuit or citation can undo years of careful budgeting and planning. Ensuring compliance with federal and state laws is a core function of benefits administration. Federal laws that may apply to your benefits programs include the following:

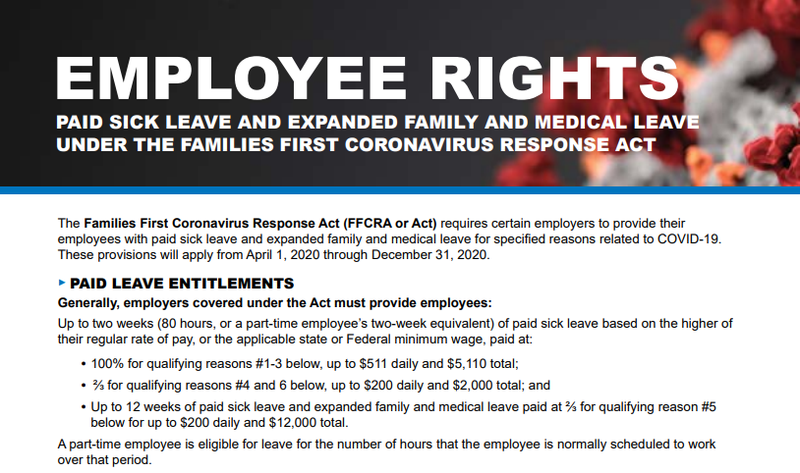

- From now through December 2020, employers with under 500 employees must comply with the Families First Coronavirus Response Act (FFCRA). Limited exemptions are provided for businesses with fewer than 50 employees.

- All employers must comply with the Health Insurance Portability and Accountability Act (HIPAA) and the Uniformed Services Employment and Reemployment Rights Act (USERRA).

- If you offer a group-sponsored health plan or a qualified retirement plan, you must comply with the Employee Retirement Insurance Security Act (ERISA). A qualified plan is one that allows employees to defer income taxes, such as a 401(k).

- If you have 15 or more employees, you also need to comply with Title VII of the Civil Rights Act (Title VII), the Genetic information Nondiscrimination Act (GINA), the Pregnancy Discrimination Act (PDA), and the Americans With Disabilities Act (ADA), among other antidiscrimination laws.

- If you have more than 20 employees, you need to comply with the Consolidated Omnibus Budget Reconciliation Act (COBRA) and Age Discrimination in Employment Act (ADEA).

- If you have more than 50 employees, you must comply with the Family and Medical Leave Act (FMLA) and Mental Health Parity and Addiction Equity Act (MHPAEA).

The DOL’s latest poster on FFCRA, shows the requirements for businesses with up to 500 employees. Image source: Author

Tips for ensuring compliance

To maintain compliance, follow these best practices:

- Know the law: It may go without saying, but it’s important to know which laws apply to your business, how they affect benefits administration, and how they affect management activities such as performance reviews.

- Know when they apply: As your business grows, your legal obligations change. Make sure you know the milestones for laws affecting benefits so you can stay ahead of the curve.

- Meet posting requirements: Employers must post notices of employee rights under applicable laws prominently where all employees can see them. You can get free copies of posters required under federal law from the U.S. Department of Labor (DOL). Contact your state labor department for resources covering state laws.

- Use free resources: The DOL, state labor departments, small business development centers, and many other authorities provide guidance, employee resources, and training to help small businesses stay compliant. Take full advantage of their services.

- Ask for advice: Many of the HR business partners you work with such as health care insurers and retirement plan administrators can help you navigate requirements.

Step 5: Fine-tune your benefits package

The final aspect of benefits administration is tracking results and fine-tuning your approach as needed to meet company goals.

Tips for fine-tuning your benefits package

The following tips will help you maintain a winning benefits program:

- Define success: With every employee benefit you offer, it’s critical to define success and measure results. That may seem obvious when you’re looking at a big-ticket item like health care, but it’s just as important that you measure the value of low- and no-cost benefits such as telework or employee picnics. For every benefit, what is the desired outcome?

- Measure results: With an outcome defined for every benefit, measure its success at least annually and preferably more often. HR metrics such as job application and acceptance rates, exit interviews, and employee surveys can help you assess the value of each benefit you offer. Measuring results continually lets you sense when employees’ needs are changing, or when a benefit is not the best use of finite resources.

- Adjust your offerings: Using data from your assessments as well as input from tax and legal advisors, you should continually fine-tune your offerings to maximize benefits and minimize costs. At least once a year, you should gather as many experts as you can for a full benefits review informed by all the data you’ve gathered throughout the year.

The best benefits administration software for your small business

If you’re looking for an HR software to help administer benefits to your employees, here are our top choices.

1. Zenefits

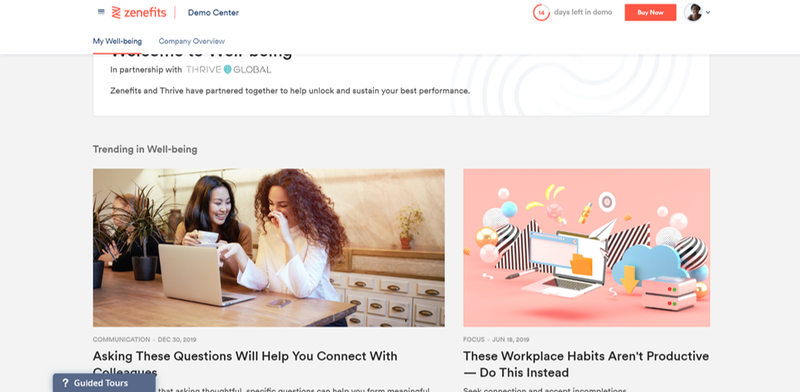

Zenefits is an all-around HR administration software champion. It automates key benefits administration functionalities including time and attendance tracking and benefits enrollment.

Zenefits software provides an employee wellness tracker. Image source: Author

A self-service portal lets employees enroll in benefits independently, update personal information, and print medical insurance cards. Zenefits incorporates a very broad range of benefits, including less common offerings such as commuter assistance. It even includes an employee wellness application.

2. Workday HCM

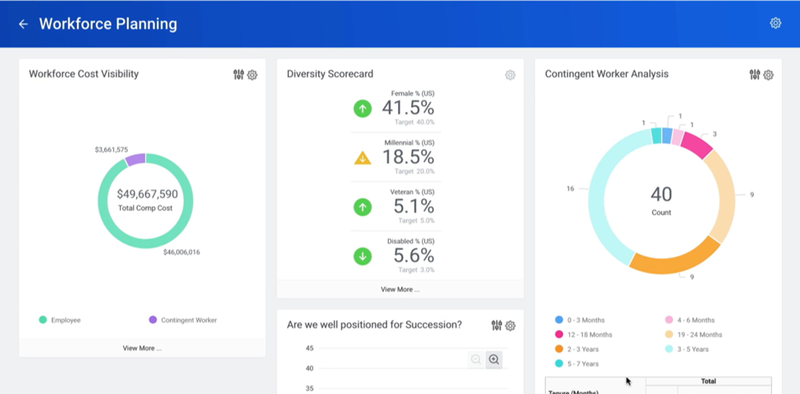

Workday is another powerful benefits management software option. Workday provides rich workforce management and planning features to inform HR strategy and resource management. It includes an employee portal for leave tracking and enrollment in benefits plans.

Workday is a data beast that makes HR planning and analytics easier. Image source: Author

3. SentricHR

SentricHR lets you choose common benefits such as health care and life insurance, set them up, and manage your budget. The software gives employees full visibility into their benefits, including costs. While SentricHR is a versatile HR software, its benefit options are not as robust as those offered by Zenefits.

SentricHR offers an employee portal and other useful features for benefits administration. Image source: Author

Make every benefit dollar count

Benefits administration is a critical strategic function that lets you woo the talent you seek and the talent you already have. Employees who are happy with their benefits tend to be happy with their jobs, and more likely to stay in them.

With a benefit package tailored to your employees’ needs and your company’s finances, you can keep everyone performing at their best and moving toward your goals.

[ad_2]

Source link