[ad_1]

This Top 5 comes from interest.co.nz’s Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you’re interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

There have been very few occasions in the past two decades where markets are this bearish… in fact only two: ’08 Financial Crisis & COVID-crash. When positioning gets this one-sided, potential for aggressive short-squeeze rises so stay nimble. pic.twitter.com/3cfWzYlVIv

— John Bromhead (@jbfm_) May 13, 2022

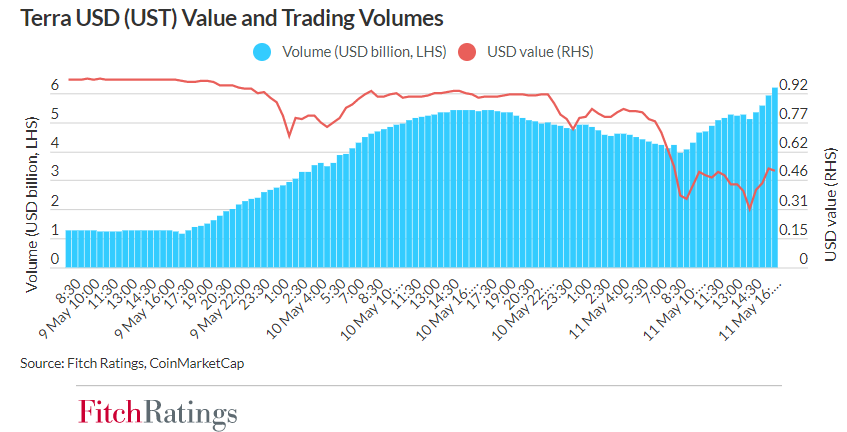

Bloomberg opinion writer Matt Levine casts an eye over this week’s massive sell-off in cryptocurrencies, fanned by crashing stablecoin Terra USD, and the unmooring of fellow stablecoin Tether from its US dollar peg. Supposed to maintain a value of one dollar, Terra USD fell as low as 23 cents.

Levine wonders about potential contagion flowing into the rest of the financial system. This is US focused. But as we know if Wall Street and/or the US economy sneezes, we tend to catch a cold.

If you asked a normal person, you know, two weeks ago: “How would it affect your life if the prices of some monkey JPEGs and algorithmic stablecoins crash,” I think most people would reasonably have said “I do not own a monkey JPEG and do not aspire to own one, so this will not affect me at all.” My guess is that they would have been right. My guess is that the real world is not too affected by the crypto world, and that if crypto prices crash there will not be a ton of contagion in the rest of the financial system. But I think it is, at this point, debatable. Crypto has at least started to work its way into the real financial system. Some traditional investors also own crypto; if their crypto goes down they might have to sell regular stuff. Some public companies are exposed to crypto (because they are crypto exchanges, because they have levered crypto holdings, etc.), so your boring old index fund might go down when crypto goes down.

Levine highlights an article from his Bloomberg colleagues Lyn Thomasson and Anchalee Worrachate pointing out concern that retail investors already hit by dabbling in so-called meme stocks, may be facing the music again. For anyone wondering, a meme stock refers to the shares of a company that have gained a cult-like following online, especially through social media.

As markets slumped in unison on Thursday, traders pointed to the chaos in crypto as a focal point of their concern. Strategists are increasingly worried that small traders, already nursing losses from the meme stock craze, will be wiped out on their crypto holdings and sell everything else.

“Contagion here is not via linkages between the crypto ecosystem and the traditional financial system, but via retail investors sentiment,” said Nikolaos Panigirtzoglou, global market strategist at JPMorgan Chase & Co. “If the $1 trillion capital loss in crypto markets causes broad-based retrenchment by retail investors in other risk assets such as equities, then that’s where the spillover is.” …

2) The critical importance of improving supply chain resilience.

Earlier in the month I wrote about a government issues paper on plans to develop New Zealand’s first ever comprehensive freight and supply chain strategy. Covid-19 induced disruptions have turned supply chains into big news over the past couple of years, helping to fan the flames of inflation we’re now seeing. This is a really important, and I think fascinating, area.

In this Newsroom article David Robb, Professor of Operations and Supply Chain Management at the University of Auckland Business School, looks at stress testing resilience in supply chain entities.

This example he cites from Switzerland is really interesting.

During turbulent periods the first port of call often involves increasing inventories. Clearly, item perishability, obsolescence, and holding costs must be considered, but this can be achieved by changing safety stock parameters. We should also consider extending national reserves beyond products such as PPE and Tamiflu to include imported items such as food ingredients, lubricants, and petroleum to safeguard both local supply and exports. We could rotate this inventory to ensure limited waste.

In this, we could learn from Switzerland, where a public-private partnership has maintained a system of compulsory stocks for decades. The Federal Office for National Economic Supply (Fones) mandates stocks of two to six months’ supply of products such as soap, screws, lubricants, sugar, oils, cereals, and fuel.

In involving about 300 private sector firms (which own the stock), efficiency is improved and risk reduced. Holding costs are recovered by higher prices, estimated to be less than NZ$25 per capita per year. These strategic reserves have allowed Switzerland to navigate pandemic supply chain disruptions well and they are supplemented by household emergency supplies – Fones recommends households maintain a one-week supply of a basket of goods, including food and drink.

Naturally, the ideal basket of goods for us would differ, as we have quite different import/export dependence, and while not landlocked, we have very long lead times, lower population density, and are more prone to natural disasters. We may consider prioritising imported goods and materials, including common intermediate goods, that would protect our export sector’s ability to operate. And if we do this well, the management systems could perhaps become part of our government-to-government offering.

3) An Aussie mortgage interest rate cap.

With an election looming in Australia, Clive Palmer’s United Australia Party (UAP) has a 3%, five-year cap on mortgage interest rates as a key policy. Is this a good idea, and is it even workable? The ABC’s Michael Janda takes a look and finds it would be a case of turning the clock back to a time when interest rates and inflation were generally high and access to credit wasn’t as easy as it is today.

UAP leader Craig Kelly told News Corp in a recent interview that the cheap mortgages could be funded by the government issuing bonds at 0.1 or 0.2 per cent and on-lending that money to the banks.

The problem is that the current Australian government five-year bond rate is already above the proposed 3 per cent mortgage cap, and no private investor would take such a low return.

There is one institution that could provide this kind of funding — the Reserve Bank.

In fact, it already ran a similar scheme during the pandemic, which is one reason why there were so many fixed mortgages available at interest rates below 2 per cent until that program ended in the middle of last year.

“The [mortgage cap] scheme would only work if banks could obtain funding below (and well below) the cap,” explained former Commonwealth Bank chief economist Michael Blythe.

“The RBA did achieve this outcome as part of its QE [quantitative easing] operations via the Term Funding Facility during the pandemic.

“But those were unusual times and shouldn’t be the norm.”

A question that looms for me here is, if the Reserve Bank of Australia were to provide ongoing cheap funding for mortgages, would retail banks even be needed?

4) Catching Covid again & again.

I recently caught Covid-19. I got it from one of my kids. After surviving months in New Zealand’s Covid capital of Auckland without getting it, we frustratingly caught it while on holiday in one of the country’s remoter regions, the Hokianga. Three out of four in our household got it. We’re all vaccinated and fortunately none of us was too sick. Still, I’d rather not get it again. Thus it’s a little alarming to see suggestions that getting Covid more than once or twice might be the best way to build up immunity against the virus.

Bloomberg’s Justin Fox writes about this, heavily leaning on the thinking of German virologist Christian Drosten. His suggestion is that for Covid-19 to become an endemic virus like the flu, lots of people might need to get it again and again. That, Drosten, says is because we won’t be able to vaccinate people every few months, meaning the virus itself might have to keep updating people’s immunity.

It is this mucosal immunity that keeps influenza from spreading most of the year, with the disease’s effective reproduction number (the average number of people who will get it from each one who has it) surpassing 1 for only a few months in winter, when indoor crowding, drier air and other factors seem to lead to increased transmission.

Contrast that with Covid: Current vaccines generate some mucosal immunity but it fades quickly, and while there are nasal-spray vaccines in development that target the mucous membrane, they’re not ready yet, and this approach has been of only mixed effectiveness against influenza. Meanwhile, less than half the German population has been infected with Covid, Drosten said (in the U.S., according to a Centers for Disease Control and Prevention report this week, it’s 57.7%), so there probably isn’t nearly enough mucosal immunity out there to prevent the reproduction number from rising back to 2 or 3 in the fall, bringing another huge wave of infections and concomitant stresses on hospitals and disruption of daily life.

One thing that could preclude this, Drosten speculated, might be a lot of young people (the “Party Generation,” he called it, in English) getting infected a second or third time over the summer, but he expressed doubt that this would be enough to make a difference in 2022. How many times are people going to need to be infected to confer effective immunity against transmission, asked NDR science reporter and podcast moderator Korinna Hennig. Drosten’s reply:

My idea is that this is in the range of a number that you can count on one hand. But no one can say for sure at the moment.

5) Stilt house tumbles into the ocean.

The quite dramatic video below, of a house falling into the ocean, certainly caught my eye this week. There are a series of additional tweets from journalist Tolly Taylor on US homeowners versus rising sea levels and storms.

Here in NZ the Government on Monday is set to unveil the country’s first Emissions Reduction Plan and details of the 2022 Climate Emergency Response Fund. Brian Fallow will be covering this for interest.co.nz.

An unoccupied house on stilts in Rodanthe, North Carolina, as it collapses into the ocean this afternoon.

Was worth $381,200 according to Zillow. pic.twitter.com/RxkgOkBIv0— Tolly Taylor (@TollyTaylor) May 10, 2022

[ad_2]

Source link