[ad_1]

All mortgage rates will be above 6% over the coming year, Kiwibank economists believe.

This will make rates well over double what they were a year ago.

At the moment the mortgage rates range from around 4.4% to 6.9%, the economists say in their weekly First View publication.

“Mortgage rates are rising, and will rise further with expected RBNZ [Reserve Bank] tightening,” Kiwibank chief economist Jarrod Kerr, senior economist Jeremy Couchman and economist Mary Jo Vergara say.

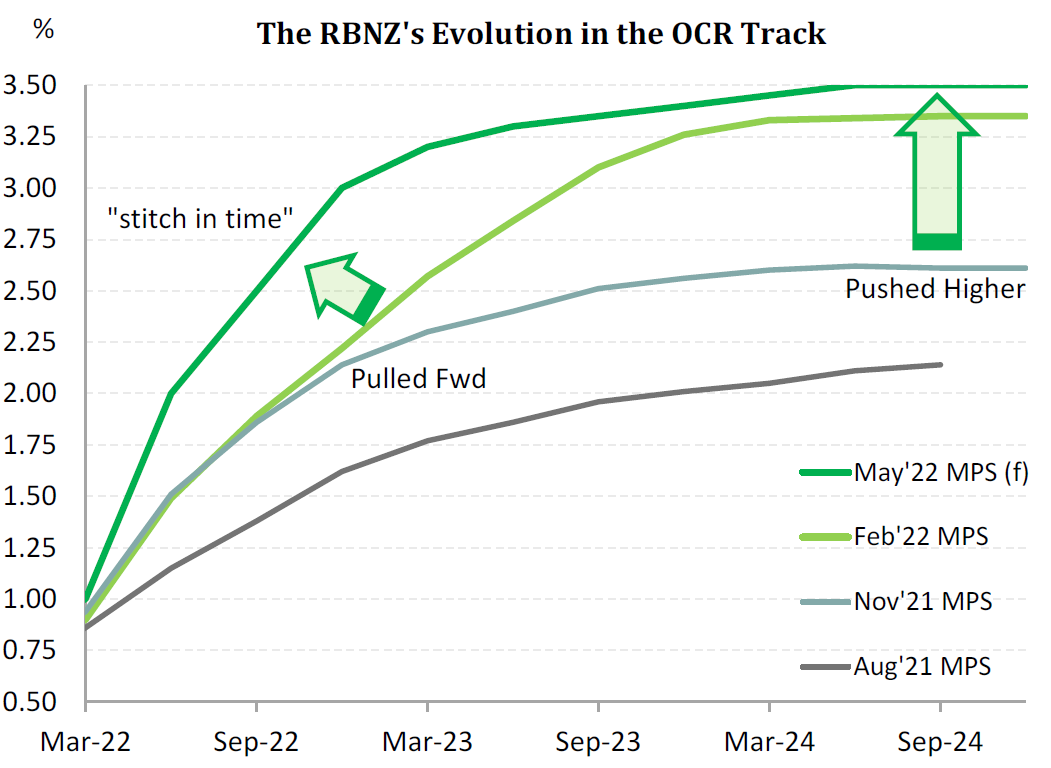

There’s a strong consensus in the marketplace that the RBNZ will raise the Official Cash Rate on Wednesday by another ‘double jump’, that is by 50 basis points to 2.0%, following a 50 bps rise in April as it grapples for a handhold on the galloping (6.9% annual rate) inflation. The RBNZ is effectively ‘bringing forward’ its earlier forecast rate rises in an attempt to get ahead of inflation – though it was at pains to say in its last OCR review in April that it didn’t see the endpoint of rate rises being any higher than previously forecast.

“All mortgage rates on offer are likely to lift from the current levels of between 4.4% to 6.9%, to 6% to 7.5% over the coming year,” the Kiwibank economists say.

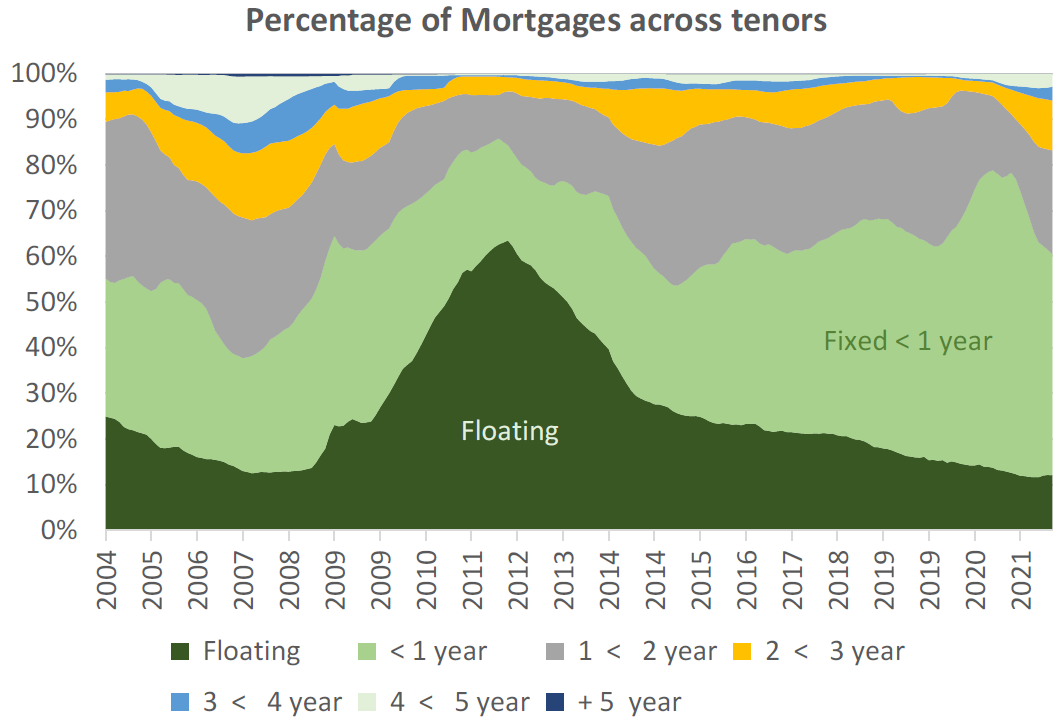

“More than 60% of outstanding mortgages are either floating, or rolling off fixed rates this year.

“The impact of the RBNZ’s tightening is being felt now and will continue to weigh on household budgets in the year ahead.”

The Kiwibank economists will be closely scrutinising on Wednesday [and they most certainly won’t be alone] the RBNZ’s latest ‘OCR track’ that will appear in the Monetary Policy Statement. This ‘track’ gives the RBNZ’s forward estimates of where the OCR will be over the course of the next three years.

“The OCR track will have been pulled forward, to take account of the two 50bp moves, and pushed higher – although we don’t expect the end point to be materially higher, given the ‘stitch in time’ approach,” the economists say.

“We expect to see the end point lift from 3.35% to 3.5%.”

“We suspect the RBNZ will [actually] stop around 3%.

“Why? Because the impact of every move to date, and from here, is causing a material impact on the housing market and household consumption. Cooling the housing market and taming consumption is the desired impact of rate hikes.

“And we’re forecasting house prices to fall by around 10% by year end. Consumption growth will wane as households face the negative wealth effect of falling house prices and a continued cost-of-living crisis.

“Of course, it’s easy to say that the risk of a recession rises with every rate hike. Recession risk is why we expect the RBNZ to pause at 3% – and not follow through with its forecast tightening in entirety,” the economists say.

“If we’re right, wholesale markets have too much in the way of hikes priced.

“The terminal rate implied in interest rate markets is closer to 4%. We expect to see a slight rally in rates, lower yields, as the market realises fewer hikes are likely.”

They are forecasting the RBNZ to move back to 25bp moves beyond this Wednesday, and with the 3% cash rate by November.

“Come November, the housing market is likely to have experienced a 10% decline in prices. The negative wealth effect will have dampened consumption, and the cost-of-living crisis is likely to be lingering. We suspect a move to 3% will be enough to turn the Kiwi economy and tame the inflation beast.

“We simply think the economy will struggle with aggressive tightening to 3.5% and beyond,” Kerr, Couchman and Vergara say.

[ad_2]

Source link