[ad_1]

ThitareeSarmkasat/iStock via Getty Images

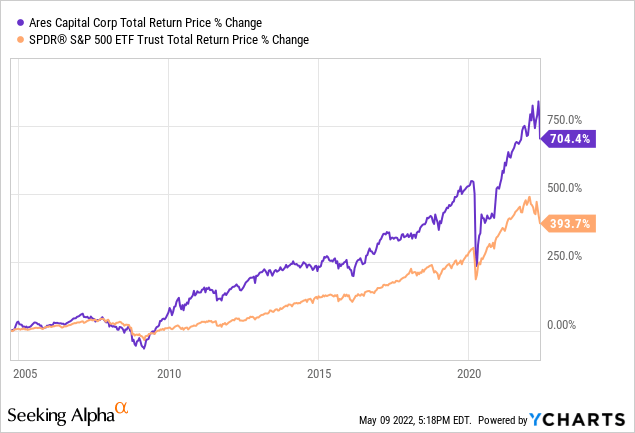

Ares Capital Corp. (NASDAQ:ARCC) is one of the preeminent blue chip BDCs with an investment grade balance sheet and an attractive 8.4% dividend yield. The company has crushed the S&P 500 (SPY) over the course of its public existence and today offers investors an attractive combination of high current yield and dividend growth as well as resistance to rising interest rates.

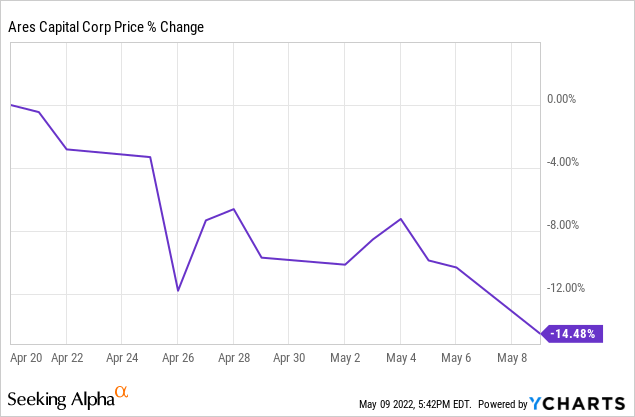

While the stock sold off sharply in the wake of its Q1 results, we are bullish on the stock moving forward for the following reasons:

#1. Ares Capital’s NAV Growth Continues

Despite an environment in which ARCC’s equity holdings are likely taking a hit from market volatility, ARCC still managed to generate NAV per share growth. Net asset value per share reached $19.03, up 0.4% sequentially and 9% year-over-year. When combined with the substantial dividend payout over the past year, ARCC’s shareholder wealth creation has been – and continues to be – impressive.

Core earnings per share of $0.42 fell by a penny year-over-year, but still covered the $0.42 dividend.

#2. ARCC – Strong Balance Sheet & Portfolio Performance/Positioning

While not as impressive as Oaktree Specialty Lending’s (OCSL) metrics, ARCC’s debt/equity ratio of 1.13x was quite solid, especially given how massive and well diversified their investment portfolio is. Furthermore, it represents a marked improvement from the 1.26x level seen at the end of Q4. ARCC also has tremendous liquidity of nearly $5.9 billion, including available cash of $690 million.

Meanwhile, the nonaccrual rate at cost of 1.2% is well below ARCC’s 10-year average of 2.5% and is also well below sector averages, reflecting very good underwriting practices and a portfolio that is well-positioned to weather an economic downturn.

Last, but not least, the CEO emphasized on the earnings call that ARCC remains well-positioned for rising interest rates, stating:

we don’t believe a tightening monetary cycle will have negative effects on us. Our large weight floating rate loan portfolio is financed by mostly fixed rate unsecured sources of financing and our assets are largely floating rate investments. We believe this positions us well to have our net interest earnings benefit from rising rates. As of quarter end, holding all else equal and after considering the impact of income-based fees, we calculated that a 100 basis point increase in short-term rates could increase our annual earnings by approximately $0.23 per share, a 14% increase above this quarter’s core EPS run rate.

A 200 basis point increase in short-term rates could increase our total annual earnings by approximately $0.44 per share, a 26% increase above this quarter’s core EPS run rate.

We also do not expect that a projected increase in rates will result in deteriorating credit performance, particularly given our strong starting point with portfolio weighted average interest coverage of nearly 3 times. What this means is that holding all else equal, including the leverage at the borrower level, short-term base rates would need to rise above 3% before aggregate interest coverage would dip below 2 times, which is similar to the 5-year pre-pandemic weighted average of 2.3 times.

Importantly, this analysis doesn’t consider EBITDA growth or deleveraging that often occurs in our portfolio. We feel good about the ability of our portfolio companies to navigate a higher rate environment and believe these dynamics will further differentiate Ares Capital versus many of the other income-oriented alternatives in the market today.

#3. Safe & Attractive Dividend From ARCC

Last, but not least, ARCC’s dividend remains safe and attractive. Even though core EPS barely covered the quarterly dividend in Q1, there are several factors that also need to be considered which make the 8.4% current dividend yield much safer than the tight coverage implies.

First and foremost, ARCC has a very solid investment grade balance sheet with plenty of liquidity as we have already mentioned.

Second, its portfolio is performing well and ARCC has a proven track record of successful underwriting through economic cycles.

Third, ARCC expects rising interest rates to serve as a strong catalyst for earnings per share.

Last, but not least it still has quite a bit of undistributed taxable income. As the CEO pointed out on the earnings call:

I want to discuss our undistributed taxable income and our dividends. We currently estimate that our spillover income from 2021 into 2022, will be approximately $651 million or $1.32 per share. We believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend throughout market cycles and sets us apart from many other BDCs that do not have this level of spillover.

Investor Takeaway

ARCC remains a leading blue chip BDC with fundamentals that imply consistent and growing dividends per share alongside steady capital appreciation are likely on the way in the coming years.

Furthermore, ARCC is uniquely well positioned to benefit from rising interest rates and its strong portfolio performance implies that it is in pretty good shape should an economic downturn hit.

As a result, we think the latest pullback in the share price presents an interesting opportunity to potentially add to our position, which we may do in the near future:

[ad_2]

Source link