For central banks, the facts have now changed: inflation has been persistent enough for them to drop the ‘transitory’ moniker and start acting. At the same time, markets do not expect the US Federal Reserve, or the ECB for that matter, to be able to hold ground on policy tightening, with a sharp reversal of the current rate rising cycle expected from 2023 on.

Bonds are generally not yet signalling recession, but equity prices more so. There is a ‘Covid-feel’ to markets: moves in yields and weakness in major equities are reminiscent of March 2020. Global growth optimism is at an all-time low, with stagflation worries at June 2008 levels; unsurprisingly, the profit outlook is at its worst since September 2008, although analyst views are lagging.

While credit spreads have widened, deeply negative returns across the asset class have been chiefly duration led. The liquidity premium investors demand in corporate bonds has risen, but the moves have been relatively contained. In high-yield credit, the premium is still well below the top 400bp demanded in periods of stress. We wonder whether current spreads can truly compensate investors for a deterioration in credit risk as the circumstances turn more challenging.

Relative to equities, investment-grade credit appears particularly attractively valued in both the US and Europe. We see credit as a clear buy opportunity should our appetite for taking more risk grow.

Equities – The first shoe

The more than 20% drop in US equities by mid-June is a signal to some that markets are already pricing in recession. We believe this misreads the situation. The fall has been driven almost entirely by the rise in 10-year US real yields from -1.2% to over 0.8%.

If markets were truly pricing in recession, earnings expectations would have dropped sharply. Excluding commodities, they haven’t by much despite the deterioration in the outlook. Even Europe ex-UK earnings have been resilient.

However, the recent cuts in gas supplies by Russia call into question any optimism about Europe’s outlook. Europe needs the gas more than Russia needs the revenues from its sale. Russia appears to be in little need of foreign currency. Indeed, a complete halt to Russian gas exports would likely lead to stagflation in the region, with GDP growth turning negative while inflation remains high.

What of the Fed?

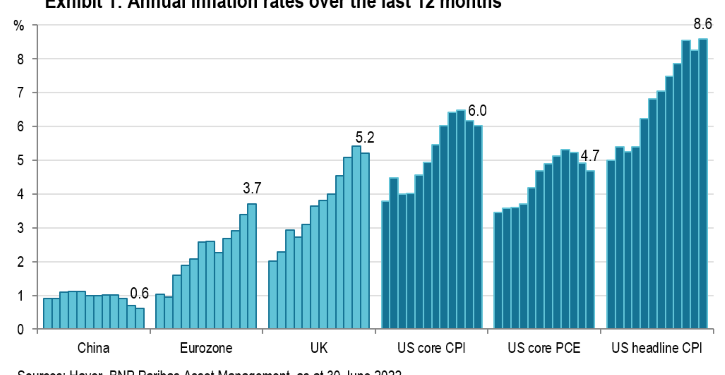

The US central bank’s recent 75bp rate rise indicates policy rates have now caught up to where they arguably should have been months ago. The path of rates will now depend on how inflation evolves in the months ahead. The Fed expects headline Personal Consumption Expenditures inflation to drop to 5.2% by the end of 2022 and to 2.6% in 2023, with core PCE falling to 4.3%, and then to 2.7%.

The long-hoped-for transitory inflationary factors will need to come into play for these inflation projections to be met.

While some of the forces driving inflation, such as supply chain bottlenecks and pent-up demand, should wane, longer-lasting structural factors could keep prices rising more sustainably. Re-shoring production would reverse the costs savings from globalisation, lower labour force participation rates could hamper services sector production, and house prices are still rising at 20% per year, which will feed through to higher rents.

Will recession (defined as two quarters of negative GDP growth) be avoided in the US? We believe so, but we still see growth slowing sharply in 2023, with an increase in unemployment dragging down wages and ultimately core (services) inflation. Goods prices should rise more slowly (or fall in some cases) as base effects kick in, while higher mortgage rates will damp house price appreciation.

Asset class views as of 30 June 2022

[1] The title refers to the quote “Well when events change, I change my mind. What do you do?”. This has been attributed to the economist Paul Samuelson. Source: https://quoteinvestigator.com/2011/07/22/keynes-change-mind/

Disclaimer

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience.

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. The views expressed in this podcast do not in any way constitute investment advice.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

[ad_2]

Source link