[ad_1]

Freelance journalist Tarric Brooker has authored an interesting article estimating how forecast interest rate rate rises would compare with Australia’s historical experience.

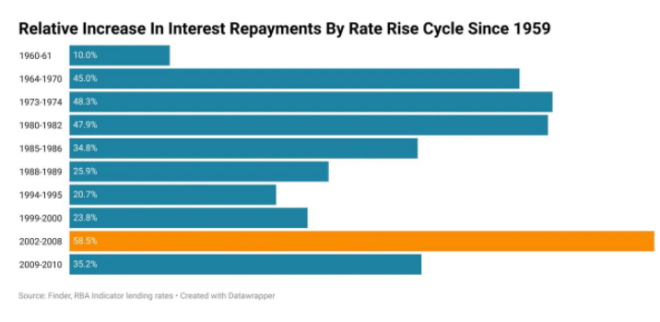

Rather than examining raw interest rate increases, Brooker has instead calculated the percentage change in mortgage interest repayments from the trough to the peak of the interest rate cycle.

The analysis shows that the 2002-2008 interest rate cycle is currently Australia’s largest, with mortgage interest repayments climbing 58.5% over that cycle:

2002 to 2008 holds the record for the biggest rise in mortgage interest repayments.

To estimate how the coming cycle will compare, Brooker has measured the impact on mortgage interest repayments that would arise from the Big Four banks’ interest rate forecasts and the futures market, namely:

- CBA: Cash rate to peak at 1.6%

- Westpac: Cash rate to peak at 2.25%

- NAB: Cash rate to peak at 2.6%

- ANZ: Cash rate to peak at 3%

- Futures Market: Cash rate to peak at 3.56%

According to Brooker, every interest rate forecast other than the CBA’s would see Australian mortgage interest repayments rise by more than they did in 2002-2008:

Most economists forecast a record rise in mortgage interest repayments.

CBA’s forecast rise in the cash rate would slightly undershoot the 2002-2008 rate cycle with a 56.8% increase in average mortgage interest repayments. By contrast, the other forecasts would see mortgage interest repayments increase by record amounts of between 80% (Westpac’s forecast) and 125% (future’s market forecast).

Tarric Brooker concludes with the following salient statement:

Australians have never seen interest repayments on their mortgages rise so much in a single rate rise cycle, making this a truly unprecedented event should any of the big bank scenarios come to pass with the exception of that of the Commonwealth Bank…

Ultimately, tough times may lay ahead for mortgage holders…

I view the CBA’s interest rate forecast as the most realistic for the simple reason that Australians are so indebted and households will struggle to cope with even a 1.6% rise in mortgage rates.

Anything greater risks a house price crash, a severe reduction in household consumption spending, and an unnecessary recession.

[ad_2]

Source link

![Early detection saved her life. A new CT measure mandates expanded insurance coverage of breast cancer diagnosis, treatment. [Hartford Courant]](https://mortgageinsurancecenter.com/wp-content/uploads/2022/05/Early-detection-saved-her-life-A-new-CT-measure-mandates-75x75.jpg)