[ad_1]

Tetyana Babiy /iStock via Getty Images

Note: All amounts discussed are in Canadian dollars

When we last covered Boardwalk Real Estate Investment Trust (OTCPK:BOWFF), we gave it a neutral rating and stayed on the sidelines. The valuation was average for the risks and we did mention the one thing that could really hit this hard.

The risk from an interest rate spike remains, but rents are still way cheaper than the costs to purchase a home. We think a good modicum of pricing power remains with landlords and outside of interest rates going really vertical, Boardwalk should be fine.

Source: 8% Distribution Hike And More To Come

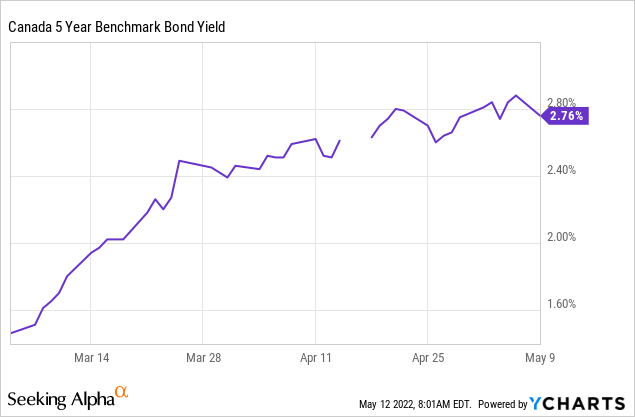

While not exactly a vertical move, the jump in Canadian bond yields from that point has been quite exceptional.

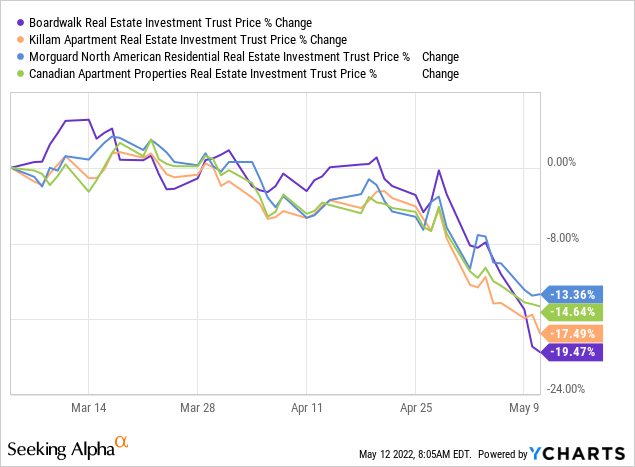

Boardwalk ignored the price action at first and even defied gravity in the March selloff. However, it finally did go into full reverse and then actually dropped the most among Canadian apartment REITs.

We examine the recently released Q1-2022 results and tell you how things are shaping up.

Q1-2022

While Q4-2021 was a quarter of superlatives, Q1-2022 fell into a completely different arena. The numbers looked good when comparing year over year and funds from operations (FFO) were $0.68 per unit, increasing 4.6% vs 2021. Even same property rental revenue growth of 2.1% was respectable. But what was to be noted here was that the FFO was actually well below Q4-2021 levels. Despite occupancy and rent increases, same property net operating income (NOI) just moved up by 1.2%. This is nearing stall speed on the portfolio. While the FFO number was slightly under the forecast, Boardwalk moved down its guidance for the year.

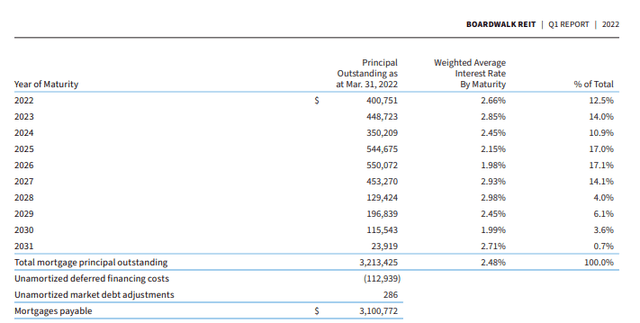

Guidance (Boardwalk)

Outlook

There are three parts here to the story. The first is the NOI drop from last update. This is coming from the inflation aspect. While we were exceptionally impressed with how well Boardwalk handled the pressures in 2021, it is clear now that nobody squeezed water from stone. The drop while disappointing was to be expected at some point. Unfortunately, it came during a time when the markets were not at their best behavior.

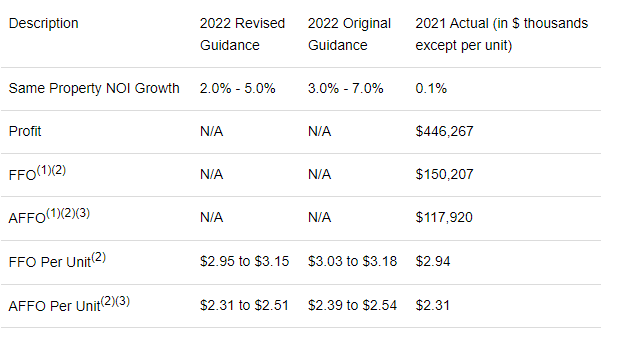

The second aspect of the story is the NOI to FFO conversion. You can see in the ranges presented above, the low end of NOI growth is 2% while the low end for the FFO and adjusted FFO (AFFO) is 0%. This can stem from rising expenses at the corporate level and higher interest costs. Neither of those two are surprising, but nonetheless go to point out how complicated it is to benefit from inflation without letting it slip away to the same rising cost pressures. Now in the case of Boardwalk, G&A expenses were quite flat and it is likely the interest rate jumps creating the bulk of this guidance downdraft.

The interest rate aspect is one where things did take a scary turn. Now, we have warned about this risk in almost every single article we have written on Boardwalk. Even then, the jump was quite spectacular.

In the first quarter, Boardwalk renewed its maturing mortgages at a weighted average interest rate of 2.44% while extending the term of these mortgages by an average of five years.

For the remainder of 2022, the Trust anticipates $400.8 million of mortgages payable maturing with an average in-place interest rate of 2.66% and will continue to renew these mortgages as they mature. Current market 5 and 10-year CMHC financing rates are estimated to be 3.70% and 4.00%, respectively. While interest rates have increased significantly since the beginning of March, the Trust remains positioned with a balanced laddered maturity schedule within its mortgage program, a disciplined capital allocation program and continued use of CMHC funding, which decreases the renewal risk on its existing mortgages.

Source: Seeking Alpha (emphasis by author)

The jump is large compared to the existing rates in place for 2022 and 2023. Further down, if rates continue to rise or even stabilize here, they will absorb a lot of potential NOI increases.

The final aspect we want to touch on is what happens to the Net Asset Value in such a case. Remember that NAV is not really impacted by the increasing interest rates on the debt. But it is impacted by jumps in the risk-free interest rate and cap rates can be quite sensitive at the low end. According to Boardwalk their NAV is $68.61. While we have had our misgivings with their NAV calculations in the past, we would note here that the current discount has been seen just three times in the last 10 years. One was during the COVID-19 crash and previous to that was when oil prices collapsed in 2016 and 2018. This is the first time we are seeing such a large discount when oil prices are exceptionally strong.

Verdict

Boardwalk has challenges like all other REITs in this environment. The backdrop of most of its rents coming from oil-rich provinces is something that helps it, a lot. We don’t see any issues with passing on rent increases, at least enough to offset inflation and interest rate pressures. The REIT does trade below its fair value in the market, although an exact number is hard to pin down today. We think it could be sold easily at a 25% premium and bears might be pushing their luck, this deep into the selloff. While we are reluctant to buy it outright today, we are scouting for an entry for cash secured puts on this one and will alert our subscribers when we make the choice.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source link