[ad_1]

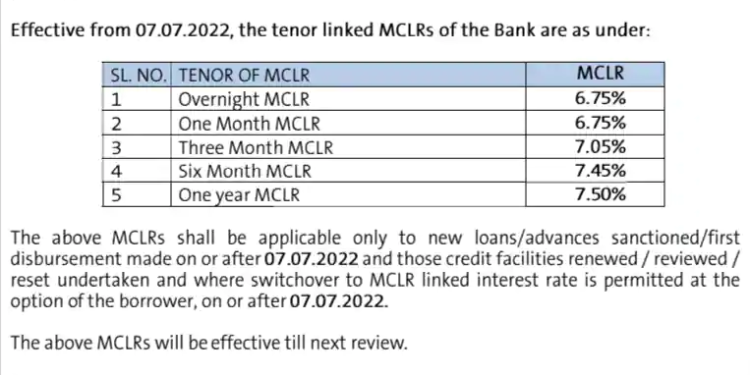

With effect from July 7th, 2022, Canara Bank, a public sector lender, increased its Marginal Cost of Fund Based Lending Rate (MCLR) and Repo Linked Lending Rate (RLLR) for loans / advances in overnight to one-year tenors. As a result, the bank’s tenor-linked MCLRs will go into effect on July 7, 2022. The bank increased its overnight to one-month MCLR rate by 10 basis points to 6.75 per cent. The 3-month MCLR rate increased by 10 basis points from 6.95 per cent to 7.05 per cent, while the 6-month MCLR increased by 10 basis points from 7.35 per cent to 7.45 per cent. The one-year MCLR is the standard by which banks benchmark their home loan rates, and for this duration, the bank increased the rate by 10 basis points, from 7.40 per cent to 7.50 per cent.

Additionally, Canara Bank increased its Repo Linked Lending Rate (RLLR) rate by 50 basis points. The RLLR was 7.30 per cent earlier, but it is now 7.80 per cent. Repo-linked lending rate, also known as RLLR, is the lending rate that is linked to the repo rate set by the RBI. As a result of the RBI’s 50 basis point increase in the repo rate in June, banks’ MCLRs are being affected, which raises the EMI burden for those who are taking out home loans. Canara Bank has said in a note that “Existing borrowers of the bank shall have an option to switch over to interest rates linked to MCLR (other than fixed rate loans). Borrowers willing to switch over to the MCLR based interest rate may contact the branch.”

View Full Image

“The above MCLRs shall be applicable only to new loans/advances sanctioned/first disbursement made on or after 07.07.2022 and those credit facilities / renewed / reviewed, reset undertaken and where switchover to MCLR linked interest rate is permitted at the option of the borrower, on or after 07.07.2022,” the bank has said in a press release statement.

And meanwhile, the MCLR has been increased by 20 bps by the two leading public sector banks, ICICI and HDFC Bank. Beginning on July 1, the new ICICI Bank MCLR rates are in effect. As a result of the ICICI Bank MCLR rate increase, home loan interest rates would rise for both fresh and existing loan borrowers, which in turn make a burden on their EMIs for home loans, vehicle loans and any other loan linked to marginal cost. Right now, the ICICI Bank’s MCLR rates for terms of six months and a year are 7.70% and 7.75%, respectively. With effect from July 7, 2022, private sector lender HDFC Bank has increased its marginal cost of funds-based lending rate (MCLR) on loans across all tenures by 20 basis points. The three-year MCLR will be 8.25 per cent, the two-year MCLR will be 8.15 per cent, and the one-year MCLR, which is related to many retail loans, will now be 8.05 per cent. On the monthly reset date, the above-discussed bank shall hike interest rates on home loans or any loan product linked to MCLR. The increase in MCLR will make personal loans, home loans, car loans or any more expensive borrowers see an increase in the equivalent monthly installments (EMI) for retail loan products linked to MCLR of the above banks.

[ad_2]

Source link