[ad_1]

What happens when an emergency arises and you have no money to handle it? It could happen due to multiple reasons such as a medical emergency, children’s marriage or their education, paying off your debts etc. It is when the personal loan can help you immediately with minimum documentation. A personal loan is an unsecured loan that you can borrow if you need funds to pay for your financial needs. Most banks offer personal loans up to Rs 25-30 lakh, but some banks may even offer you more depending on your monthly income, credit score and requirements.

The best thing about personal loans is that you can use the fund for any purpose, such as getting your house renovated, your children’s marriage or education, medical expenses, or even travelling to a foreign country for a holiday. Some people prefer personal loans as they offer flexible repayment options and suitable repayment tenure.

These days personal loans are easily available. You can apply online on banks’ websites, through their mobile apps or even visit any nearby branch. If you meet the eligibility criteria and have a good credit score, you can get the personal loan approved in a few hours to days, depending on your lender. For existing customers with good track records, banks also give preapproved personal loans at lower interest rates and are easily available.

Since a personal loan is an unsecured loan, a good credit score plays an important role. Banks give good weightage to the credit score in evaluating creditworthiness. If you have a credit score above 750, your chances of getting a personal loan increase significantly. However, you need to evaluate all the options and carefully examine the terms and conditions of the personal loan. You need to check the processing fee, hidden charges if any, foreclosure charges etc. Before applying for a personal loan, make sure you have clarity about the loan and its terms and conditions so that you don’t face any difficulties at the time of repayments, according to BankBazaar.

It is advisable to use a personal loan only to meet your requirements. Avoid taking multiple personal loans as if you default or delay in paying your EMIs, it may land you in a financial crisis, and your credit score can also get hit. Also, remember that too many loan applications lead to multiple credit enquiries, and these enquiries may show you as a credit hungry customer, and it may impact your credit score.

Apply for an amount that meets your requirements. If you borrow beyond your repayment capacity, it may add to your financial woes. Also, remember to provide genuine documents and information to the banks. While processing your loan application, if anything comes out to be false or not correct, then it may lead to the rejection of your loan application. Keep relevant documents handy before applying and compare the interest rates and EMIs for the loan amount you need. It gives you an idea of how much money you will need every month to pay towards your EMIs without getting affected financially.

The approval of the loan depends on multiple factors, as the eligibility criteria may vary from bank to bank. But there are some basic criteria, such as your age, income, credit score, employment status, etc., that play a big role in helping you get the personal loan hassle-free.

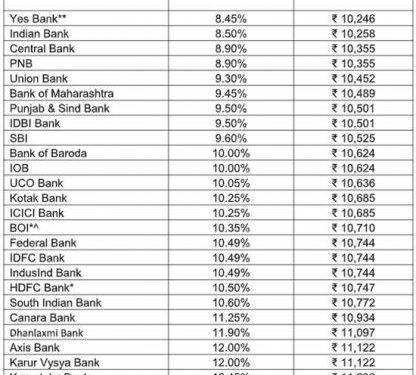

The table below helps you compare the interest rates of multiple banks for a loan amount of Rs 5 lakh for five years, along with EMIs you will have to pay for this loan. It has 25 banks to help you compare and decide the lender and interest rates as per your requirements, eligibility and convenience.

Interest Rates & EMI on Personal Loan

Compiled by BankBazaar.com

Note: Interest rate on Personal Loan for all listed (BSE) Public & Pvt Banks considered for data compilation; Banks for which data is not available on their website, are not considered. Data collected from respective bank’s website as on 03 May 2022. Banks are listed in ascending order on the basis of interest rate i.e. bank offering lowest interest rate on Personal loan is placed at top and highest at the bottom. EMI is calculated on the basis of Interest rate mentioned in the table for Rs 5 Lakh Loan with a tenure of 5 years (processing and other charges are assumed to be zero for EMI calculation); Interest and charges mentioned in the table is indicative and it may vary depending on bank’s T&C. * Rack Interest Rate; ** min APR during Jan 22 to Mar 22; *^for senior citizens

[ad_2]

Source link

![Early detection saved her life. A new CT measure mandates expanded insurance coverage of breast cancer diagnosis, treatment. [Hartford Courant]](https://mortgageinsurancecenter.com/wp-content/uploads/2022/05/Early-detection-saved-her-life-A-new-CT-measure-mandates-75x75.jpg)